- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

Investors in Zai Lab (NASDAQ:ZLAB) from three years ago are still down 74%, even after 11% gain this past week

It is a pleasure to report that the Zai Lab Limited (NASDAQ:ZLAB) is up 42% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. Indeed, the share price is down a whopping 74% in the last three years. So it sure is nice to see a bit of an improvement. But the more important question is whether the underlying business can justify a higher price still.

While the stock has risen 11% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Zai Lab

Because Zai Lab made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Zai Lab saw its revenue grow by 34% per year, compound. That's well above most other pre-profit companies. So why has the share priced crashed 20% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

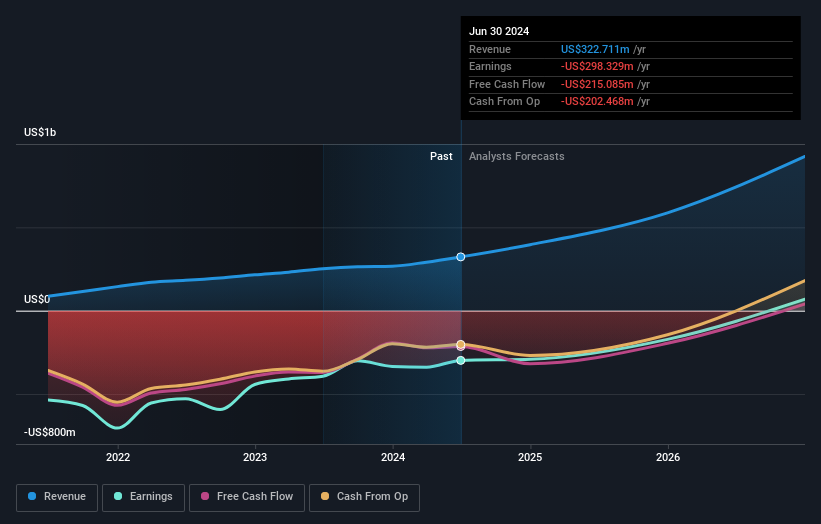

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Zai Lab is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Zai Lab in this interactive graph of future profit estimates.

A Different Perspective

Zai Lab shareholders gained a total return of 14% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 3% per year, over five years. It could well be that the business is stabilizing. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zai Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ZLAB

Zai Lab

Develops and commercializes therapies to treat oncology, autoimmune disorders, infectious diseases, and neuroscience.

High growth potential and good value.