- United States

- /

- Biotech

- /

- NasdaqGM:XENE

Xenon Pharmaceuticals (XENE): Fresh Valuation Perspective Following Modest Share Price Uptick

Reviewed by Simply Wall St

See our latest analysis for Xenon Pharmaceuticals.

Xenon Pharmaceuticals’ share price return over the past year is still down double digits, but its 5-year total shareholder return of more than 250% signals the bigger story here has been about long-term momentum building behind the scenes. While the stock slipped recently, the broader trend shows investors are still betting on the company’s growth potential.

On the hunt for other healthcare stocks with a strong performance story? You can check out See the full list for free. as your next stop.

With shares still trading well below analyst targets despite recent gains, the question for investors now is whether Xenon Pharmaceuticals remains undervalued or if the promise of future growth is already reflected in the price.

Price-to-Book Ratio of 5.3x: Is it justified?

Xenon Pharmaceuticals is currently trading at a price-to-book (P/B) ratio of 5.3x, which is slightly below the peer average of 5.6x. This suggests modest value on this metric. However, compared to the industry average for US Biotechs of 2.5x, Xenon's shares appear significantly more expensive.

The P/B ratio is often used to evaluate biotech companies that have not yet achieved consistent profitability, since it compares a company’s market price to its net asset value. Investors rely on this ratio as a proxy for how much the market is willing to pay for each dollar of net assets. This is a key consideration for early-stage and research-driven firms like Xenon.

While the market seems to be granting Xenon Pharmaceuticals a valuation premium, the higher multiple could reflect optimism about the company's forecast revenue growth. However, it is important to note that Xenon is currently unprofitable, and its price-to-book valuation looks expensive relative to broader industry standards. There is also insufficient data to calculate a fair ratio based on regression analysis, which might otherwise indicate a level the market could move toward over time.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 5.3x (OVERVALUED)

However, sustained unprofitability and sharp stock price drops in recent months could challenge optimism about Xenon Pharmaceuticals’ future growth trajectory.

Find out about the key risks to this Xenon Pharmaceuticals narrative.

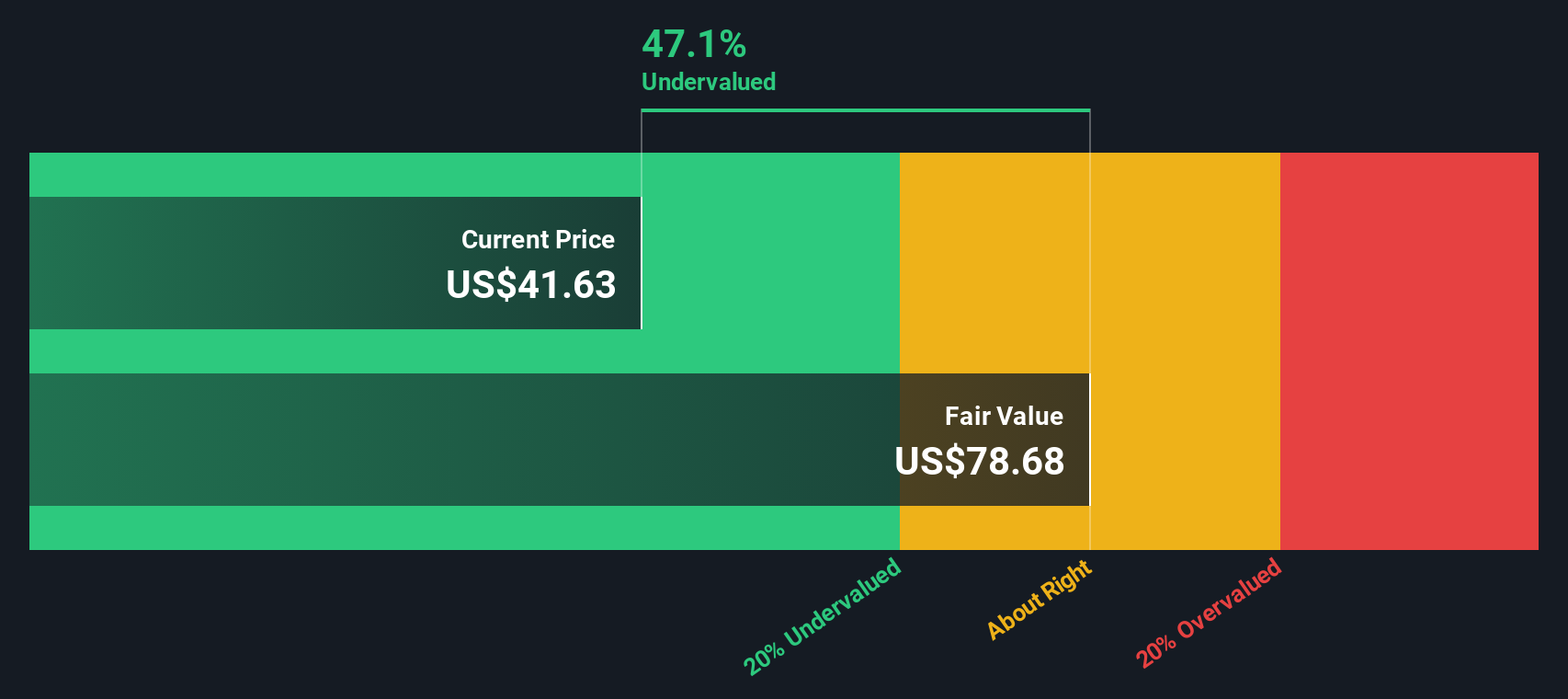

Another View: Discounted Cash Flow Suggests Undervaluation

While Xenon Pharmaceuticals may look expensive compared to industry averages based on its price-to-book ratio, our DCF model presents a different perspective. By projecting future cash flows, the SWS DCF model estimates fair value at $68.60, which is nearly 44% higher than the current share price. Could the market be overlooking potential upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Xenon Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Xenon Pharmaceuticals Narrative

If you see the numbers differently or want to dive into your own research, take a few minutes to build your personal take on Xenon Pharmaceuticals. You can Do it your way.

A great starting point for your Xenon Pharmaceuticals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for one opportunity when there are so many growth and value prospects out there. Make your next big move with ideas you won’t want to miss.

- Discover strong cash flow potential by adding momentum to your watchlist using these 863 undervalued stocks based on cash flows.

- Explore income-generating opportunities by scanning through these 16 dividend stocks with yields > 3% with yields above 3% and established track records.

- Explore the AI sector by examining high-potential innovations via these 24 AI penny stocks in this rapidly evolving space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XENE

Xenon Pharmaceuticals

A neuroscience-focused biopharmaceutical company, engages in the discovery, development, and delivery of therapeutics to treat patients with neurological and psychiatric disorders in Canada.

Flawless balance sheet and good value.

Market Insights

Community Narratives