- United States

- /

- Biotech

- /

- NasdaqGS:ZYME

A Look at Zymeworks (ZYME) Valuation After Breakthrough Phase 3 Cancer Trial Results

Reviewed by Simply Wall St

The latest announcement from Zymeworks (NasdaqGS:ZYME) centers on the positive topline readout from its Phase 3 HERIZON-GEA-01 trial for Ziihera. The trial delivered notable clinical benefit in HER2-positive gastroesophageal cancer patients.

See our latest analysis for Zymeworks.

Recent weeks have seen Zymeworks making headlines by announcing a $125 million share repurchase plan, refreshing its board, and securing a four-year high in its share price after releasing strong clinical data for its lead cancer candidate. Powered by this momentum, Zymeworks delivered a 25% share price return over the past month and has soared nearly 56% year-to-date, rewarding long-term shareholders with a 196% three-year total return, even as the longer five-year record remains in the red. With investor optimism building, the company’s successful trial results and royalty-driven growth strategy have clearly captured market attention.

Now could be a smart time to explore other biotech innovators in the same space. See the full healthcare stock lineup here: See the full list for free.

With shares at a four-year high and optimism running high after recent clinical milestones, is Zymeworks’ valuation reflecting only current success, or is there still potential upside for investors betting on future growth?

Most Popular Narrative: 6% Undervalued

With Zymeworks closing at $22.99 and the most-followed narrative suggesting a fair value of $24.45, the consensus puts forward a positive outlook supported by recent clinical success. This valuation stands above the last trade, hinting at further upside if the assumptions pan out.

The advancing acceptance of personalized and precision medicine is accelerating investment and deal activity in antibody engineering, directly aligning with Zymeworks' core platforms (Azymetric and EFECT), which have already attracted multiple high-value partnerships. This trend increases the probability of further milestone and royalty revenue, providing upside to earnings and supporting healthier net margins via a capital-light partnership model.

The path to that fair value is not obvious. Behind every dollar are ambitious growth forecasts, expanding margins, and an optimistic take on royalty revenue. Want to peel back the layers and see which future milestones could tip the scales? The numbers shaping this narrative might surprise you.

Result: Fair Value of $24.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain. If crucial milestones are missed or commercial partners underperform, either of these factors could undermine the current optimistic outlook.

Find out about the key risks to this Zymeworks narrative.

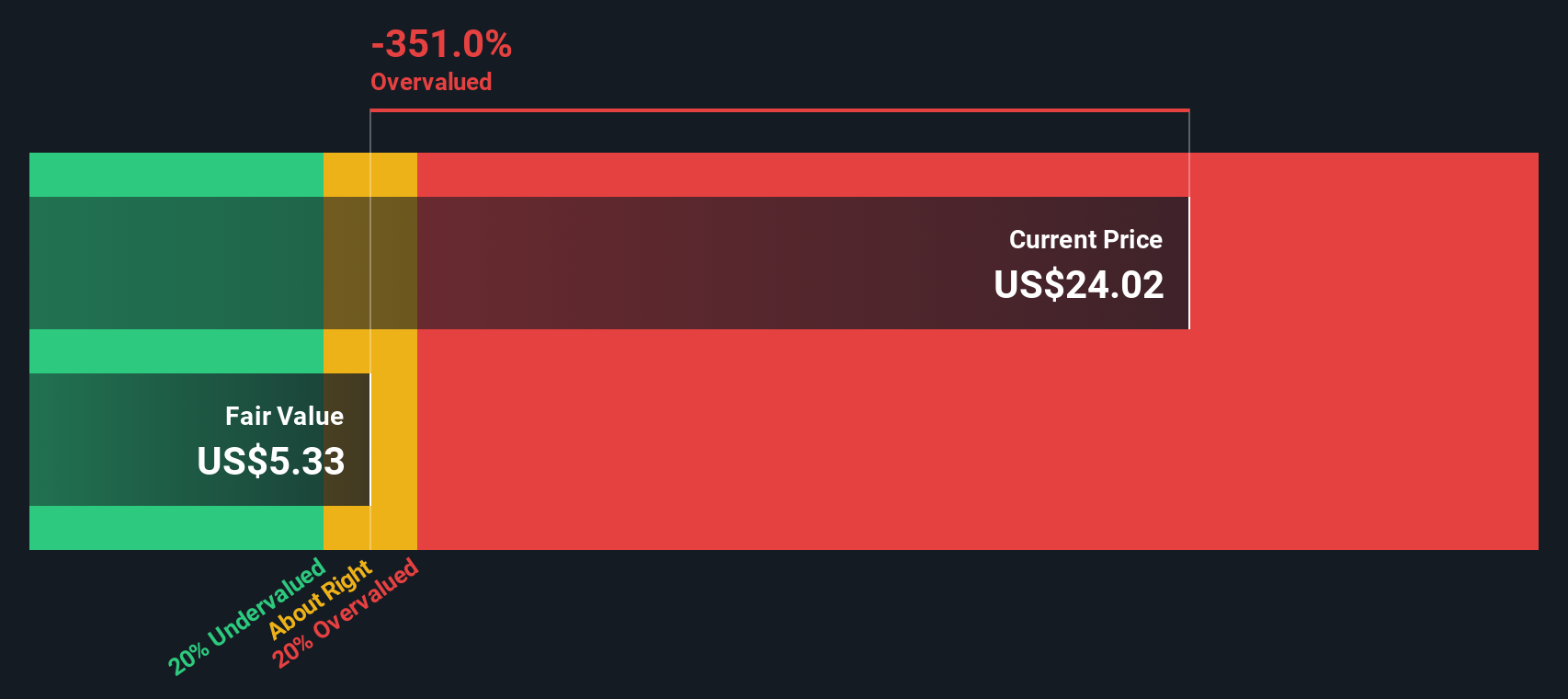

Another View: Discounted Cash Flow Model Challenges the Upside

While the consensus narrative argues that Zymeworks is undervalued, our DCF model presents a more cautious perspective. According to this analysis, the intrinsic value appears far below the current price, raising questions about the bullish fair value estimate and highlighting a potential valuation gap. Can Zymeworks’ story justify such optimism, or is the market overlooking key risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zymeworks for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zymeworks Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Zymeworks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay ahead by tracking tomorrow’s trends today. Don’t let great opportunities slip past you. Find out which stocks could boost your portfolio right now:

- Unlock the potential of AI-driven disruption by reviewing these 27 AI penny stocks as artificial intelligence transforms entire industries.

- Capture undervalued gems trading below their fair value by scanning these 908 undervalued stocks based on cash flows and position your money where the market’s expectations may have missed the mark.

- Build reliable passive income streams when you evaluate these 18 dividend stocks with yields > 3% and uncover high-yield opportunities that may reward you quarter after quarter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zymeworks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZYME

Zymeworks

A clinical-stage biotechnology company, discovers, develops, and commercializes biotherapeutics for the treatment of cancer, and autoimmune and inflammatory diseases (AIID).

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives