- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

Assessing Vertex Pharmaceuticals (VRTX) Valuation After Recent Share Price Dip

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 20.9% Undervalued

According to the most widely followed narrative, Vertex Pharmaceuticals is currently viewed as undervalued by over 20% compared to its fair value, based on robust growth assumptions and analyst consensus expectations.

"Robust global launches, improving reimbursement, and disciplined reinvestment strengthen future earnings and broaden opportunities amid rising healthcare spending and AI-driven drug development trends. Dependence on cystic fibrosis drugs, regulatory and pricing pressures, and uncertain pipeline outcomes threaten Vertex's profitability, margins, and long-term revenue growth."

Curious what is fueling this bold undervaluation call? The narrative’s powerful fair value hinges on future earnings growth, profitability milestones, and a projected multiple that could rival industry leaders. Want to see the specific projections and the financial leap required for Vertex to meet analyst targets? The forecast details inside the full narrative might surprise you.

Result: Fair Value of $479.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the company's persistent reliance on cystic fibrosis drugs and increasing competition could quickly change this situation if new rivals appear or setbacks occur.

Find out about the key risks to this Vertex Pharmaceuticals narrative.Another View: What Do Market Multiples Say?

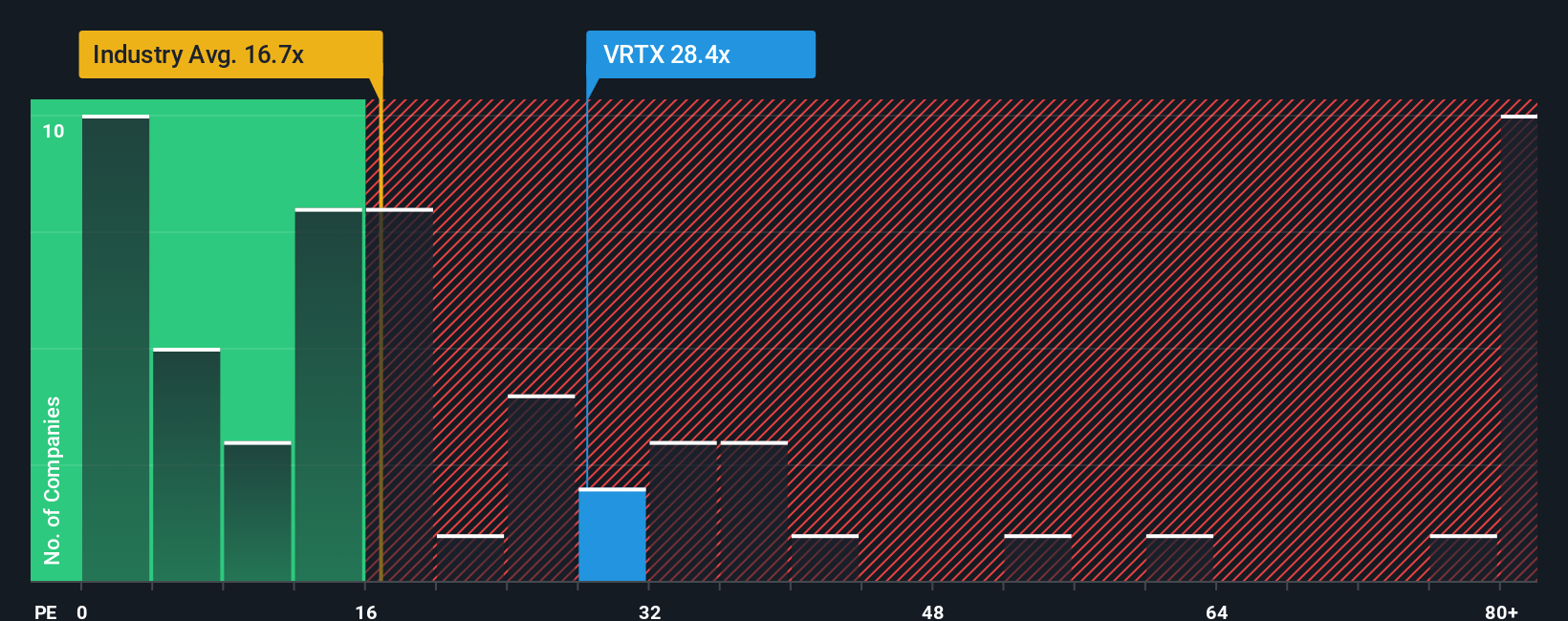

While many models suggest Vertex is undervalued, comparing its current valuation to the industry shows a very different story. In this light, the company actually looks more expensive than the typical biotech stock. Could the market be pricing in more risk or more potential?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Vertex Pharmaceuticals to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Vertex Pharmaceuticals Narrative

If you have a different perspective or want to see how the numbers stack up according to your own analysis, you can quickly build your version of the story. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Looking for More Investment Ideas?

Upgrade your investment tactics by tapping into themed stock ideas that could shape tomorrow’s winners. Don’t sit on the sidelines while smarter portfolios get ahead. Take action now to find your next standout opportunity with these targeted screens:

- Supercharge your search for reliable yields and financial strength by checking out companies offering dividend stocks with yields > 3%.

- Position yourself at the frontier of technology growth by exploring innovative businesses riding the wave of AI penny stocks.

- Uncover great value potential with our handpicked list of stocks that are currently undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives