- United States

- /

- Biotech

- /

- NasdaqGM:XNCR

Did Xencor's (XNCR) Narrower Loss and Early XmAb819 Data Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Xencor recently reported a much narrower net loss for the third quarter of 2025 and shared initial clinical data from its Phase 1 study of XmAb819 in patients with advanced clear cell renal cell carcinoma.

- These updates highlight both improved operational results and ongoing innovation in the company's oncology pipeline, showcasing progress in financial health and drug development.

- We'll look at how Xencor's reduced net loss and early XmAb819 data shape its longer-term investment narrative and growth outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Xencor Investment Narrative Recap

Xencor’s investment appeal relies on the belief that it can translate its protein engineering platforms into differentiated medicines and durable revenue growth, primarily through successful late-stage clinical development and potential out-licensing. While the recently reported narrower net loss underscores improved operational discipline, this news does not meaningfully change the biggest near-term catalyst, which is robust late-stage clinical data for its lead TL1A program, nor does it reduce the major risk of high R&D costs and potential commercialization pressures if the company moves forward independently. The initial Phase 1 study results for XmAb819 in renal cell carcinoma, while promising for pipeline expansion, are less likely to affect the TL1A timeline which remains the most pivotal driver for sentiment and future performance. The earnings improvement is encouraging, but does not materially alter the inherent risks tied to execution in a competitive, capital-intensive sector. However, investors should be aware that despite improved financials, Xencor’s ability to achieve differentiation against established and emerging TL1A competitors still presents...

Read the full narrative on Xencor (it's free!)

Xencor's outlook anticipates $180.3 million in revenue and $29.0 million in earnings by 2028. This relies on a 7.1% annual revenue growth rate and a $200.1 million earnings increase from current earnings of -$171.1 million.

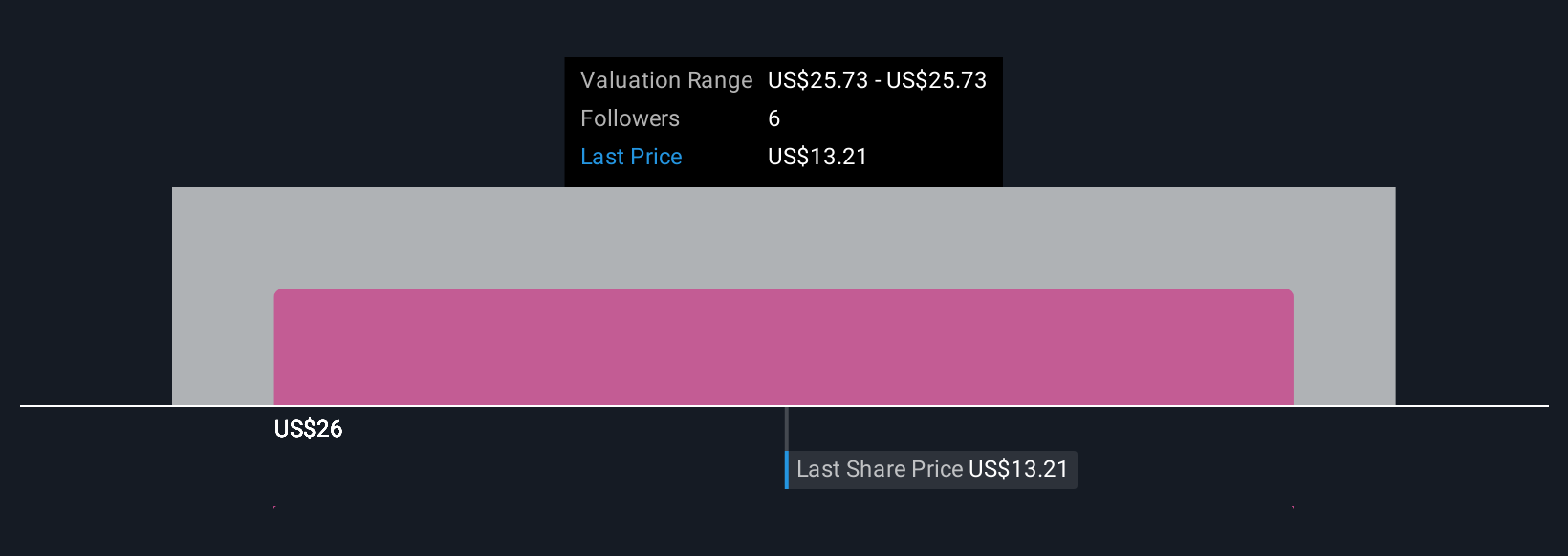

Uncover how Xencor's forecasts yield a $27.64 fair value, a 97% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided only one fair value estimate for Xencor at US$27.64, indicating a limited but specific outlook. This contrasts with the ongoing challenge of expensive late-stage clinical trials, a risk that could influence your confidence in the company's future performance.

Explore another fair value estimate on Xencor - why the stock might be worth just $27.64!

Build Your Own Xencor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xencor research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Xencor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xencor's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XNCR

Xencor

A clinical-stage biopharmaceutical company, focuses on the discovery and development of engineered monoclonal antibodies for the treatment of asthma and allergic diseases, autoimmune diseases, and cancer.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives