- United States

- /

- Pharma

- /

- NasdaqGS:ZVRA

How Investors May Respond To Zevra Therapeutics (ZVRA) CFO R. LaDuane Clifton’s Planned Departure

Reviewed by Sasha Jovanovic

- Zevra Therapeutics announced that Chief Financial Officer and Treasurer, R. LaDuane Clifton, will be stepping down from his roles effective December 31, 2025, to pursue other professional opportunities.

- Clifton’s departure marks a significant leadership transition, as he has been instrumental in guiding Zevra’s evolution from a development-stage firm to a commercial-stage rare disease company with a strong financial base.

- We'll consider the implications of this executive leadership change on Zevra's investment narrative and future financial direction.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Zevra Therapeutics Investment Narrative Recap

Zevra Therapeutics appeals to investors who believe in the company's ability to expand in the rare disease therapy market, leveraging commercial progress around MIPLYFFA and the pipeline. The upcoming CFO transition is not expected to materially impact the near-term MIPLYFFA revenue trajectory, which remains the central catalyst, nor does it directly change existing risks related to OLPRUVA or EU expansion for arimoclomol. One particularly relevant recent announcement was Zevra’s submission of a Marketing Authorization Application for arimoclomol in Europe. While this development supports the diversification of future revenue streams, the greatest short-term focus for investors remains on U.S. MIPLYFFA uptake and maintaining financial discipline during executive turnover. However, investors should be aware that, in contrast to leadership transitions, the slower-than-expected adoption and impairment charges around OLPRUVA remain a...

Read the full narrative on Zevra Therapeutics (it's free!)

Zevra Therapeutics is projected to reach $296.5 million in revenue and $151.4 million in earnings by 2028. This trajectory assumes a 68.5% annual revenue growth rate and a $155.3 million increase in earnings from the current -$3.9 million level.

Uncover how Zevra Therapeutics' forecasts yield a $23.22 fair value, a 170% upside to its current price.

Exploring Other Perspectives

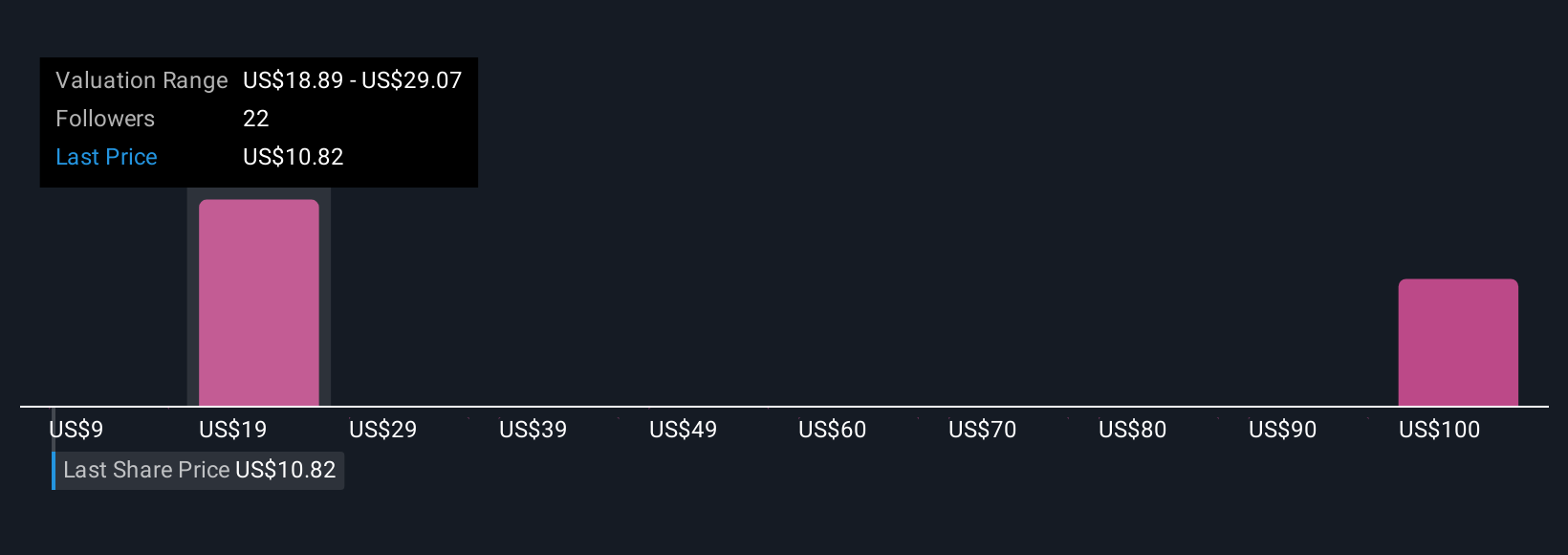

Eight members of the Simply Wall St Community gave fair value estimates for Zevra ranging from US$18 to US$104.13 per share. While opinions split widely, many are closely watching if slow OLPRUVA adoption could challenge long-term revenue targets and financial flexibility.

Explore 8 other fair value estimates on Zevra Therapeutics - why the stock might be a potential multi-bagger!

Build Your Own Zevra Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zevra Therapeutics research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zevra Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zevra Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zevra Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZVRA

Zevra Therapeutics

A commercial-stage company, focuses on addressing unmet needs for the treatment of rare diseases in the United States.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives