- United States

- /

- Biotech

- /

- NasdaqGM:VNDA

Vanda Pharmaceuticals (VNDA): Forecasts See Earnings Growth of 68.5% Annually Heading Into Earnings Season

Reviewed by Simply Wall St

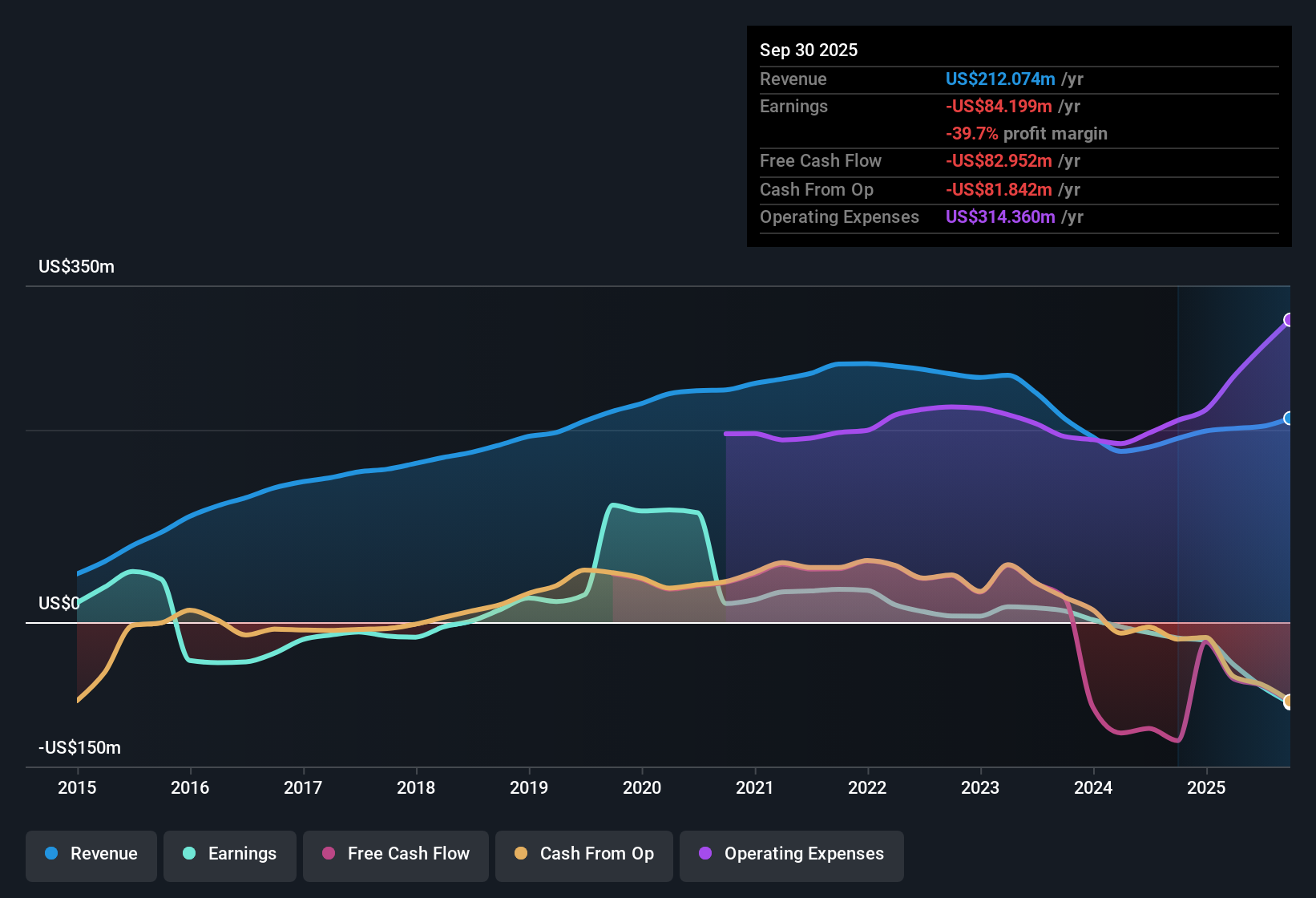

Vanda Pharmaceuticals (VNDA) remains unprofitable, with its losses worsening at a pace of 73.9% per year over the past five years. Looking forward, forecasts point to a potential turnaround, with annual earnings expected to grow 68.52% and the company projected to reach profitability within three years. Revenue growth is also set to outstrip the broader U.S. market, with an annual forecast of 23.1%. A price-to-sales ratio of 1.2x suggests the stock may offer relative value against peers. With no flagged risks and notable strengths in growth and value, investors are likely to focus on these upside drivers despite Vanda’s recent history of deepening losses.

See our full analysis for Vanda Pharmaceuticals.The next section will put these numbers in context, comparing them to the key narratives that investors and analysts have been watching. Some expectations may be confirmed, while others could be upended.

See what the community is saying about Vanda Pharmaceuticals

Profit Margins: Path Toward Positive Territory

- Analysts expect Vanda’s profit margins to swing from −32.9% today to 1.8% by 2028, reversing the company’s long-standing negative margins if forecasts hold.

- According to the analysts' consensus view, increased focus on newer therapies for psychiatric and neurological conditions, alongside launches like Fanapt and PONVORY, supports this projected margin recovery.

- Consensus notes that Bysanti’s launch and improved Medicaid rebate structures could further strengthen margins, addressing concerns around historical gross-to-net revenue gaps.

- Yet, critics highlight that ongoing heavy spending on R&D and SG&A, driven by major launches and pipeline investments, could still pressure profitability if revenue growth does not accelerate as expected.

- What sets this improvement apart is how it counters past years of deepening losses by linking clinical pipeline advancement directly to long-term profitability for Vanda’s neurological franchise. 📊 Read the full Vanda Pharmaceuticals Consensus Narrative.

Product Pipeline Feeding Revenue Upside

- Revenue is forecast to grow at 28.6% annually over the next three years, substantially outpacing the US market average of 10.3% for the same period.

- From the consensus narrative, launches of Fanapt in bipolar I disorder and PONVORY in multiple sclerosis are credited with driving recent prescription and revenue gains, while near-term approvals for Bysanti and tradipitant are poised to expand Vanda’s reach across aging patient populations.

- Consensus sees late-stage pipeline success, including drugs for rare diseases like generalized pustular psoriasis, as a source of diversified revenues and future market exclusivity, supporting long-term top-line growth.

- However, there is a recognized risk: slow uptake or payer resistance, especially in tough neurology markets, might threaten the pace and sustainability of expected revenue expansion from these newer assets.

Valuation: Deep Discount vs. Peers

- Vanda trades at a price-to-sales ratio of 1.2x, dramatically lower than both the US biotech average of 10.8x and the peer average of 11.5x, signaling perceived value by the market.

- Based on the consensus narrative, this discount is underpinned by analysts setting a price target of $12.67, almost three times the current share price of $4.32. Yet considerable disagreement remains, with the most bullish price target at $20.00 and the most bearish at $5.00.

- Consensus suggests hitting the $12.67 target would require annual revenue to reach $432.2 million and a sharp turnaround to positive earnings of $7.7 million by 2028.

- This scenario would also imply a steep price-to-earnings ratio of 122.5x compared to the US biotech sector’s 15.5x multiple, making the expected profitability shift critical to realizing the stock’s upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vanda Pharmaceuticals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an opportunity or risk that stands out to you in the figures above? Share your viewpoint and build your own investment story in minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Vanda Pharmaceuticals.

See What Else Is Out There

Despite promising turnaround forecasts, Vanda’s history of accelerating losses and inconsistent profitability makes future earnings growth less certain than its peers.

If you’re looking for companies with steadier revenue and earnings momentum through cycles, focus on stability by searching through stable growth stocks screener (2112 results) right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VNDA

Vanda Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of therapies to address high unmet medical needs worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives