- United States

- /

- Pharma

- /

- NYSE:BHC

Bausch Health (NYSE:BHC) Valuation in Focus as Shares Maintain Recent Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Bausch Health Companies.

This latest movement is part of a broader trend for Bausch Health Companies, as the stock’s share price has lost momentum over the past year, down over 21% in total shareholder return, despite some short-term gains and intermittent headline events. At $6.39 per share, longer-term holders have faced a tough ride, with recent momentum still subdued.

If you’re looking for other opportunities beyond pharmaceuticals, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares lagging behind both recent highs and analyst targets, investors are left to consider whether the current price is a bargain for future growth or if the market has already accounted for all that lies ahead.

Most Popular Narrative: 9.8% Undervalued

Bausch Health Companies is trading just below what the most prominent narrative believes to be its fair value, given recent growth and profitability trends. The market appears to be pricing in many challenges, but some see scope for recovery based on operational improvements and expansion plans. Here is one perspective driving that case:

International diversification, with sustained double-digit growth in regions like EMEA and Canada and new product launches in Latin America and Poland, enables Bausch to benefit from expanding healthcare access in emerging markets. This supports long-term topline growth and reduces geographic concentration risk.

Is Bausch Health’s future tied to global sales breakthroughs or a massive rebound in margins? Find out which market forces and financial forecasts set this valuation apart from the crowd. Dive deeper into the projections powering this fair value before making your next move.

Result: Fair Value of $7.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, new Medicare price cuts for Xifaxan and ongoing high debt levels could have a significant impact on Bausch Health's profitability and growth outlook.

Find out about the key risks to this Bausch Health Companies narrative.

Another View: Multiples Tell a Different Story

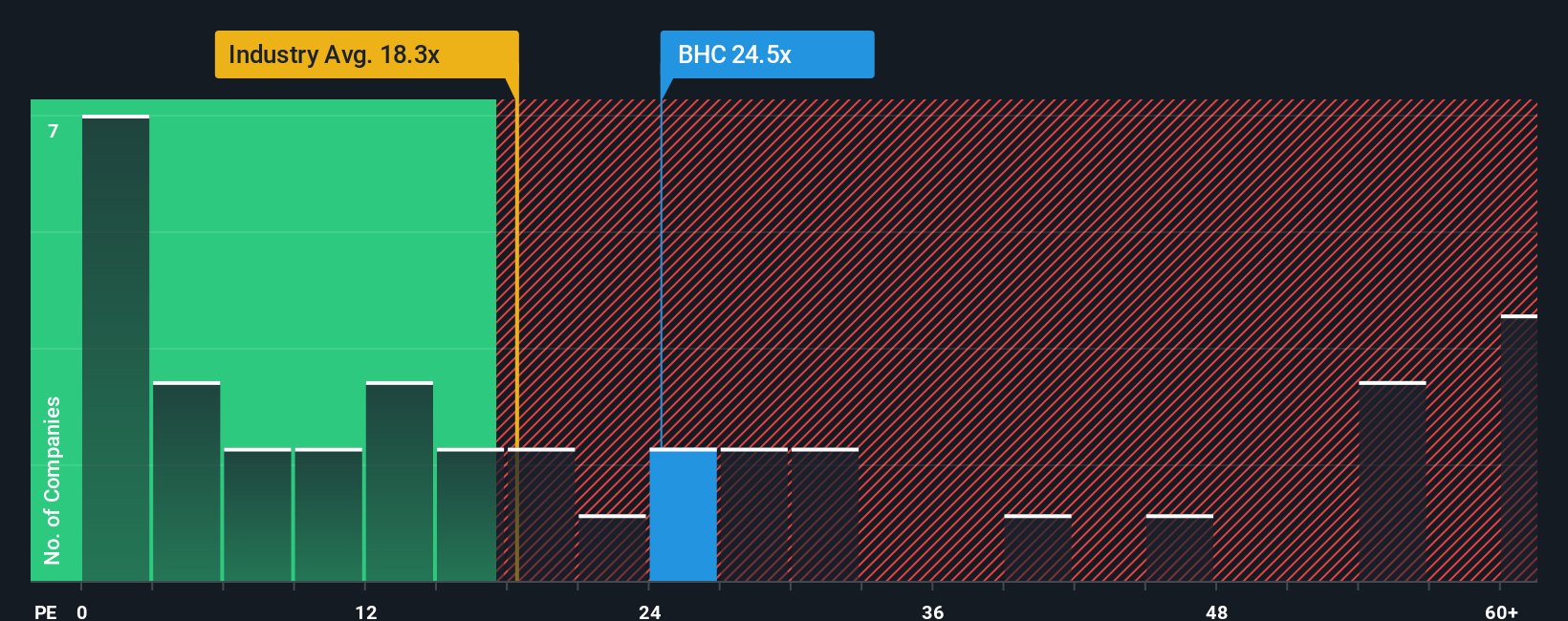

Looking from a different perspective, Bausch Health appears pricey when you compare its current price-to-earnings ratio of 24.1x to the US Pharmaceuticals industry average at 18.3x, as well as its own fair ratio of 20.2x. This difference suggests investors are paying a premium, adding risk if the market’s optimism fades. With a peer average at 29.5x, though, there could be enough upside to justify the risk, or it may be more sensible to approach with caution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bausch Health Companies Narrative

If you have a different perspective or want to dig deeper into the numbers, you can craft your own narrative quickly using our platform. This process often takes just a few minutes. Do it your way

A great starting point for your Bausch Health Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step into the world of tomorrow's standout stocks by checking hand-picked opportunities tailored for growth, value, and innovation. If you want to stay ahead of the crowd, don’t miss out on these potential game-changers.

- Accelerate your portfolio by backing companies offering high yields and steady payouts. Check out these 18 dividend stocks with yields > 3% with yields above 3%.

- Position yourself in the next technological revolution by tapping into cutting-edge firms powering artificial intelligence through these 25 AI penny stocks.

- Capitalize on market inefficiencies by targeting overlooked businesses trading below their intrinsic value, all within these 897 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives