- United States

- /

- Biotech

- /

- NYSE:ABBV

AbbVie (ABBV) Reports $14.5 Billion One-Off Loss, Undercutting Bullish Margin Recovery Narratives

Reviewed by Simply Wall St

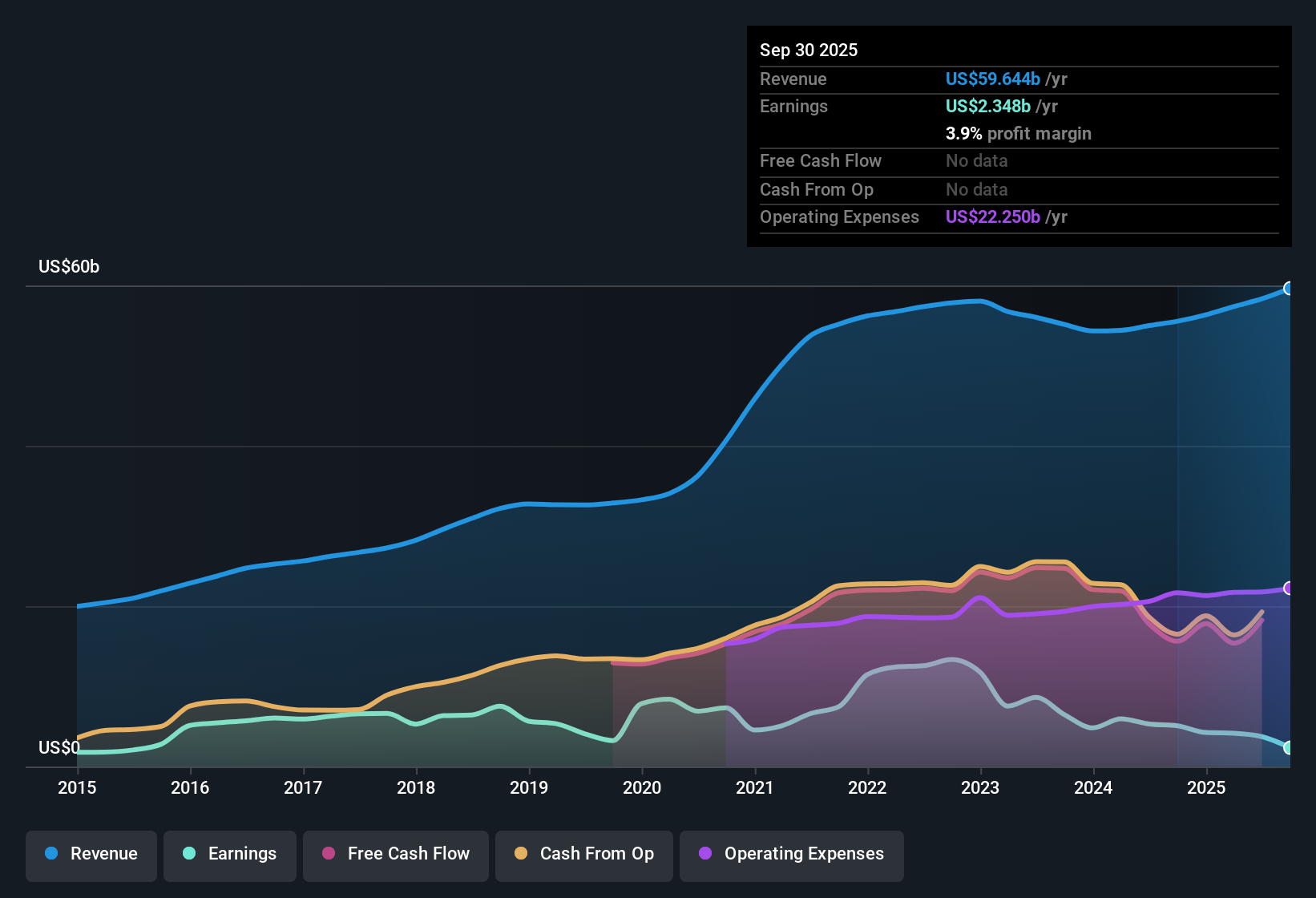

AbbVie (ABBV) reported a net profit margin of 6.4% for the twelve months through September 2025, down from 9.6% a year earlier, as its bottom line took a hit from a major one-off loss of $14.5 billion. Over the past five years, average annual earnings have declined by 11.5%, although forecasts now point to a rebound, with revenue expected to grow 6.8% per year and earnings growth projected at around 16% annually, just ahead of the broader market. This blend of near-term weakness and long-term optimism sets the stage for a mixed debate on AbbVie’s current state and future potential.

See our full analysis for AbbVie.Next up, we’ll see how these headline figures stack up against the key narratives that investors and analysts have been following. We will look for points of agreement and areas where the numbers tell a new story.

See what the community is saying about AbbVie

Margins Set for Big Rebound by 2028

- Analysts expect AbbVie’s profit margins to rise from 6.4% today to 28.5% within three years, shifting toward levels that could dramatically boost future earnings.

- According to the analysts' consensus view, the margin expansion relies on new revenue from immunology, especially Skyrizi and Rinvoq, in addition to added growth in neuroscience and international markets.

- The consensus narrative highlights that broader product launches and efficiency efforts are designed to more than offset losses from older drugs, supporting the forecasted earnings jump from $3.7 billion now to $20.8 billion by 2028.

- However, execution risk remains if competitive or regulatory pressures on key drugs intensify. Continued strong uptake is vital for the margin turnaround the consensus expects.

- With profit margins projected to more than quadruple, the consensus sees significant upside, but it all hinges on new therapies maintaining momentum. Read the full narrative for the debate’s next twists. 📊 Read the full AbbVie Consensus Narrative.

PE Ratio Far Above Peers, Despite Discounted Share Price

- AbbVie’s current Price-To-Earnings Ratio stands at a lofty 103.5x, much higher than peer and industry averages. However, its share price of $218.04 trades at a 45% discount to the $397.70 DCF fair value.

