- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Wave Life Sciences (WVE): A Closer Look at Valuation After a Volatile Start to 2024

Reviewed by Simply Wall St

See our latest analysis for Wave Life Sciences.

Wave Life Sciences’ share price has been on a rollercoaster this year, with a sharp slide of 47% year-to-date reflecting market caution despite some renewed buying in recent sessions. While the 1-year total shareholder return is down around 51%, the three-year total return stands out with a gain over 66%. This highlights how quickly sentiment can shift in biotech as risk and opportunity collide.

Curious to see how other healthcare stocks are moving right now? The healthcare screener spotlights dozens of innovators worth watching. See the full list for free.

With the stock trading at a steep discount to analyst targets, but with recent financials showing mixed signals, it begs the question: does Wave Life Sciences offer a compelling entry point, or has the market already accounted for its prospects?

Most Popular Narrative: 65% Undervalued

The most widely discussed narrative highlights a potential disconnect between Wave Life Sciences’ last close price of $7.05 and an estimated fair value that is more than twice as high. With analysts projecting sharp growth even though the stock is trading well below consensus, momentum could increase if these expectations are met.

The expansion and clinical validation of Wave's proprietary RNA editing and siRNA platforms, along with the emergence of new wholly-owned pipeline candidates for both rare and prevalent diseases, position the company to benefit from growing market adoption of RNA-based and precision therapies. This supports the potential for longer-term top-line growth and increases the opportunity for partnership revenue.

Is there a secret formula behind this high valuation? The answer may lie in ambitious growth assumptions for both revenue and profit margins, which push the boundaries of industry norms. Discover which pivotal events could turn optimism into reality or cause shares to lose momentum. The narrative is bold. Are the projections unrealistic? Only the full deep-dive provides the answer.

Result: Fair Value of $20.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and reliance on a few clinical programs could quickly shift sentiment if product approvals or major partnerships do not materialize soon.

Find out about the key risks to this Wave Life Sciences narrative.

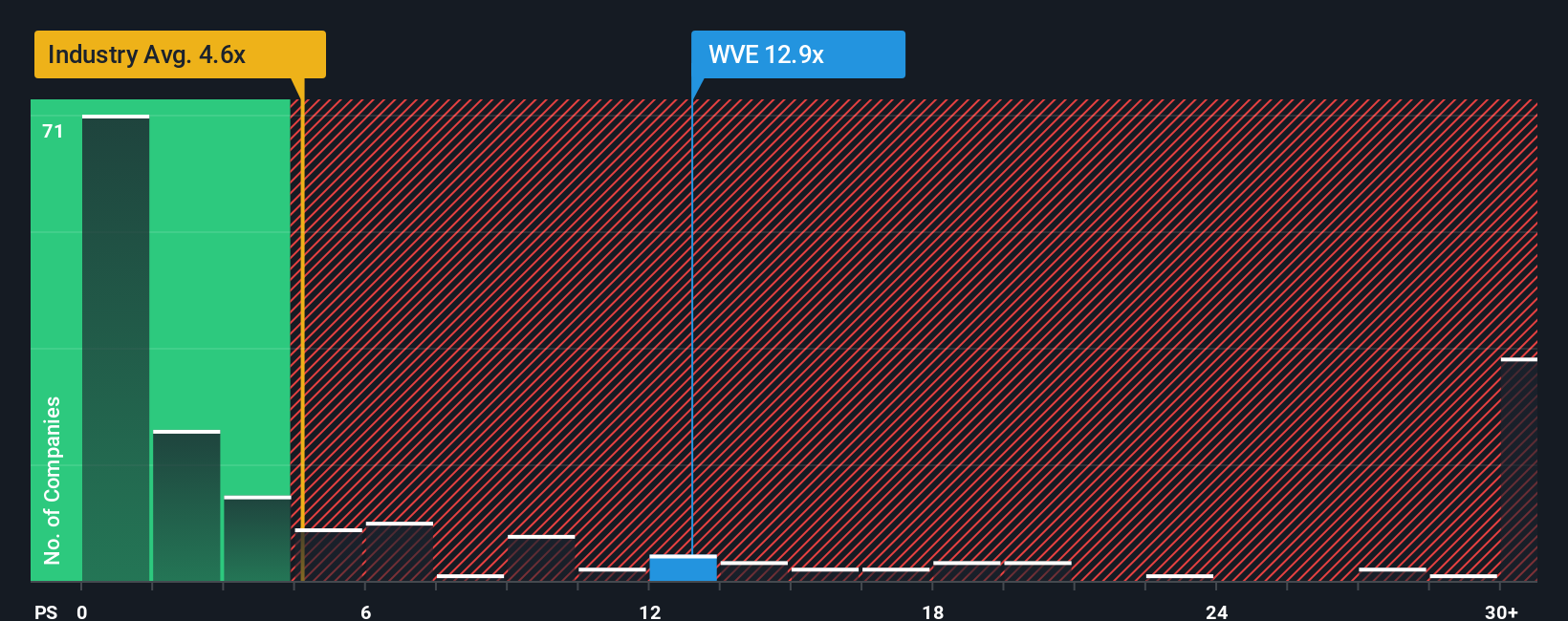

Another View: Valuation by Sales Ratio Paints a Different Picture

While some see major upside based on future earnings potential, the market’s current pricing tells a different story. Wave Life Sciences is trading at a price-to-sales ratio of 10.8, which is noticeably higher than both the US Pharmaceuticals industry average of 4.0 and the peer average of 4.2. In comparison to the fair ratio of 1.6 that the market could shift toward, this gap suggests the stock may be priced for perfection, leaving little margin for error if expectations change. Could momentum alone support this valuation, or will the numbers eventually catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wave Life Sciences Narrative

If these perspectives don't resonate or you want to see the numbers for yourself, you’re just minutes away from building an independent view. Do it your way

A great starting point for your Wave Life Sciences research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your portfolio by tracking opportunities that match your goals. If you skip these hand-picked themes, you might just miss tomorrow’s best performers.

- Unlock the potential for reliable payouts by checking out these 17 dividend stocks with yields > 3% among companies delivering yields above 3% and steady financial strength.

- Jump into the future of medical breakthroughs and see how AI is shaping healthcare with these 30 healthcare AI stocks, which could transform diagnostics and treatment.

- Spot tomorrow’s undervalued winners by tracking these 918 undervalued stocks based on cash flows focused on stocks priced well below their intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives