- United States

- /

- Biotech

- /

- NasdaqGM:VERA

The Bull Case For Vera Therapeutics (VERA) Could Change Following Positive Phase 3 Atacicept Kidney Data

Reviewed by Sasha Jovanovic

- Vera Therapeutics recently presented successful Phase 3 trial results for atacicept in late-stage kidney disease at the TD Cowen Immunology and Inflammation Summit, reporting a 46% reduction in proteinuria and favorable safety outcomes.

- This progress is allowing the company to move forward with a Biologics License Application, advancing closer to potential regulatory review in the U.S.

- We'll take a look at how the strong efficacy results from the atacicept trial shape Vera Therapeutics' investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Vera Therapeutics' Investment Narrative?

To believe in Vera Therapeutics as a shareholder, you need conviction in the company's ability to bring atacicept through regulatory approval and into the commercial market, especially for IgA nephropathy. This recent Phase 3 data, showing a 46% reduction in proteinuria with favorable safety, is significant, it has already shifted immediate sentiment and raised the stakes for short-term catalysts, notably the pending FDA review. While previous risks largely centered on clinical success and regulatory delays, the trial results seem to lower those scientific hurdles for now. However, the business remains exposed to ongoing financial losses, dilution risk from new fundraising, and execution risks around commercialization should atacicept reach the market. The jump in analyst sentiment and share price activity post-announcement suggest this news event is material, making regulatory response the next key focus, but turning clinical wins into sustainable revenue is still a big challenge. On the other hand, investors should be especially aware of how unprofitability and future capital needs could impact returns.

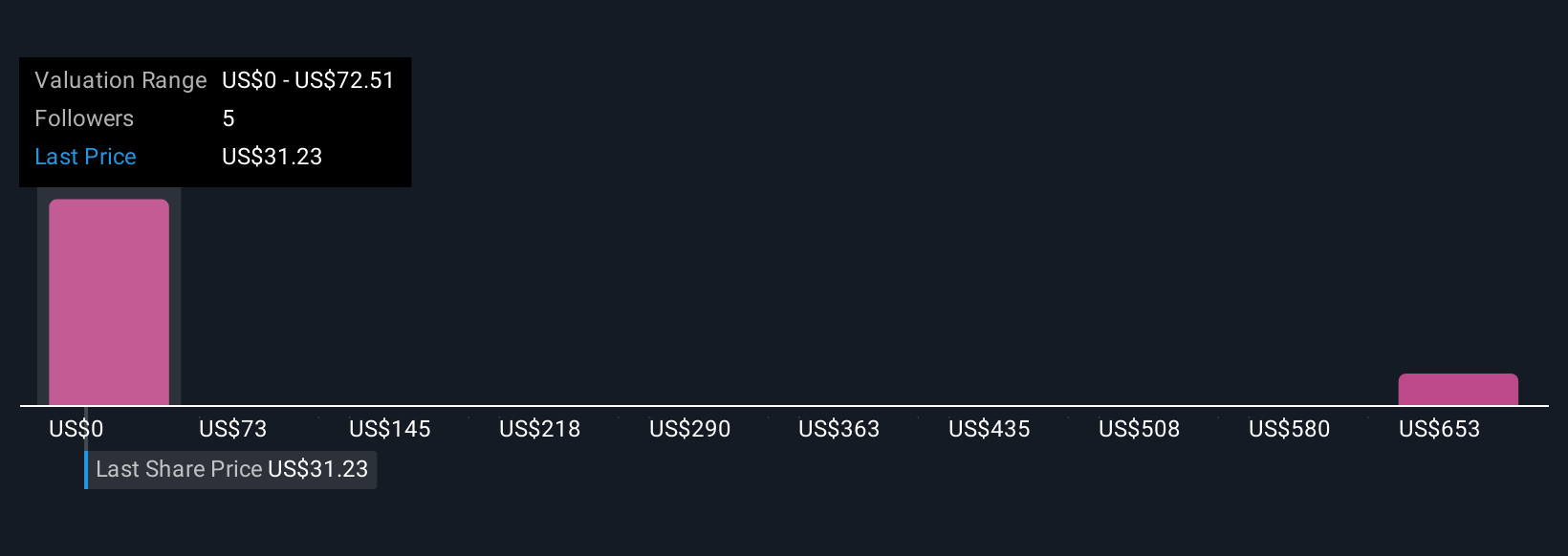

Vera Therapeutics' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Vera Therapeutics - why the stock might be a potential multi-bagger!

Build Your Own Vera Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vera Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Vera Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vera Therapeutics' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERA

Vera Therapeutics

A clinical stage biotechnology company, focuses on the development and commercialization of transformative treatments for patients with serious immunological diseases.

Excellent balance sheet and fair value.

Market Insights

Community Narratives