- United States

- /

- Biotech

- /

- NasdaqGS:ZYME

Zymeworks (ZYME) Is Up 28.8% After Ziihera Phase 3 Win and Royalty Model Shift - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On November 18, 2025, Zymeworks announced positive Phase 3 results for Ziihera (zanidatamab-hrii) in advanced HER2-positive gastroesophageal adenocarcinoma, alongside a US$125 million share repurchase program and the appointment of Scott Platshon as Acting Chief Investment Officer.

- This combination of clinical success, leadership changes, and a shift toward a royalty-driven model signals a focused effort to optimize future cash flows and build a diversified portfolio of healthcare assets.

- We'll assess how Ziihera's Phase 3 success and the new royalty-focused approach may reshape Zymeworks' investment case.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Zymeworks Investment Narrative Recap

To be a shareholder in Zymeworks, you need to believe the company can convert significant clinical progress, like the strong Phase 3 results for Ziihera, into regulatory milestones, sustained royalty payments, and broader pipeline momentum. The recent trial success materially boosts the likelihood of near-term milestone revenues, but continued reliance on partners for product approvals remains the top risk, as any delays or commercial disappointments could quickly impact cash flow and valuation.

Among the recent developments, the US$125 million share repurchase program stands out. This move is closely linked to the company’s confidence in upcoming milestones for Ziihera and other licensed assets, as well as its shift to a royalty-driven model, providing a financial cushion if milestones are realized as anticipated.

However, investors should be aware that even after positive trial results, the potential for regulatory delays or partner execution issues remains very real...

Read the full narrative on Zymeworks (it's free!)

Zymeworks' outlook anticipates $150.9 million in revenue and $24.2 million in earnings by 2028. This scenario depends on a 7.1% annual revenue growth rate and a $97.9 million improvement in earnings from the current -$73.7 million.

Uncover how Zymeworks' forecasts yield a $34.20 fair value, a 44% upside to its current price.

Exploring Other Perspectives

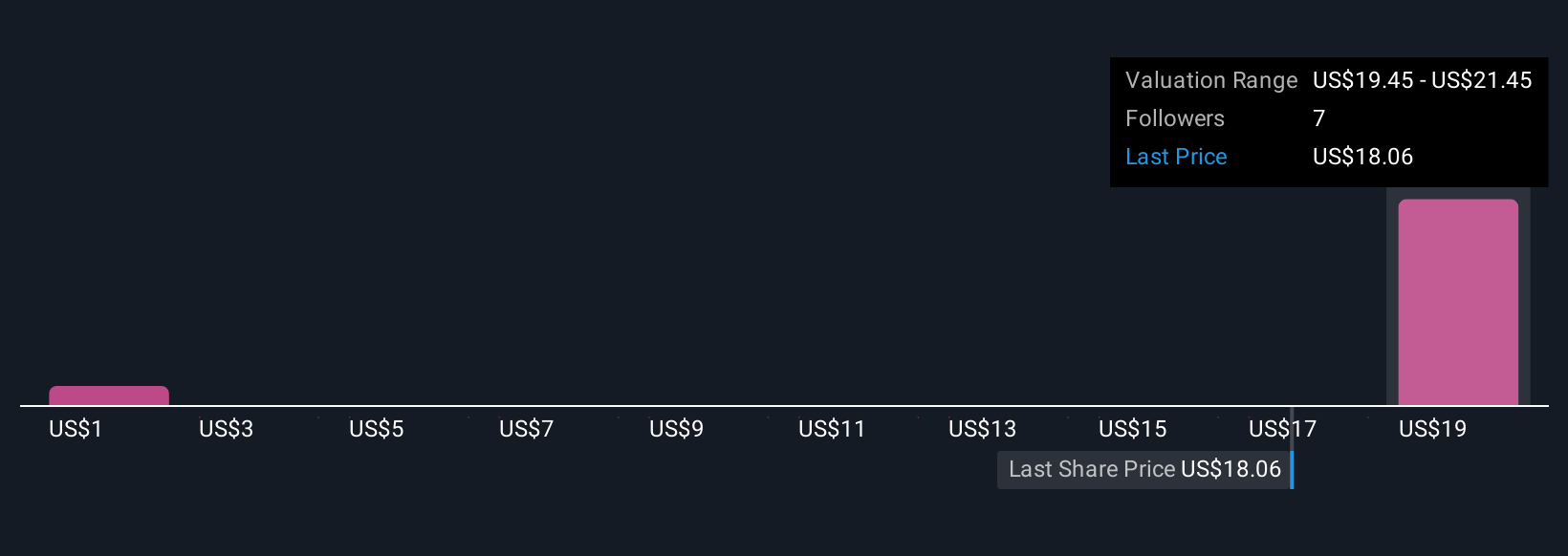

Simply Wall St Community fair value estimates for Zymeworks, based on two investor models, range widely from US$1.43 to US$34.20 per share. As partners drive future milestone revenues, this difference invites you to weigh how reliance on external execution could influence returns.

Explore 2 other fair value estimates on Zymeworks - why the stock might be worth as much as 44% more than the current price!

Build Your Own Zymeworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zymeworks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zymeworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zymeworks' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zymeworks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZYME

Zymeworks

A clinical-stage biotechnology company, discovers, develops, and commercializes biotherapeutics for the treatment of cancer, and autoimmune and inflammatory diseases (AIID).

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives