- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

How Positive Trial Results May Impact Vertex Pharmaceuticals’ Share Price Valuation in 2025

Reviewed by Bailey Pemberton

- Ever wondered if Vertex Pharmaceuticals' current share price is a hidden bargain or if the best days are behind it? Let’s dive into the key factors that might shape its future value.

- Despite a nearly flat move over the past week and a modest 4.6% gain in the last month, Vertex Pharmaceuticals is still down 15.6% over the past year. However, it remains up an impressive 95.8% over five years.

- Vertex recently announced positive trial results for one of its pipeline drugs, which sparked renewed optimism among investors and analysts. In addition, several high-profile partnerships in gene editing and rare disease research have put the company back in the biotech spotlight.

- Looking at traditional valuation metrics, Vertex scores a 3 out of 6 on our value checks. This suggests there is plenty for value-focused investors to unpack. We will walk through the numbers and common valuation approaches next, but stick around for a unique perspective on finding true value that is worth considering before you make your mind up.

Find out why Vertex Pharmaceuticals's -15.6% return over the last year is lagging behind its peers.

Approach 1: Vertex Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model seeks to estimate a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This method is widely used because it attempts to capture both current performance and growth potential over time.

For Vertex Pharmaceuticals, the latest reported Free Cash Flow stands at $3.46 billion. Analyst estimates and model extrapolations suggest this figure could climb to around $6.61 billion by 2029, with cash flow growth supported by product pipeline advances and expanded market opportunities. The ten-year outlook, which combines analyst forecasts for the next five years with longer-term projections, demonstrates a consistent increase in expected annual cash flows.

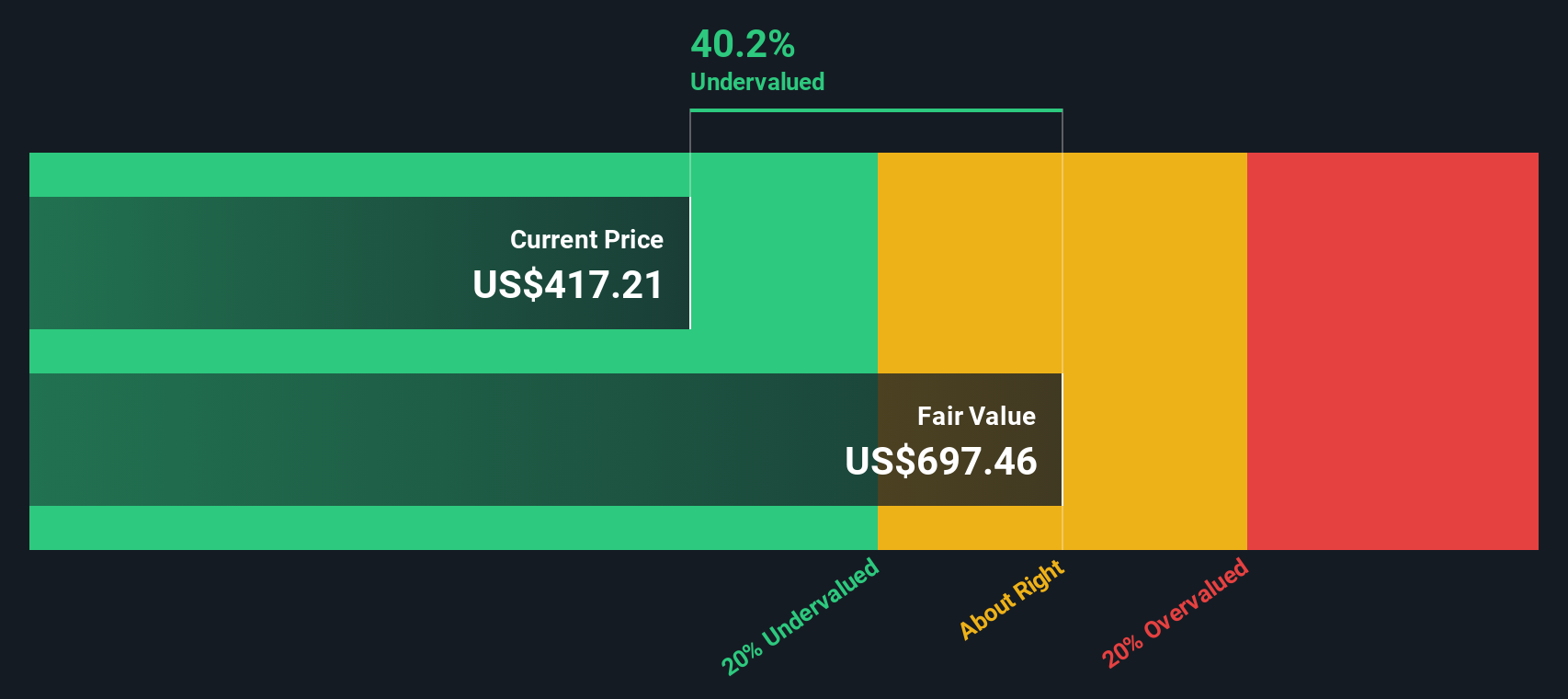

Based on the DCF analysis, Vertex's estimated intrinsic value comes out to $701.98 per share. This figure is nearly 40 percent higher than the company's current share price, indicating a significant margin of safety.

In summary, the DCF approach signals that Vertex shares are currently undervalued by 39.9 percent, giving value-focused investors a clear reason to pay attention.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vertex Pharmaceuticals is undervalued by 39.9%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Vertex Pharmaceuticals Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to assess the value of profitable companies because it reflects what investors are willing to pay for each dollar of a company's earnings. It is especially relevant for mature businesses like Vertex Pharmaceuticals that generate consistent profits, as it ties the stock price directly to underlying earnings power.

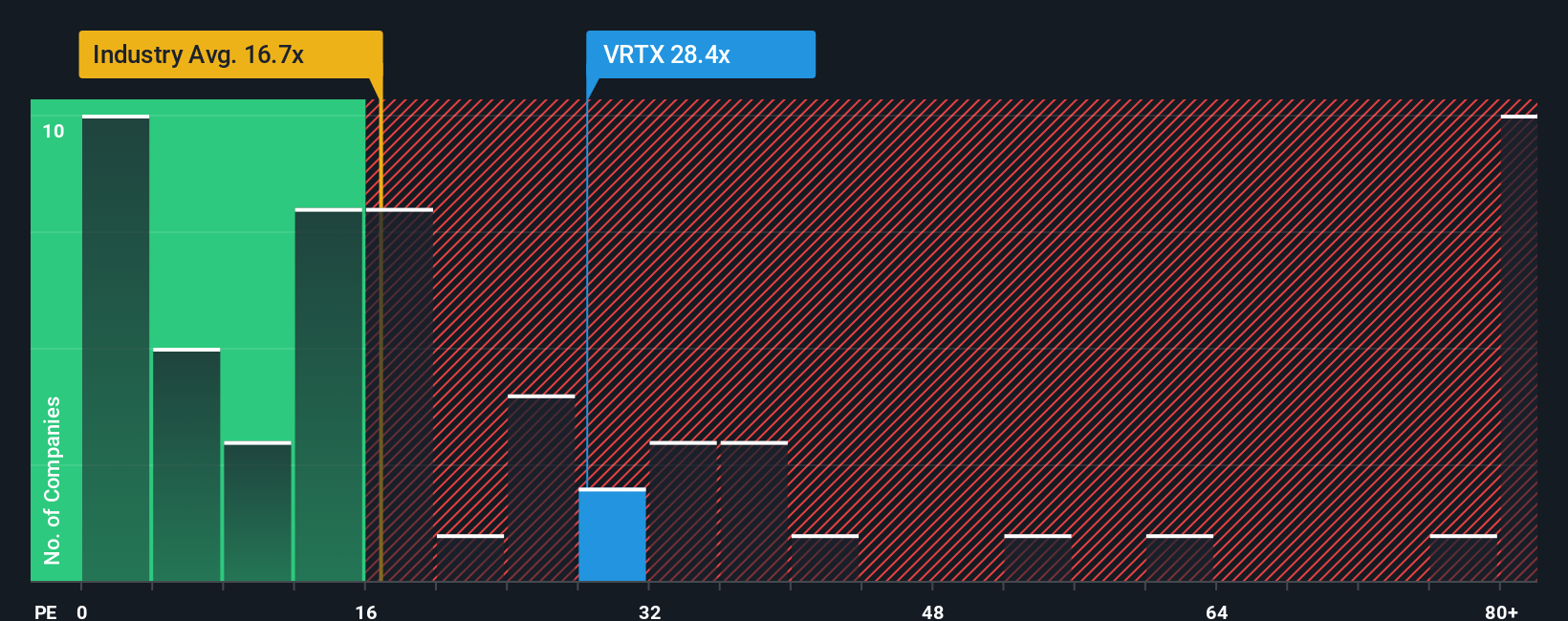

A higher PE ratio can be justified when a company has strong growth expectations or presents lower risk, while a lower PE often reflects investor caution or slower growth prospects. For Vertex, the current PE ratio sits at 29.1x. This is notably higher than the Biotechs industry average of 17.0x but lower than the peer group average of 54.9x, highlighting Vertex's solid position in the sector.

To add further context, Simply Wall St's proprietary "Fair Ratio" considers key aspects such as Vertex’s earnings growth, profit margins, market cap, and risks. This approach blends these factors with usual industry measures to deliver a more tailored benchmark than a broad industry average or single-company peer, as it reflects both company-specific qualities and wider market conditions.

In Vertex’s case, the Fair Ratio is calculated at 29.0x, nearly identical to its actual PE ratio of 29.1x. This suggests that the current share price is aligned with its projected growth, profitability, and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vertex Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter and more flexible tool that lets investors tell the story behind the numbers and shape their own view of a company’s value.

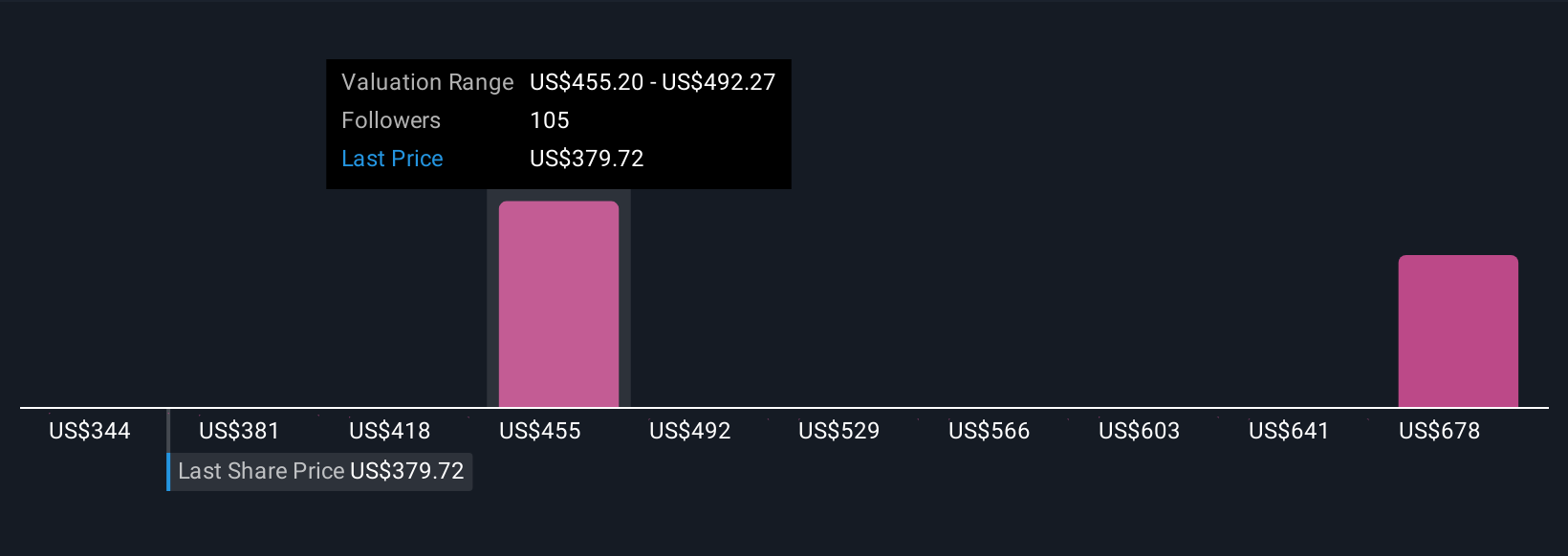

A Narrative is your personal investment perspective. It links the developments, catalysts, and risks you see for a business like Vertex Pharmaceuticals directly to specific financial forecasts and a resulting fair value. Rather than relying only on static metrics or analyst targets, Narratives empower you to document your expectations for revenue growth, margins, and earnings, and then see how these assumptions translate to a fair price per share.

Narratives are easy to use on Simply Wall St’s Community page and are leveraged by millions of investors, allowing you to compare your own outlook and valuation with others. When company news, earnings, or market conditions shift, Narratives update instantly, keeping your conclusions fresh and relevant.

For example, some investors may be optimistic, seeing strong gene editing launches and robust global sales as justification for a fair value near $616 per share. More cautious investors may see pipeline risks and industry pressures supporting a lower fair value closer to $330 per share. Narratives help you visualize these diverse viewpoints so you can decide if, when, and why it’s time to buy or sell.

Do you think there's more to the story for Vertex Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives