- United States

- /

- Biotech

- /

- NasdaqGM:XNCR

A Look at Xencor’s (XNCR) Valuation After Narrowed Losses and Upgraded Analyst Targets

Reviewed by Simply Wall St

Xencor (XNCR) posted third quarter and year-to-date results showing a sharp reduction in net losses compared to last year, which caught the attention of investors. This shift was quickly followed by renewed analyst optimism about the company’s outlook.

See our latest analysis for Xencor.

Xencor’s recent announcement of sharply reduced net losses appears to have reinvigorated interest, helping to fuel an impressive 92% share price return over the past three months. However, despite this strong short-term momentum, the total shareholder return remains deeply negative over the last year and across the longer term. This places current activity in the context of a still-lengthy recovery runway.

If you’re interested in uncovering more opportunities beyond biotech, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With analysts raising their price targets and recent results narrowing losses, the key question for investors is whether Xencor remains undervalued with further upside ahead, or if the latest gains already reflect its future growth potential.

Most Popular Narrative: 49.7% Undervalued

Analysts’ consensus fair value for Xencor lands well above the last close, suggesting that the current share price may not reflect the company’s potential upside. Their outlook incorporates recent clinical progress along with ambitious long-term earnings projections as key factors.

The robust and flexible XmAb platform enables modular drug development and the creation of differentiated assets, which is expected to reduce development costs and timelines. This could directly benefit future operating margins and net profitability. The clinical trial strategy focuses on efficient dose ranging and selection, ongoing biomarker work, and combination-therapy options. This positions the company to respond quickly to changes in standards of care and maximize the commercial potential of its pipeline, with positive implications for recurring revenue and ultimate earnings leverage.

What’s the hidden engine behind such a high valuation? The key factor appears to be a significant profit margin turnaround and a projected earnings launch that could rival major industry disruptors. Interested in learning which unique financial drivers support this narrative’s price target? Only an in-depth analysis reveals how these numbers align.

Result: Fair Value of $27.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering concerns over delayed clinical timelines and a heavy dependence on positive late-stage trial results could quickly shift the current optimism.

Find out about the key risks to this Xencor narrative.

Another View: Are Ratios Telling a Different Story?

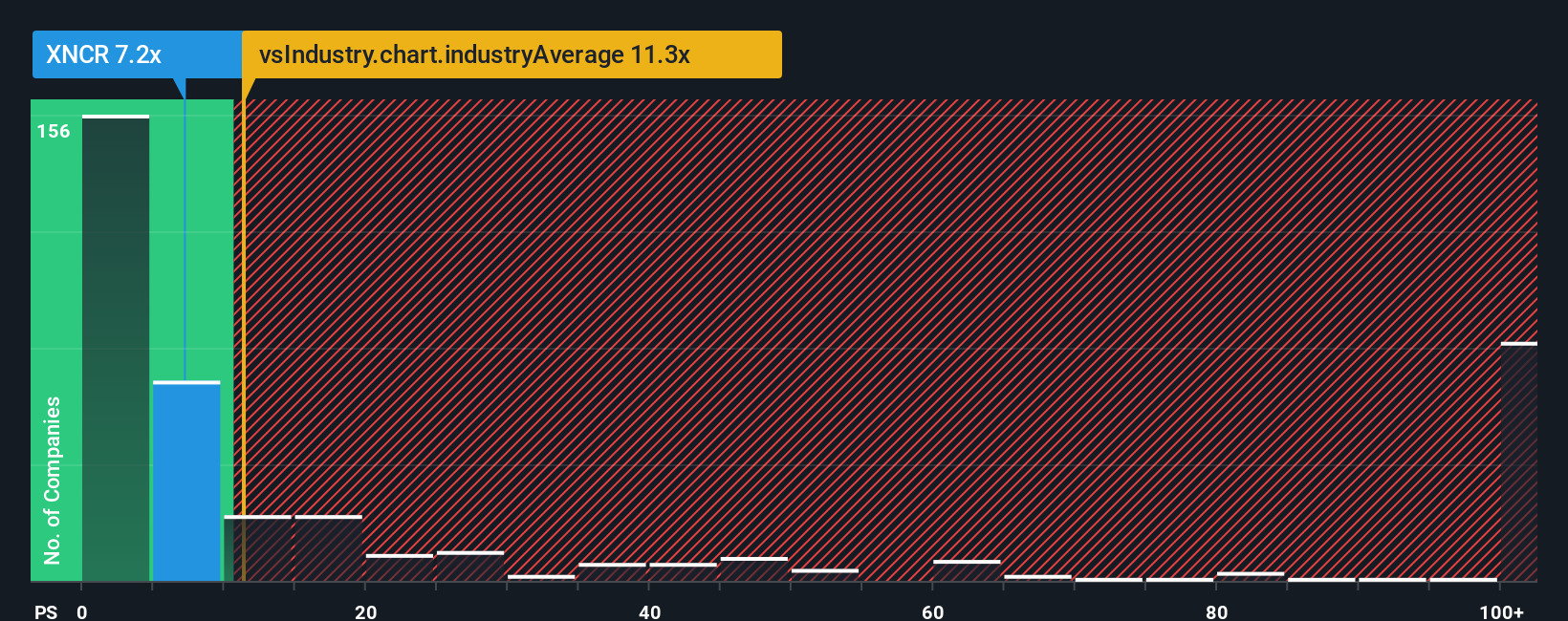

Looking at Xencor’s price-to-sales ratio shows another perspective. At 6.6x, it is nearly in line with the peer average of 6.5x but much higher than the fair ratio of 1x and well below the broader US Biotechs industry average of 11.2x. This gap suggests investors could face valuation risk if the market shifts expectations, or there may be upside if growth delivers. Will the gap narrow or widen from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xencor Narrative

If you have a different viewpoint or enjoy digging into the numbers yourself, you can easily shape your insights and build a story unique to your perspective in under three minutes with Do it your way.

A great starting point for your Xencor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next winning opportunity with tailored screeners that highlight potential gems you might otherwise miss. Smart investing starts with finding the right ideas before anyone else does.

- Tap into technology’s unstoppable growth by tracking these 24 AI penny stocks, which are driving innovation and shaping the industries of tomorrow.

- Secure your portfolio with stability and steady income via these 16 dividend stocks with yields > 3%, featuring yields above 3% from established market leaders.

- Ride the next financial revolution by following these 82 cryptocurrency and blockchain stocks, focusing on blockchain adoption, digital payments, and futuristic finance models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XNCR

Xencor

A clinical-stage biopharmaceutical company, focuses on the discovery and development of engineered monoclonal antibodies for the treatment of asthma and allergic diseases, autoimmune diseases, and cancer.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives