- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Vertex Pharmaceuticals (VRTX): Profit Margins Improve, But Revenue Growth Lags Market Into Earnings Season

Reviewed by Simply Wall St

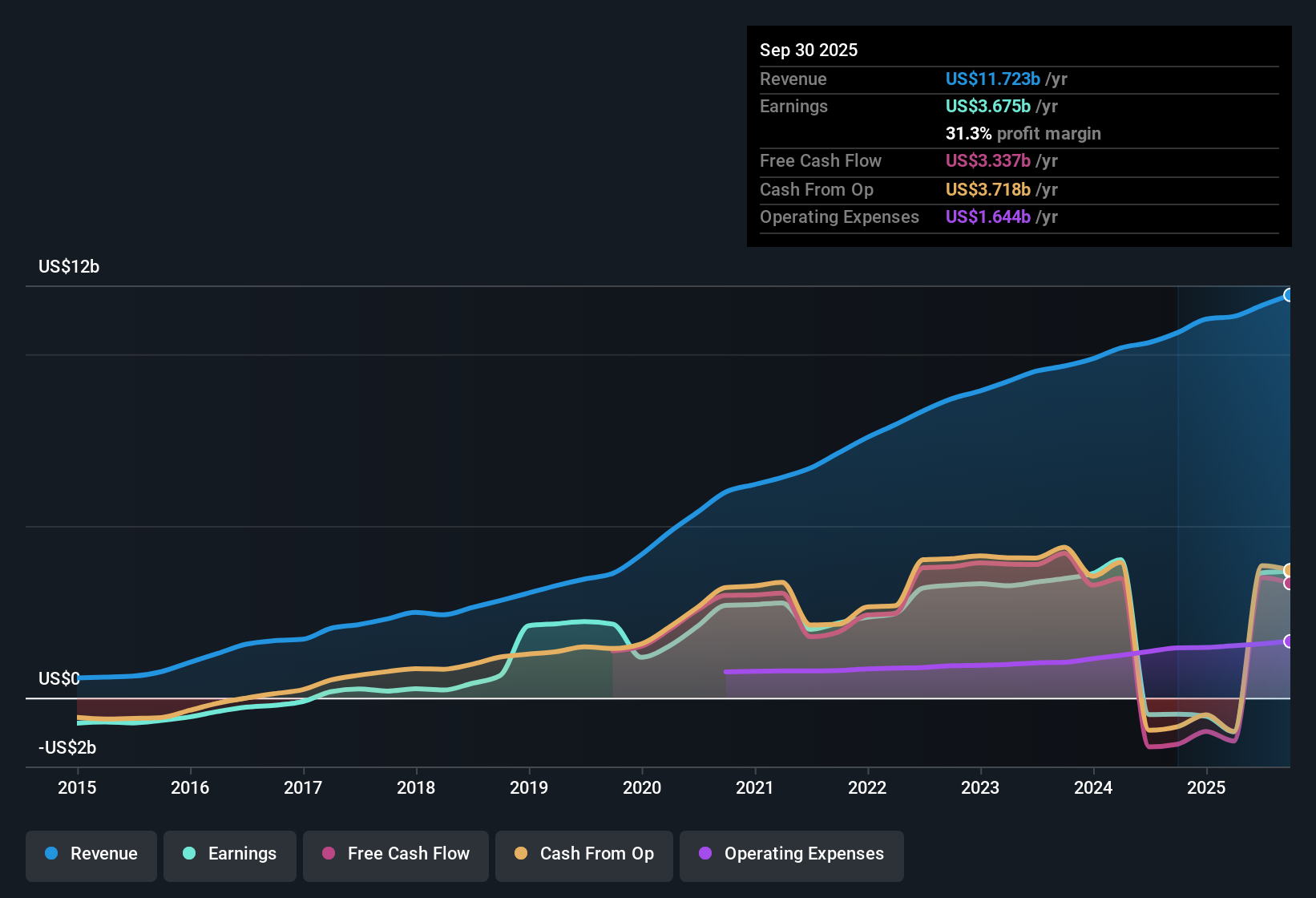

Vertex Pharmaceuticals (VRTX) is forecasting revenue growth of 8.8% annually, trailing the broader US market’s 10.5% pace. Earnings are expected to rise 13.3% per year, slower than the US average of 16%. Over the past five years, the company’s earnings have actually declined by 10.4% per year, yet Vertex recently moved into profitability and has improved its net profit margins. This puts a spotlight on ongoing improvements in earnings quality this season.

See our full analysis for Vertex Pharmaceuticals.Now, let's see how these figures measure up against the most widely held narratives in the market and which perspectives might shift as a result.

See what the community is saying about Vertex Pharmaceuticals

DCF Fair Value Rises Far Above Market Price

- DCF fair value sits at $705.53, which exceeds the current share price of $417.00 by nearly 70%. This highlights a significant valuation gap that makes Vertex appear deeply discounted by this metric.

- Bulls argue that this wide margin to DCF fair value strongly supports the optimistic outlook for substantial upside as new gene-editing therapies and pipeline launches are scaled.

- The price-to-earnings ratio of 28.8x is well below peers at 55.6x, reinforcing claims of a favorable entry point. However, it still remains higher than the broader biotech sector at 16.9x, which moderates overly optimistic views with some sector-wide caution.

- Bullish forecasts anticipate top-line growth accelerating toward 14% per year, with margins potentially rising to 46.3%. This would further support higher valuations.

Margin Expansion Drives Quality Upside

- Net profit margins, recently noted at 31.9%, are projected by the consensus narrative to climb toward 37.4% in three years. This signals ongoing efficiency gains that analysts believe will strengthen long-term earnings power.

- Analysts' consensus view highlights that pipeline diversification into areas such as gene editing and precision medicine is broadening Vertex’s revenue base and supporting rising margins, even as the company remains reliant on cystic fibrosis for the majority of its profits.

- An important factor is the simultaneous investment in new launches such as ALYFTREK and CASGEVY, which are expected to push margins higher as uptake increases and operational leverage improves.

- However, continued dependency on the CF franchise means any slowdowns or emerging competition in this segment continue to pose margin risks.

Analyst Targets Suggest Moderate Upside

- The consensus analyst price target is $480.20, offering modest headroom of around 15% from the share price of $417.00. This reflects more moderate upside expectations compared to the DCF model but remains a positive signal for those seeking steady appreciation.

- Analysts’ consensus view suggests this upside is credible only if Vertex maintains strong execution on its product launches and achieves projected earnings of $5.6 billion by 2028.

- The consensus assumes a future PE ratio of 26.5x, a step down from today's 27.9x, which would still be significantly above the industry norm. This highlights continued market confidence in the company’s leadership in high-margin therapeutics.

- However, analysts caution that much of this growth depends on successfully managing risks related to competition and regulatory changes, especially as new entrants emerge in the gene therapy and specialty drug markets.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vertex Pharmaceuticals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these figures? Add your perspective and shape your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Explore Alternatives

Vertex Pharmaceuticals’ growth outlook is tempered by its declining historic earnings, reliance on one franchise, and sector pressures that could delay stable and long-term performance.

If you want more reliable progress and steadier expansion, consider our stable growth stocks screener (2073 results) to uncover companies consistently delivering growth, regardless of industry swings or short-term setbacks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives