- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Vertex Pharmaceuticals (VRTX): Exploring Valuation as Shares Continue Month-Long Moderate Gains

Reviewed by Simply Wall St

Vertex Pharmaceuticals (VRTX) shares edged slightly higher today, continuing a month-long trend of moderate gains. The company has outperformed biotech peers recently, which has prompted investors to take a closer look at its growth metrics and overall trajectory.

See our latest analysis for Vertex Pharmaceuticals.

Vertex Pharmaceuticals’ share price has shown resilience after a dip earlier this year. The stock recently recorded a 5.3% gain over the past month, while the 1-year total shareholder return remains down around 10%. This pattern suggests momentum is gradually rebuilding as investors weigh strong fundamentals against a volatile recent stretch.

If the uptick in Vertex's stock has you thinking about the broader healthcare landscape, now’s your chance to discover other opportunities with our See the full list for free.

With Vertex Pharmaceuticals trading about 13% below the average analyst price target and showing solid long-term returns, investors must now consider whether the current valuation leaves room for upside or if the market already reflects future growth prospects.

Most Popular Narrative: 11.3% Undervalued

Compared to its last closing price of $425.57, the most widely followed narrative pegs Vertex Pharmaceuticals' fair value at $479.83. The gap is driven by expectations that future revenue and margins will remain resilient as product launches broaden the earnings base.

Vertex's pipeline diversification, including programs in pain, kidney, and type 1 diabetes, leverages global advances in genomic and gene-editing technologies. This positions the company to capture long-term growth from accelerating personalized and precision medicine adoption and supports both revenue and long-term margin expansion.

Curious how analysts justify such a premium? The core of this narrative is built on ambitious growth forecasts and a profit profile that defies industry averages. Discover the financial logic and bold assumptions analysts use to support this price claim.

Result: Fair Value of $479.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the heavy reliance on cystic fibrosis drugs and ongoing regulatory uncertainties could limit Vertex's long-term growth and present challenges to bullish forecasts.

Find out about the key risks to this Vertex Pharmaceuticals narrative.

Another View: Are Shares Actually Expensive?

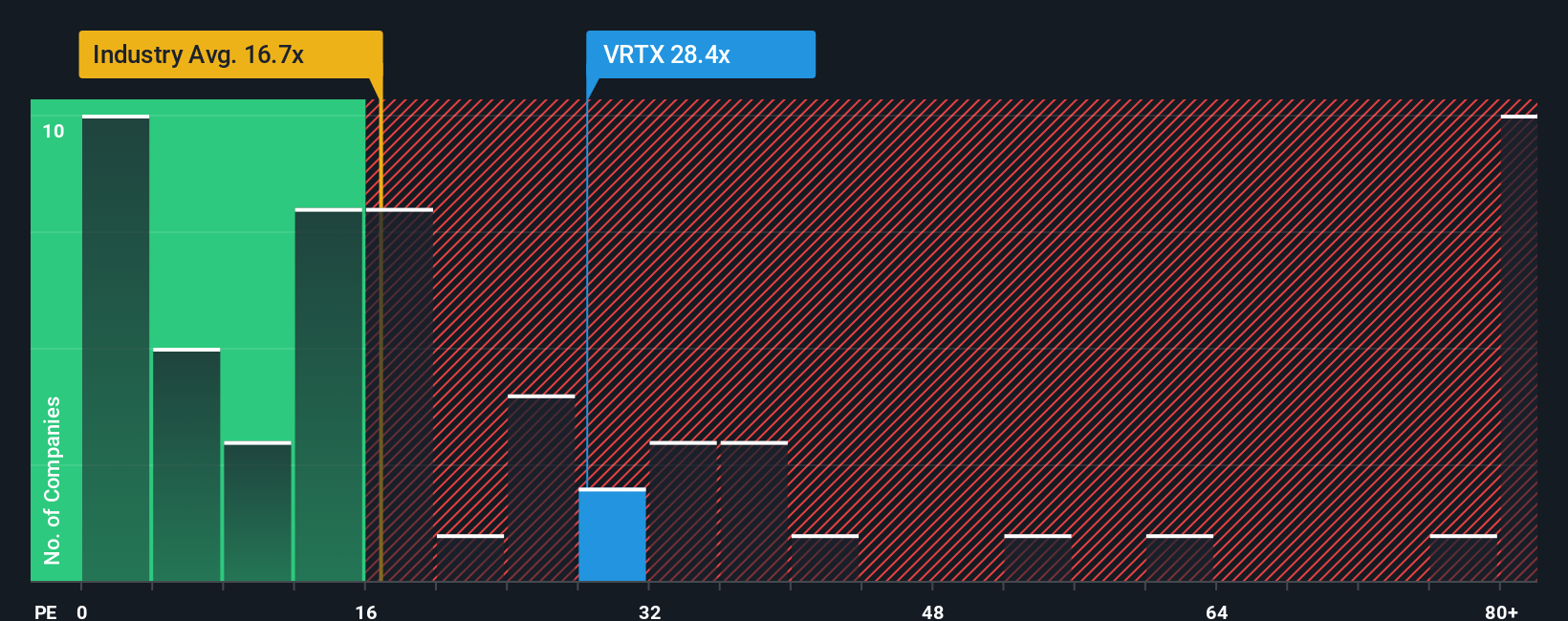

While analyst forecasts point to Vertex Pharmaceuticals being undervalued, a closer look at its price-to-earnings ratio paints a very different picture. The company trades at 30x earnings, which is not just above the US Biotechs industry average of 17.7x but also above its fair ratio of 27x. This gap highlights the potential valuation risk if market sentiment changes or growth falls short. Is the current optimism fully justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertex Pharmaceuticals Narrative

If you want to dig deeper or have a different perspective on the numbers, you can explore the data and build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Looking for More Investment Ideas?

Don’t let standout opportunities slip past. Power up your watchlist by tapping into handpicked stocks and fresh angles the crowd is missing.

- Unlock potential market-changers and get ahead of the curve with these 26 AI penny stocks in artificial intelligence innovation and automation.

- Boost your income stream by targeting high-yield picks through these 22 dividend stocks with yields > 3% offering attractive dividends and compelling fundamentals.

- Capture value now by targeting these 832 undervalued stocks based on cash flows trading below their intrinsic worth, before big moves hit the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives