- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Assessing Xeris Biopharma (XERS) Valuation Following Strong Q3 Earnings and Raised Revenue Guidance

Reviewed by Simply Wall St

Xeris Biopharma Holdings (XERS) attracted attention with its third-quarter earnings announcement, reporting strong revenue growth and a return to profitability. The company also raised its full-year revenue guidance, indicating positive momentum for the future.

See our latest analysis for Xeris Biopharma Holdings.

Following its impressive earnings and improved outlook, Xeris Biopharma Holdings has experienced significant volatility, with a recent sharp pullback. The company has posted a remarkable year-to-date share price return of 122.83 percent. Its one-year total shareholder return of 129.46 percent highlights the longer-term momentum that has been building as fundamentals improve.

If Xeris’s growth streak has you thinking about other opportunities in the sector, take a moment to explore the latest breakthroughs and performers with our See the full list for free.

But with shares up so sharply, the key question is whether Xeris stock still offers value, or if the latest rebound means the market has already factored in its future growth prospects. Is there an attractive entry point here, or has the upside been priced in?

Most Popular Narrative: 27.7% Undervalued

With Xeris Biopharma Holdings' fair value pegged at $10.67 per share, well above its last close, analysts see room for further upside. Key developments in drug launches and persistent top-line growth have shaped this positive outlook.

Persistent high gross margins, alongside scaling sales of Gvoke, Recorlev, and Keveyis, set the stage for operational leverage and sustainable EBITDA and net margin improvements as revenue expands and expense ratios decline over time.

What’s the secret behind this premium valuation? The narrative hinges on aggressive growth forecasts, margin expansion, and future profitability metrics higher than many industry peers. Want the numbers powering this bold target? The full narrative breaks down the assumptions driving this call.

Result: Fair Value of $10.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a narrow product lineup or rising expenses could challenge Xeris’s growth narrative if market dynamics unexpectedly shift.

Find out about the key risks to this Xeris Biopharma Holdings narrative.

Another View: Multiples Paint a Different Picture

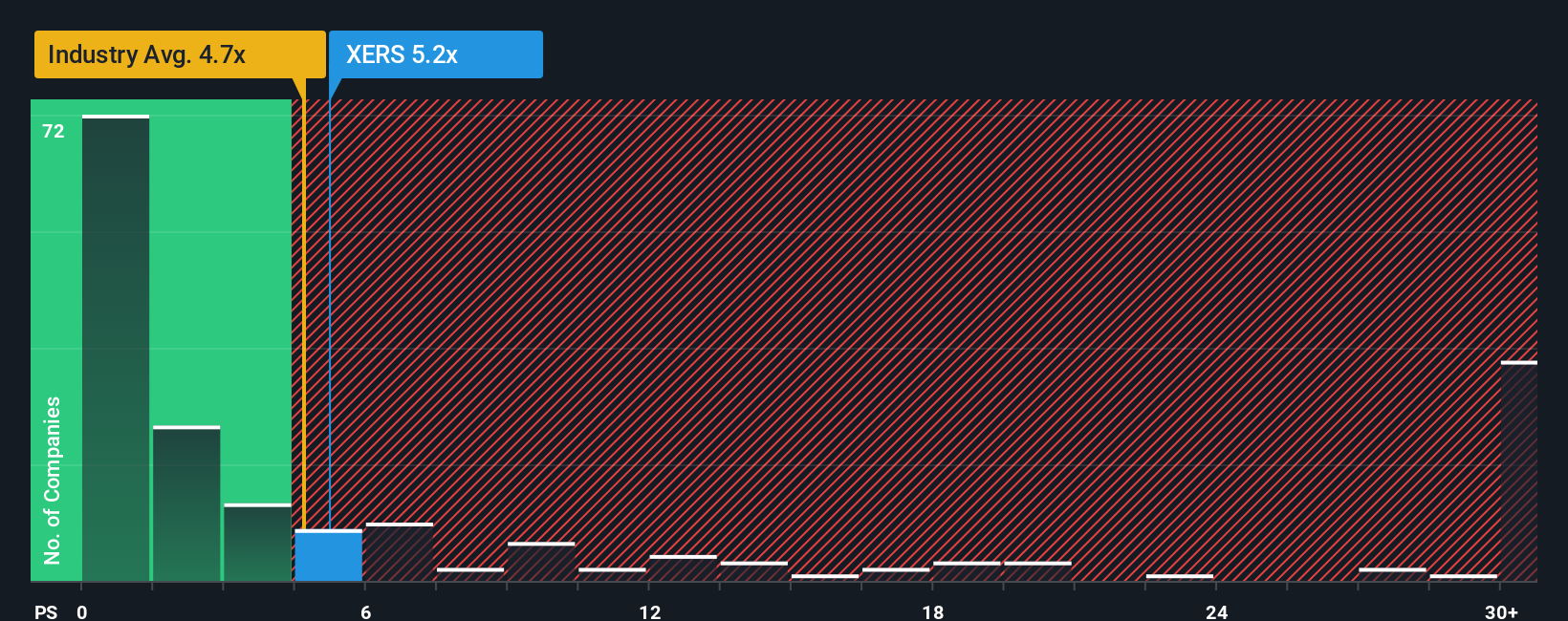

While fair value calculations point to Xeris Biopharma Holdings as undervalued, looking at its price-to-sales ratio tells a different story. Xeris trades at 4.7x sales, which is more expensive than both peers (3x) and the US pharmaceuticals industry average (4x). However, compared to the fair ratio of 6.7x, there could still be upside. High multiples, though, bring higher expectations and risk. Does the market have it right, or is there more room to run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xeris Biopharma Holdings Narrative

If you want to dig deeper and draw your own conclusions from the figures, it’s quick and easy to build your perspective using real data. Just set aside a few minutes and make it your way with Do it your way.

A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make the smartest moves with your money by tapping into unique opportunities across the market. You could miss out on tomorrow’s winners if you wait.

- Start earning more from your portfolio by targeting high-yield plays with these 17 dividend stocks with yields > 3%, putting reliable dividend potential on your side.

- Fuel growth in your holdings by unlocking the potential of these 25 AI penny stocks, which set the pace in artificial intelligence advancements.

- Explore deep value opportunities and act before the crowd by browsing these 848 undervalued stocks based on cash flows, based on real cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Reasonable growth potential and fair value.

Market Insights

Community Narratives