- United States

- /

- Pharma

- /

- NYSE:BHC

Bausch Health (BHC) Is Up 13.2% After Q3 Profit Return and Pipeline Boost Will Momentum Continue

Reviewed by Sasha Jovanovic

- Bausch Health Companies announced third-quarter 2025 results showing revenue increased to US$2.68 billion and net income reached US$179 million, reversing a loss in the same quarter last year.

- This turnaround was supported by strong performance in the Salix and Solta Medical divisions, alongside the integration of DURECT Corporation, which enhanced the company’s research pipeline and operational outlook.

- We'll explore how this combination of earnings growth and pipeline expansion may influence Bausch Health's investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bausch Health Companies Investment Narrative Recap

To be a Bausch Health shareholder today, you need to trust in the company’s ability to grow through its Salix and Solta segments, expand internationally, and develop its late-stage pipeline, all while managing heavy debt and looming regulatory risks. The strong third-quarter 2025 results reinforce confidence in near-term momentum, but do not materially change the most important short-term catalyst: continued performance from Xifaxan ahead of potential U.S. Medicare price cuts. The biggest risk remains exposure to government drug pricing reforms, potentially impacting future cash flows and margins. Of the recent company announcements, the completed acquisition of DURECT Corporation directly relates to Bausch Health’s pipeline strategy. By adding an FDA Breakthrough Therapy Designated asset (larsucosterol) for alcohol-associated hepatitis, Bausch expands its footprint in hepatology and raises its profile ahead of upcoming clinical data readouts. This supports the current catalyst of pipeline expansion, but comes with the inherent execution and commercialization risks of late-stage assets. Yet while the company surprises on adjusted earnings, it’s important for investors to understand how the pending Medicare negotiations could affect future profits…

Read the full narrative on Bausch Health Companies (it's free!)

Bausch Health Companies is projected to reach $10.1 billion in revenue and $264.4 million in earnings by 2028. This assumes a yearly revenue decline of 0.9% and represents an earnings increase of about $166 million from current earnings of $98.0 million.

Uncover how Bausch Health Companies' forecasts yield a $7.08 fair value, in line with its current price.

Exploring Other Perspectives

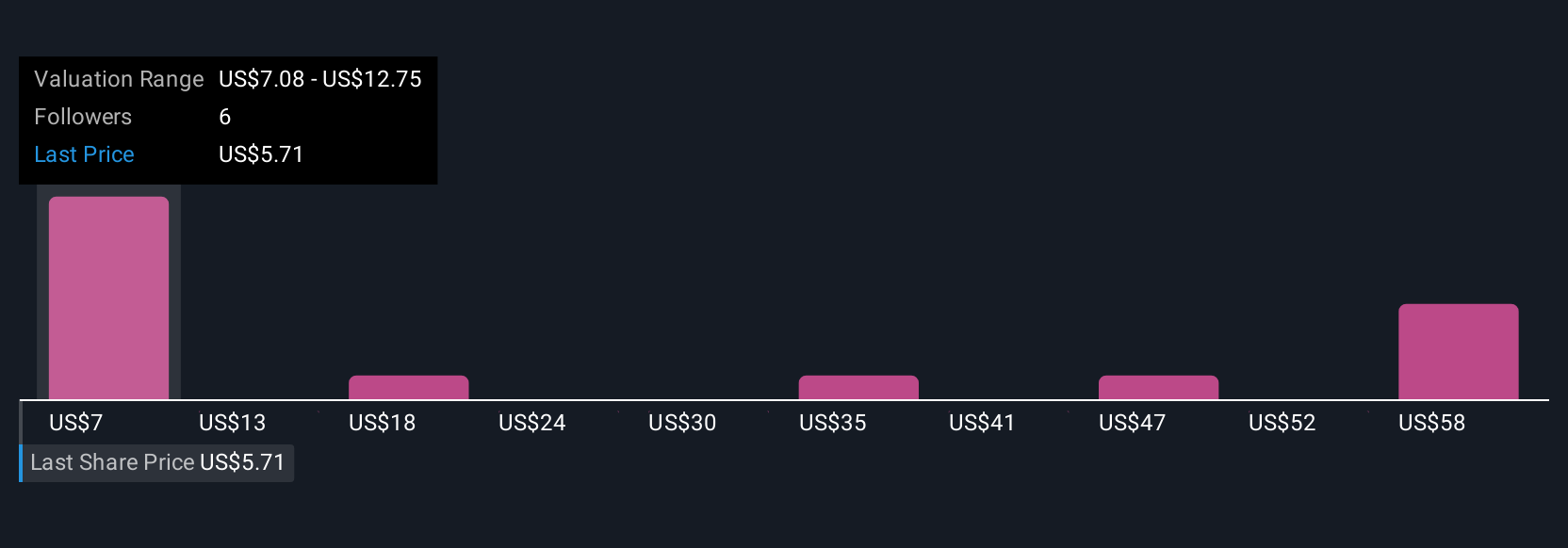

Five Simply Wall St Community members recently estimated Bausch Health’s fair value anywhere from US$7.08 to US$64.70 per share. Against this broad backdrop, surging quarterly results amplify the debate over Xifaxan’s future revenue in light of potential Medicare price cuts.

Explore 5 other fair value estimates on Bausch Health Companies - why the stock might be worth over 9x more than the current price!

Build Your Own Bausch Health Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch Health Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bausch Health Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch Health Companies' overall financial health at a glance.

No Opportunity In Bausch Health Companies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives