- United States

- /

- Pharma

- /

- NYSE:BHC

Bausch Health (BHC) Expands OraPharma Into Canada and Puerto Rico as Paulson Ups Stake – Is Market Sentiment Shifting?

Reviewed by Sasha Jovanovic

- Bausch Health Companies Inc. recently announced the commercial expansion of its OraPharma division into Canada and Puerto Rico, enhancing collaborations with dental professionals and boosting access to periodontal disease treatments such as Arestin®.

- John Paulson’s decision to more than double his stake in Bausch Health to over 70 million shares signals robust institutional interest and broader market attention for the company.

- We'll look at how OraPharma’s expansion into new regions could influence Bausch Health’s growth outlook and investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Bausch Health Companies Investment Narrative Recap

To own Bausch Health Companies shares, an investor must believe that the company can sustain growth despite intense pressure from government pricing reform and heavy debt. The expansion of OraPharma into Canada and Puerto Rico may help diversify revenue but does not materially affect the short-term catalyst, which remains the pending inclusion of Xifaxan in U.S. Medicare drug price negotiations. The biggest risk continues to be heightened regulatory scrutiny and upcoming price cuts that could impact profitability.

The recent financial results announced on October 29, 2025, are especially relevant: Bausch Health delivered a return to profitability, reporting net income of US$179 million for Q3 2025, up from a loss the prior year. This profitability, despite ongoing risks, provides some reassurance that management is working to strengthen the company’s standing while dealing with pricing and concentration pressures. Yet, while new regional moves show momentum, the shadow of potential price cuts on Xifaxan remains the factor investors still cannot ignore.

However, investors should be aware that if regulatory changes accelerate faster than anticipated, the impact on Bausch Health’s earnings could...

Read the full narrative on Bausch Health Companies (it's free!)

Bausch Health Companies is projected to generate $10.1 billion in revenue and $264.4 million in earnings by 2028. This outlook assumes a -0.9% annual revenue decline and a $166.4 million increase in earnings from the current $98.0 million level.

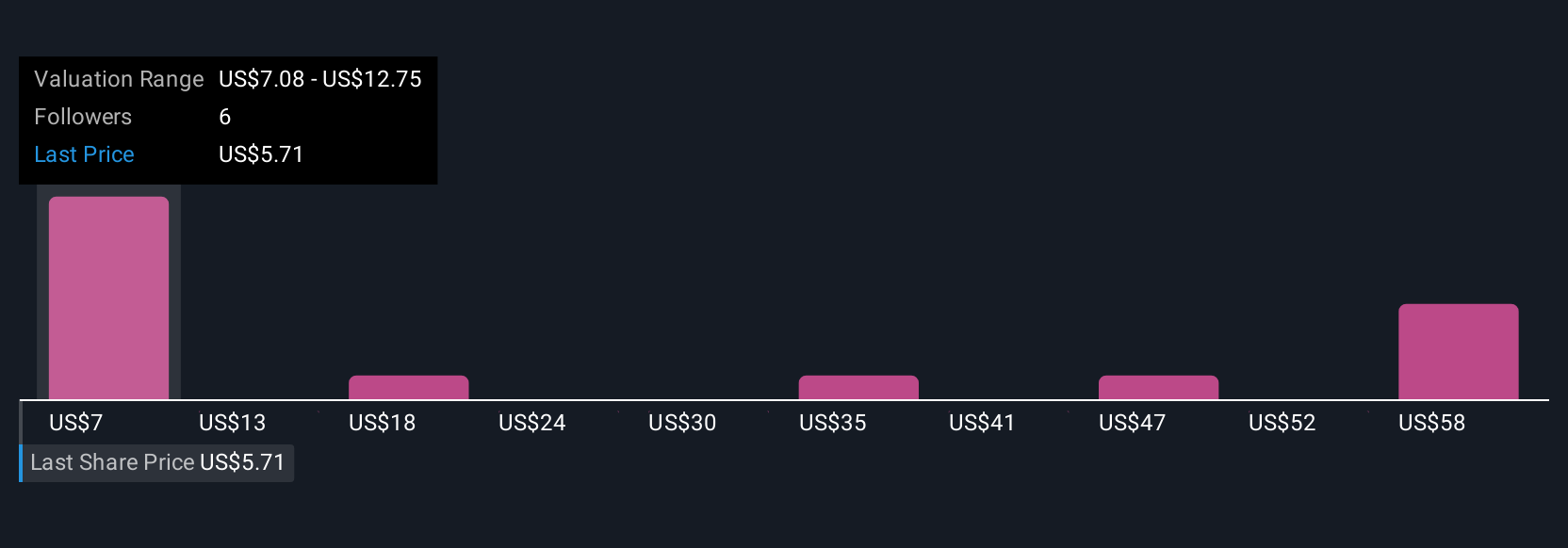

Uncover how Bausch Health Companies' forecasts yield a $7.08 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community stretch from US$7.08 to US$68.71 per share, showing wide opinion divides. While community views cover a vast spectrum, the looming risk of US drug price negotiations underscores why many remain sharply focused on the company’s future earnings strength.

Explore 5 other fair value estimates on Bausch Health Companies - why the stock might be worth just $7.08!

Build Your Own Bausch Health Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch Health Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bausch Health Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch Health Companies' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives