- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Wave Life Sciences (WVE): Revisiting Valuation as Shares Recover 11% in One Month

Reviewed by Simply Wall St

See our latest analysis for Wave Life Sciences.

After a tough start to 2024, Wave Life Sciences has found some strength in recent weeks. Its 1-month share price return of 11% reverses some earlier declines. However, the 1-year total shareholder return remains deeply negative. The three-year total return tops 100%, which suggests momentum can shift quickly as market sentiment evolves.

If this kind of comeback grabs your attention, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying off their lows and the stock trading at a significant discount to analyst price targets, the question remains: Is Wave Life Sciences undervalued, or has the market already factored in all its future growth?

Most Popular Narrative: 60% Undervalued

Wave Life Sciences last closed at $8.04, while the most-followed narrative sees fair value well above that mark. The gap between the current price and the consensus target highlights sharply contrasting expectations for future growth.

The upcoming clinical data readouts for key programs (AATD with WVE-006 and obesity with WVE-007) in late 2025 and early 2026 represent potential inflection points, supported by strong early efficacy and favorable safety. If positive, these results could significantly expand revenue opportunities in large, underserved markets, driven by an aging population and rising chronic disease prevalence.

Want to see what’s behind this dramatic upside? The narrative’s bullish price hinges on massive projected revenue and margin increases. Can Wave deliver on such bold assumptions? Only the full breakdown reveals which financial bets drive this target.

Result: Fair Value of $20.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, wavering partnership revenue and persistently high R&D costs could put pressure on growth expectations if new clinical or collaboration milestones fall short.

Find out about the key risks to this Wave Life Sciences narrative.

Another View: Multiples Paint a Cautionary Picture

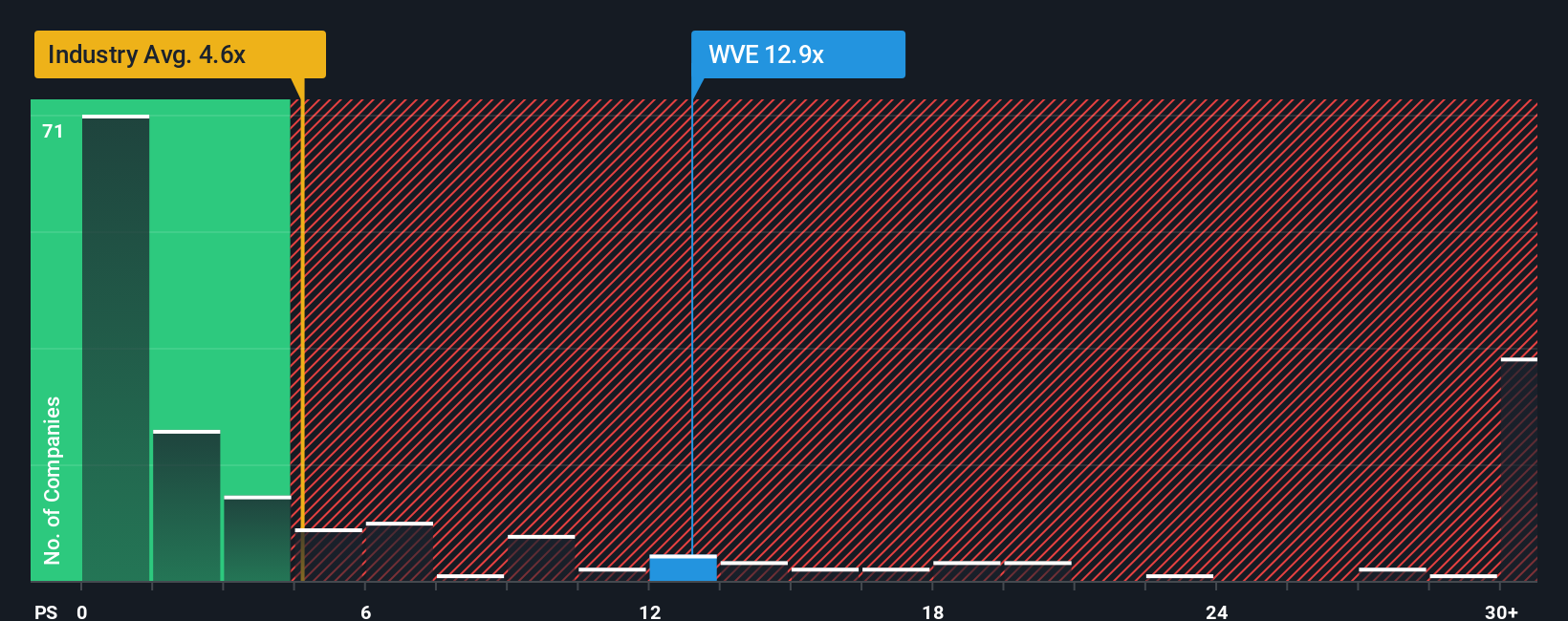

While analyst models see big upside, a quick reality check shows that Wave Life Sciences trades at a price-to-sales ratio of 13.6x. That is much higher than both the US Pharmaceuticals industry average of 4.2x and the fair ratio of 1.2x. This premium suggests investors face a risk if expectations or revenue momentum slip. Is the market paying too much for long-term hope?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wave Life Sciences Narrative

If you see things differently or enjoy digging into the details yourself, you can build your own story in just a few minutes using the available data. Do it your way

A great starting point for your Wave Life Sciences research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart opportunities are just a step away. To stay ahead of the market, check out these handpicked stock ideas and position yourself for tomorrow’s winners before the crowd catches on.

- Unlock the potential of smarter medicine by reviewing these 33 healthcare AI stocks, which is changing the future of healthcare with artificial intelligence and breakthrough treatments.

- Benefit from attractive income streams when you assess these 20 dividend stocks with yields > 3%, offering yields above 3% and strong fundamentals for reliable returns.

- Seize the momentum in disruptive technology by checking out these 26 AI penny stocks, which are leading innovations in automation, machine learning, and market-defining trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives