- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Xeris Biopharma (XERS) Turns Profitable and Lifts 2025 Outlook but What Will Sustain Growth?

Reviewed by Sasha Jovanovic

- Xeris Biopharma Holdings recently reported record third quarter results, with revenue rising to US$74.38 million and achieving net income for the first time, compared to a net loss in the previous year.

- An important development is the company raising its full-year 2025 revenue guidance and planning to expand its sales and patient support teams, pointing to accelerating business momentum.

- We’ll explore how Xeris’s milestone of achieving net profitability may alter its investment outlook and future growth narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Xeris Biopharma Holdings Investment Narrative Recap

For investors considering Xeris Biopharma Holdings, the key thesis centers on sustained revenue expansion through its core products, especially the accelerating growth in Recorlev and Gvoke, while managing competitive threats and execution risks inherent to a focused commercial portfolio. The company’s first quarterly net income and upgraded full-year revenue guidance provide a strong signal of commercial progress but do not materially change the biggest short-term risk: continued high dependence on a small number of products, particularly as the company scales investments in sales and support.

Among Xeris’s latest announcements, the plan to nearly double its sales and patient support teams is especially relevant, it directly supports recent gains in market penetration for Recorlev, which management cited as a primary source of quarterly revenue growth, yet also amplifies the critical need to balance expanding operating expenses with sustained product demand and margin improvement to secure longer-term profitability.

Yet, while growth is promising, investors should not overlook the continuing risks around concentrated product exposure, since unexpected competitive moves or underperformance in any one therapy could ...

Read the full narrative on Xeris Biopharma Holdings (it's free!)

Xeris Biopharma Holdings' outlook projects $440.9 million in revenue and $84.8 million in earnings by 2028. This assumes a 21.5% annual revenue growth and a $116.8 million increase in earnings from the current -$32.0 million.

Uncover how Xeris Biopharma Holdings' forecasts yield a $10.67 fair value, a 44% upside to its current price.

Exploring Other Perspectives

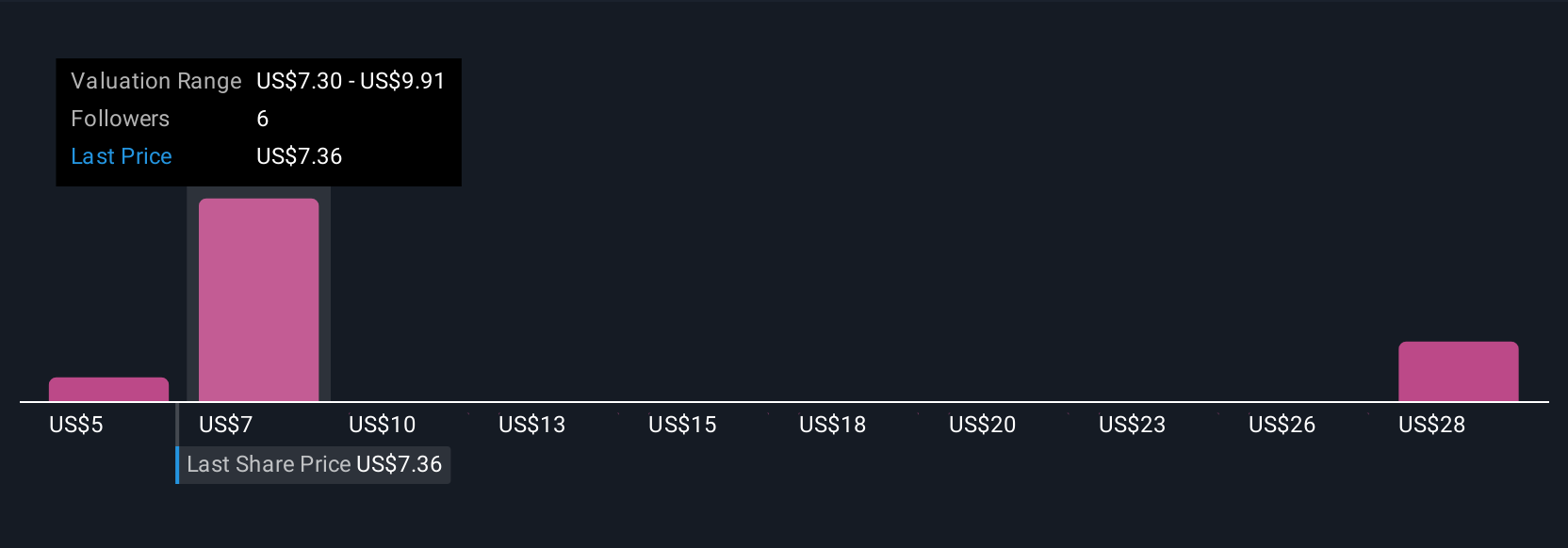

Four fair value estimates from the Simply Wall St Community span a wide interval from US$4.69 to US$32.50 per share. As opinions differ, remember Xeris’s ongoing dependence on just a handful of commercial medicines magnifies the stakes for future earnings stability, explore multiple viewpoints to see how this could influence performance.

Explore 4 other fair value estimates on Xeris Biopharma Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own Xeris Biopharma Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Xeris Biopharma Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xeris Biopharma Holdings' overall financial health at a glance.

No Opportunity In Xeris Biopharma Holdings?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Reasonable growth potential and fair value.

Market Insights

Community Narratives