- United States

- /

- Biotech

- /

- NYSE:ABBV

Is AbbVie’s Recent Drug Approvals a Signal the Stock Is Trading Below Its True Worth?

Reviewed by Bailey Pemberton

- Curious if AbbVie's stock price actually matches its true value or if there's an opportunity hiding in plain sight? You are not alone. Let's dig into what really matters for long-term investors.

- It has been an eventful year for AbbVie, with the share price rising 20.8% year to date and up 11.5% over the last 12 months, despite a recent pullback of 5.8% in the past month.

- Investors have been buzzing about AbbVie's latest drug approvals and a steady stream of clinical trial updates. Recent headlines detail strong results from its immunology pipeline and regulatory wins that could drive future revenue growth. These developments have intensified speculation around the stock's future prospects and are partly behind the recent price swings.

- Right now, AbbVie scores a 4 out of 6 on our valuation checks, reflecting areas of both value and caution. We will walk through standard valuation approaches next, but stick around. There is an even better way to look at a stock's real worth that we will reveal by the end of this article.

Approach 1: AbbVie Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those sums back to today. This calculation reflects the present value of expected long-term financial performance.

For AbbVie, the current Free Cash Flow stands at approximately $18.38 billion. Analysts forecast robust growth in the near term, with projected Free Cash Flow rising to around $33.10 billion by 2029. While analysts provide estimates for the next five years, projections beyond that are extrapolated by Simply Wall St.

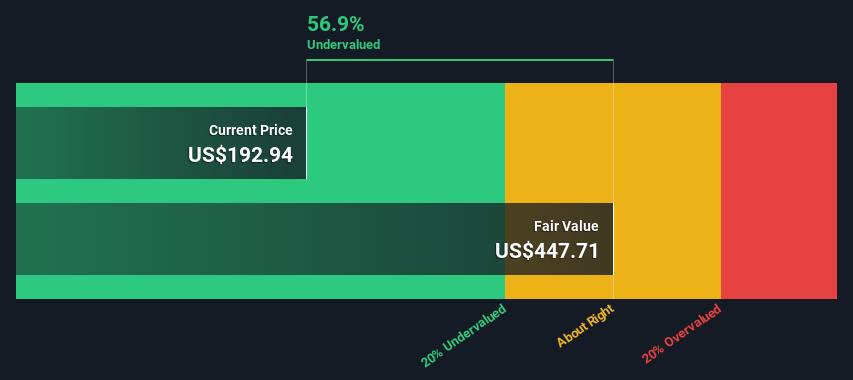

Using the 2 Stage Free Cash Flow to Equity model, the DCF analysis pegs AbbVie’s fair value at $435.41 per share. This valuation suggests the stock trades at a 50.2% discount to its estimated intrinsic worth, implying it is significantly undervalued.

In summary, the DCF model indicates there could be major upside for AbbVie at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AbbVie is undervalued by 50.2%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: AbbVie Price vs Sales (P/S) Multiple

The Price-to-Sales (P/S) ratio is a widely used metric for valuing profitable companies, particularly in the biotech sector where revenues can be a clear indicator of a company's market position and pipeline success. This multiple is less prone to short-term profit swings, making it especially relevant for firms like AbbVie with sizable and consistent revenue streams.

Growth expectations and risk also play a big part in what makes a “normal” or “fair” P/S ratio. A company with higher expected revenue growth or more stable cash flows might warrant a higher ratio. Increased risk or flat sales can push it lower.

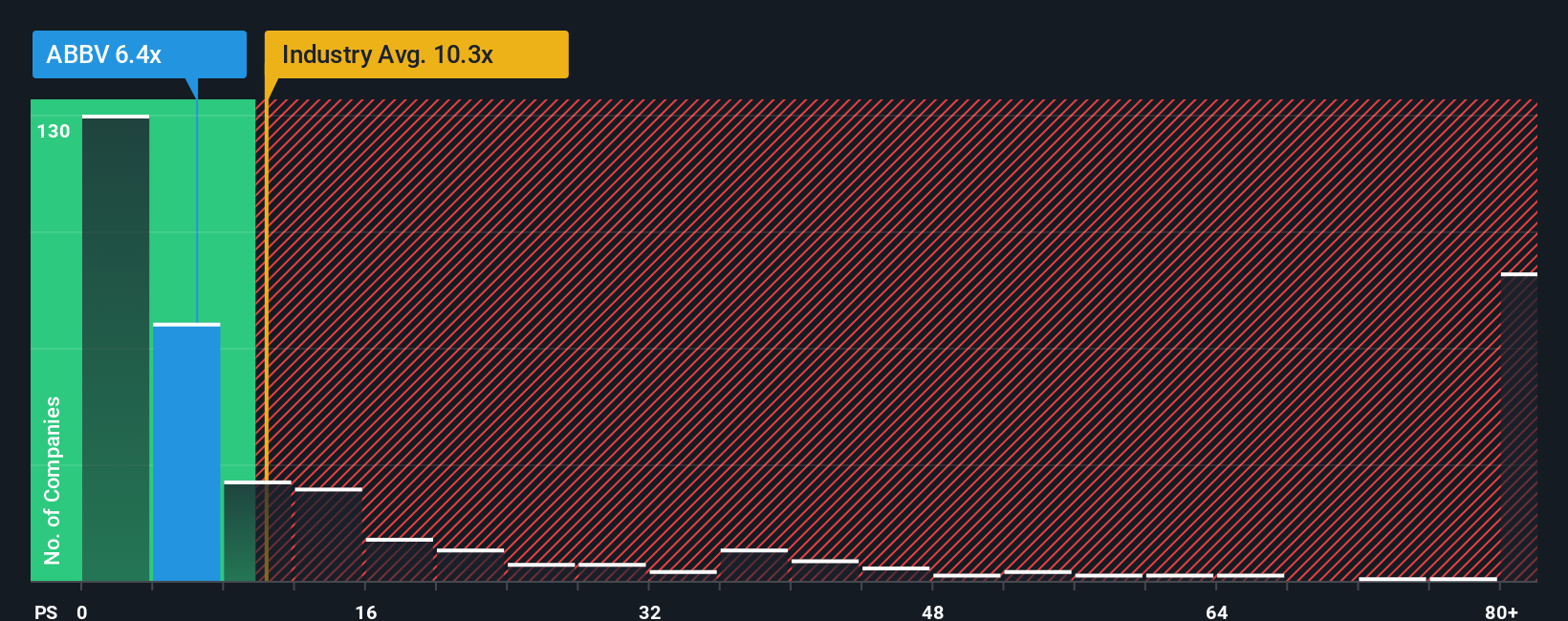

Currently, AbbVie's P/S ratio stands at 6.42x. For context, the industry average P/S ratio is 10.30x, while similar peers are trading around 5.96x. AbbVie’s ratio sits below the industry mark but is slightly above its peers, indicating a middle-ground valuation.

Rather than simply relying on peer or industry comparisons, Simply Wall St’s proprietary “Fair Ratio” factors in AbbVie’s unique position, including expected earnings growth, profit margins, market cap, and specific risks. This results in a Fair P/S Ratio of 11.38x for AbbVie, giving a more tailored view of reasonable value than broad benchmarks.

Comparing AbbVie’s current P/S ratio of 6.42x with its Fair Ratio of 11.38x, the stock appears to be trading well below what might be considered a justified multiple given its strengths and outlook. This suggests that AbbVie is undervalued based on this approach.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AbbVie Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is the story you create to explain your investment view for a company like AbbVie, connecting your reasoning, such as beliefs about its future growth, margins, and risks, to a clear financial forecast and a fair value estimate.

Unlike traditional models that focus mostly on numbers, Narratives help you articulate why you think AbbVie will thrive or struggle based on both its business drivers and market context. By blending your insight with your assumptions about revenue, earnings, and risks, you develop a holistic picture that links the company's story directly to its financial future.

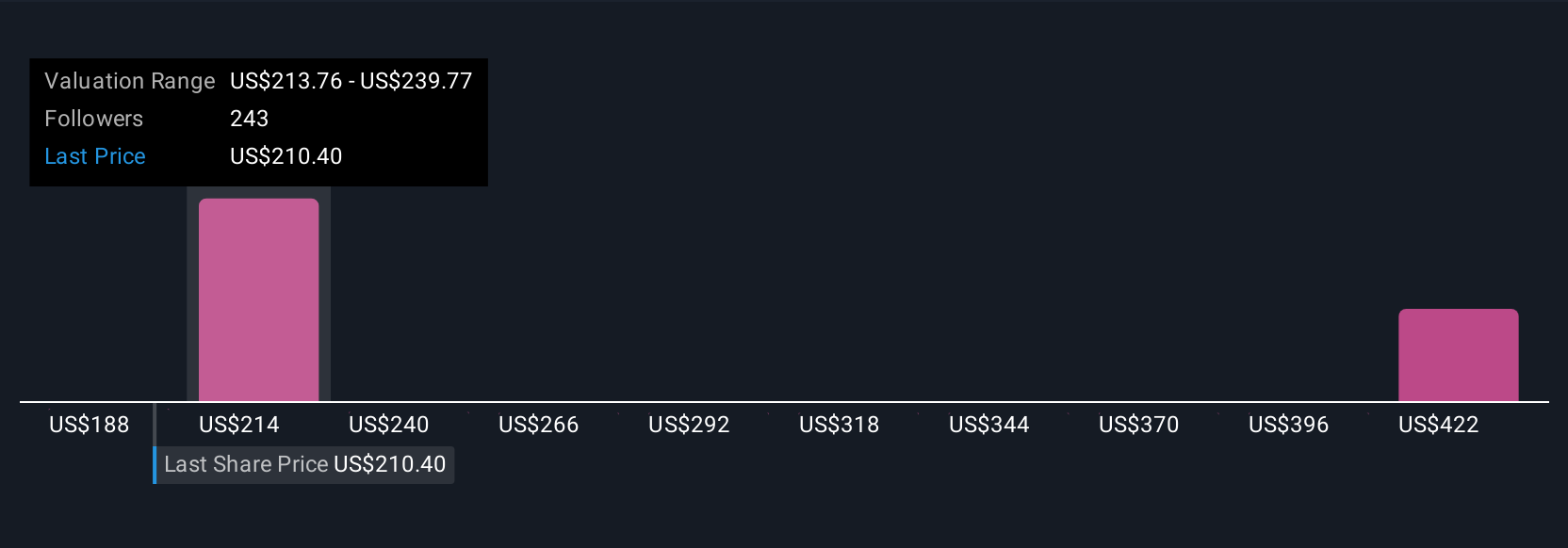

This approach is easy to use and available for everyone on Simply Wall St’s Community page, where millions of investors contribute perspectives that go far beyond the spreadsheets. Narratives empower you to decide when AbbVie is a buy or sell by comparing your fair value to the current share price, rather than relying solely on consensus estimates.

As new news, earnings, or company updates emerge, Narratives are updated dynamically, so your outlook stays relevant and informed. For example, some investors might be bullish on AbbVie, projecting a value above $255 based on global expansion and new product lines. Others are more cautious with targets closer to $170. That is the value of Narratives, helping you clearly see how your viewpoint shapes your decisions and how it compares to the thinking of real investors like you.

Do you think there's more to the story for AbbVie? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives