- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Wave Life Sciences Ltd. (NASDAQ:WVE) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Wave Life Sciences Ltd. (NASDAQ:WVE) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

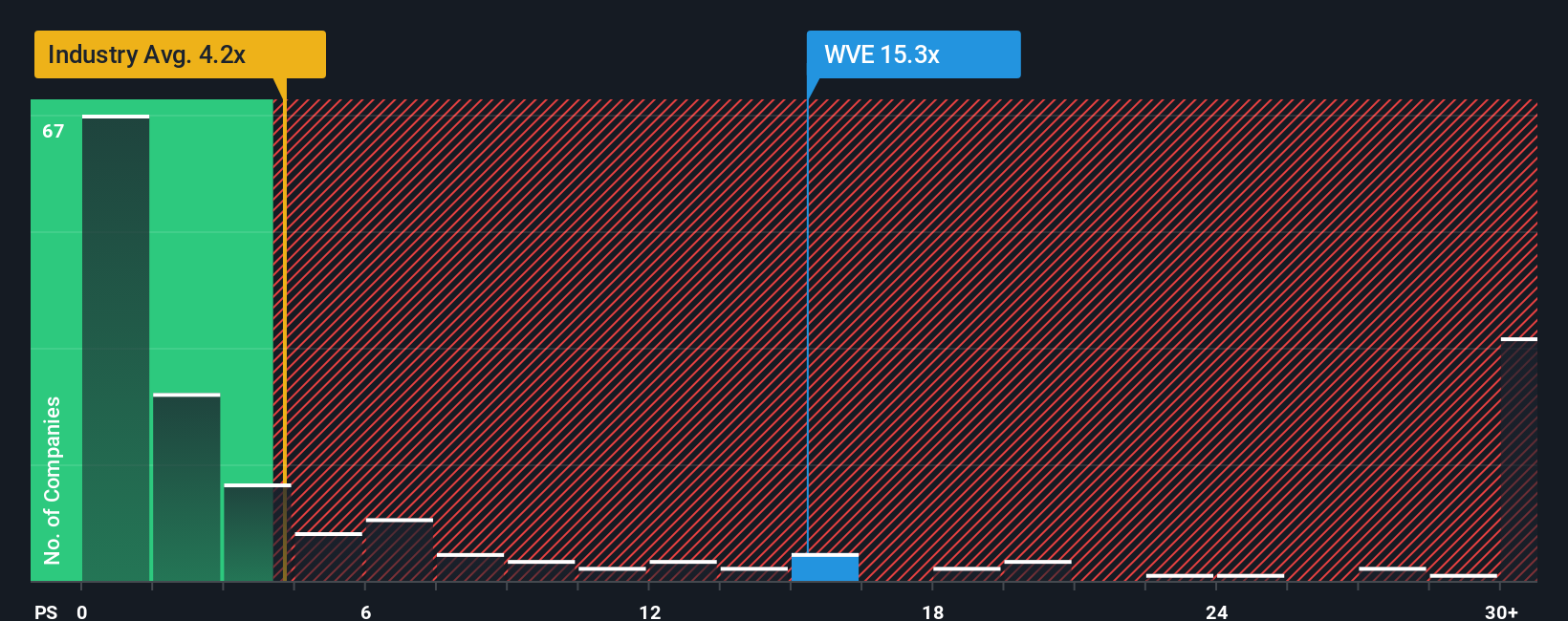

After such a large jump in price, Wave Life Sciences may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 15.3x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios under 4.2x and even P/S lower than 1.4x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Wave Life Sciences

How Has Wave Life Sciences Performed Recently?

While the industry has experienced revenue growth lately, Wave Life Sciences' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Wave Life Sciences' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Wave Life Sciences' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 133% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 24% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 29% each year, which is noticeably more attractive.

In light of this, it's alarming that Wave Life Sciences' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Shares in Wave Life Sciences have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that Wave Life Sciences currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about these 2 warning signs we've spotted with Wave Life Sciences (including 1 which is significant).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives