- United States

- /

- Biotech

- /

- NasdaqGS:ZBIO

Can Zenas BioPharma's (ZBIO) Improving Loss Per Share Shift Investor Confidence in Its Long-Term Story?

Reviewed by Sasha Jovanovic

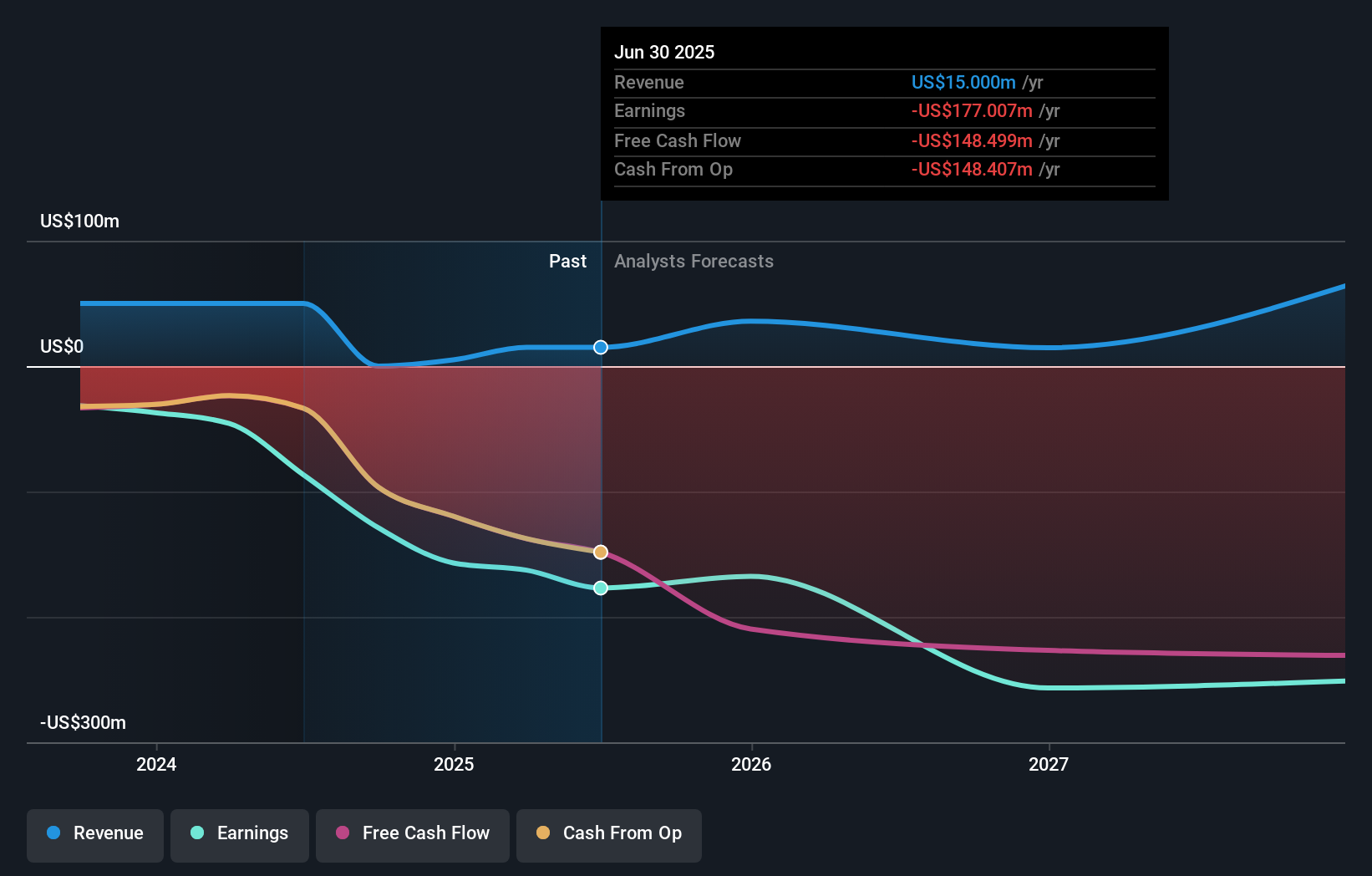

- Zenas BioPharma, Inc. reported its third quarter and nine-month results for the period ended September 30, 2025, disclosing a net loss of US$51.5 million for the quarter and US$137.3 million over nine months, with nine-month revenue of US$10 million.

- While the company's net loss increased year-over-year, the basic loss per share from continuing operations improved significantly compared to the same periods in 2024.

- We'll explore how the narrower loss per share, despite higher net losses, affects Zenas BioPharma's overall investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Zenas BioPharma's Investment Narrative?

To be comfortable as a shareholder in Zenas BioPharma, the big picture centers on belief in continued execution on promising clinical programs, especially obexelimab, and management's ability to fund operations through high losses and significant cash burn. The recent Q3 report shows net losses widening year-over-year, yet an improved basic loss per share thanks to a larger share base, hinting at shareholder dilution as a trade-off for raising new capital. This aligns with the company's sizable private placement and follow-on equity offerings, which may help ease going concern doubts raised in early 2024 but add pressure for these funds to convert into clinical or commercial milestones. The primary short term catalyst remains key clinical trial readouts, while the biggest risk continues to be execution on product development and funding needs. The latest results do little to change those near-term drivers for now, keeping the focus unchanged. However, investor concerns about potential dilution have not faded.

Insights from our recent valuation report point to the potential overvaluation of Zenas BioPharma shares in the market.Exploring Other Perspectives

Explore another fair value estimate on Zenas BioPharma - why the stock might be worth just $43.57!

Build Your Own Zenas BioPharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zenas BioPharma research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Zenas BioPharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zenas BioPharma's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zenas BioPharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBIO

Zenas BioPharma

A clinical-stage biopharmaceutical company, engages in the development and commercialization of transformative immunology-based therapies.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success