- Analysts’ consensus view points out this valuation disconnect highlights how investors are weighing premium multiples against future growth optimism.

- The gap suggests the market is cautious about near-term profitability, likely factoring in the recent $14.5 billion one-off loss and historical declines, while still recognizing long-term value in the pipeline.

- To match analyst price target logic, AbbVie would need significant earnings expansion to justify a lower, more conventional future PE of 22.5x, which is well above the GB Biotechs industry PE of 15.3x. This dynamic adds tension to how bullish forecasts are priced in today.

Bets Ride on New Drugs and Pipeline Execution

- Future earnings estimates hinge on projected revenue growth of 7.7% annually, with expectations that total earnings grow from $3.7 billion today to $20.8 billion by September 2028.

- From the analysts' consensus, AbbVie’s success depends on two critical drivers over the next few years:

- First, robust contributions from recently launched drugs in immunology and neuroscience need to keep the top line expanding and fill gaps left by losses from older assets like Humira.

- Second, ongoing investment in pipeline development, including next-generation biologics and therapies for chronic conditions, must deliver both new revenues and protection against competitive or regulatory threats, or future profit growth could fall short of these expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AbbVie on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own take on the figures? Share your insights and shape your personal view in just a few minutes with your own narrative. Do it your way

A great starting point for your AbbVie research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

See What Else Is Out There

AbbVie’s elevated PE ratio and recent earnings volatility highlight near-term uncertainty around profitability and how quickly its fundamentals can stabilize.

If you want less valuation tension and more upside, use these 832 undervalued stocks based on cash flows to find companies with stronger earnings outlooks that the market hasn’t fully priced in yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Medium-low risk average dividend payer.

Similar Companies

Market Insights

Community Narratives