- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

A Look at Vertex Pharmaceuticals’s Valuation After Discontinuing Experimental Pain Drug Development

Reviewed by Simply Wall St

Vertex Pharmaceuticals (VRTX) halted standalone development of its pain drug VX-993 after disappointing results in a mid-stage clinical trial. This update, along with regulatory hurdles for another pipeline pain treatment, shifted investor focus despite previously solid earnings.

See our latest analysis for Vertex Pharmaceuticals.

While Vertex’s latest pain drug setback took center stage, its share price has still climbed nearly 6% year-to-date and rallied over 10% in the last three months. This reflects both market optimism tied to broader sector moves and the company’s otherwise strong operational growth. Despite this, the one-year total shareholder return remains down nearly 8%, hinting that long-term holders are still waiting for sustained momentum to return.

If shifting drug pipelines have you curious about other opportunities in the space, now’s your chance to discover See the full list for free.

With Vertex trading at a notable discount to analyst targets despite robust financial growth, investors are left to wonder whether the current price offers real value or if the market has already factored in future upside.

Most Popular Narrative: 10.4% Undervalued

With Vertex Pharmaceuticals closing at $429.82, the current stock price is notably below the most popular fair value estimate of $479.83. This gap has investors zeroing in on a narrative driven by growth in gene-editing and emerging therapies, even as near-term risks make headlines.

Vertex's pipeline diversification, including programs in pain, kidney, and type 1 diabetes, leverages global advances in genomic and gene-editing technologies. This positions the company to capture long-term growth from accelerating personalized and precision medicine adoption, supporting both revenue and long-term margin expansion.

The forecast that underpins this valuation leans on several bold projections about future profitability and revenue expansion. Want to see which financial levers analysts are banking on for this premium price, and whether a richer margin profile is really on the cards? Click through to discover the story behind this eye-catching valuation.

Result: Fair Value of $479.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant reliance on the cystic fibrosis franchise and uncertain outcomes for pipeline candidates could quickly shift market sentiment regarding Vertex’s long-term prospects.

Find out about the key risks to this Vertex Pharmaceuticals narrative.

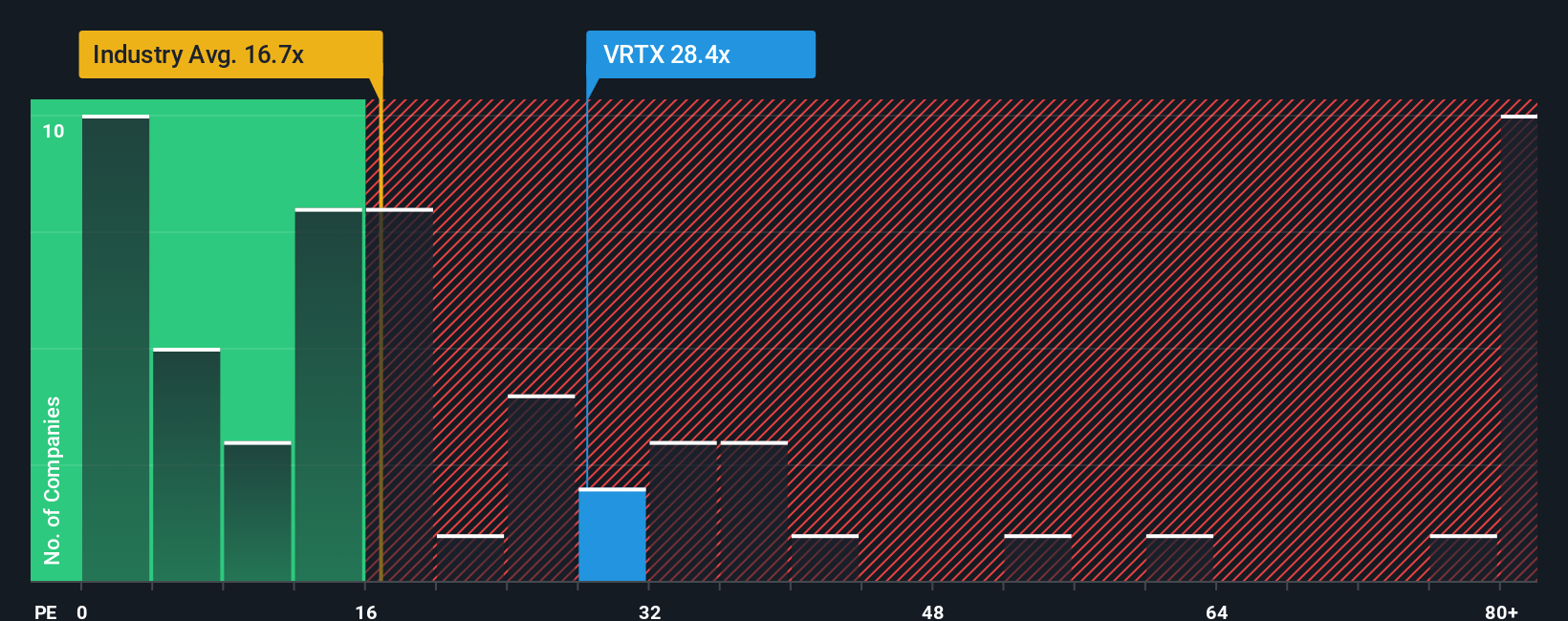

Another View: The Price-to-Earnings Debate

Switching to a price-to-earnings lens, Vertex trades at 29.7 times earnings, which is steeper than both the US Biotechs industry average of 18.8x and its peer average of 59.4x. Interestingly, this is only slightly above the fair ratio of 28.9x, suggesting the market sees stable but not screaming value ahead. Is this premium justified or could mean reversion bring surprises?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertex Pharmaceuticals Narrative

If you see the story unfolding differently or want to dive into the numbers yourself, explore the tools to craft a personalized perspective in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Looking for More Investment Ideas?

Don’t let opportunity slip by while others get ahead using powerful data. Make confident, informed moves and expand your research with these handpicked investment angles right now:

- Capture steady passive income by exploring these 14 dividend stocks with yields > 3%, which features reliable returns and robust dividend yields above 3%.

- Spot hidden value in overlooked stocks by checking out these 924 undervalued stocks based on cash flows. This tool is tailored for investors seeking strong cash flow opportunities.

- Seize tomorrow’s biggest technology breakthroughs before the crowd with these 26 AI penny stocks, which highlights developments at the cutting edge of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success