- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Veracyte (VCYT): Exploring Valuation After Recent Share Price Rally

Reviewed by Simply Wall St

Veracyte (VCYT) has been attracting attention as its stock climbed nearly 22% over the past month. Investors are taking note of the company’s momentum, especially as market sentiment favors innovative players in the diagnostics space.

See our latest analysis for Veracyte.

Veracyte's momentum this month builds on a sharp recovery, with a 47.2% share price return in the past 90 days. This stands out against a more modest 8.9% total shareholder return over the past year. It appears that investors are growing increasingly optimistic about the company's growth prospects as recent results and renewed interest in diagnostics spark fresh demand for the stock.

If Veracyte’s breakout run has you curious, this is a great time to discover See the full list for free.

Yet with shares rallying so sharply, the key question is whether the recent gains reflect fresh upside still to come, or if the market has already priced in Veracyte’s renewed growth outlook, leaving less room for a true bargain.

Most Popular Narrative: 3% Overvalued

While Veracyte's last close of $42.35 sits just above the current fair value estimate of $41.10, market optimism is still high. The latest narrative lays out the growth runway and some of the bold underlying assumptions shaping this outlook.

Pipeline momentum, with five major product launches and a pivotal clinical study (OPTIMA) completing in the next 18 months, positions Veracyte to further diversify revenue, drive cross-selling, penetrate new markets (for example, MRD in bladder cancer, Prosigna for breast cancer), and significantly expand addressable markets. All of this supports long-term topline acceleration.

Want the real story behind these pipeline projections? There is a crucial financial leap embedded in these assumptions. The future numbers this narrative expects could challenge even the most bullish estimates. If you want to know which forecasts are fueling that premium, dig into the full calculation that powers this valuation.

Result: Fair Value of $41.10 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear risks. For example, Veracyte’s heavy reliance on its core products and potential regulatory challenges could disrupt this bullish narrative.

Find out about the key risks to this Veracyte narrative.

Another View: Market Multiples Paint a Different Picture

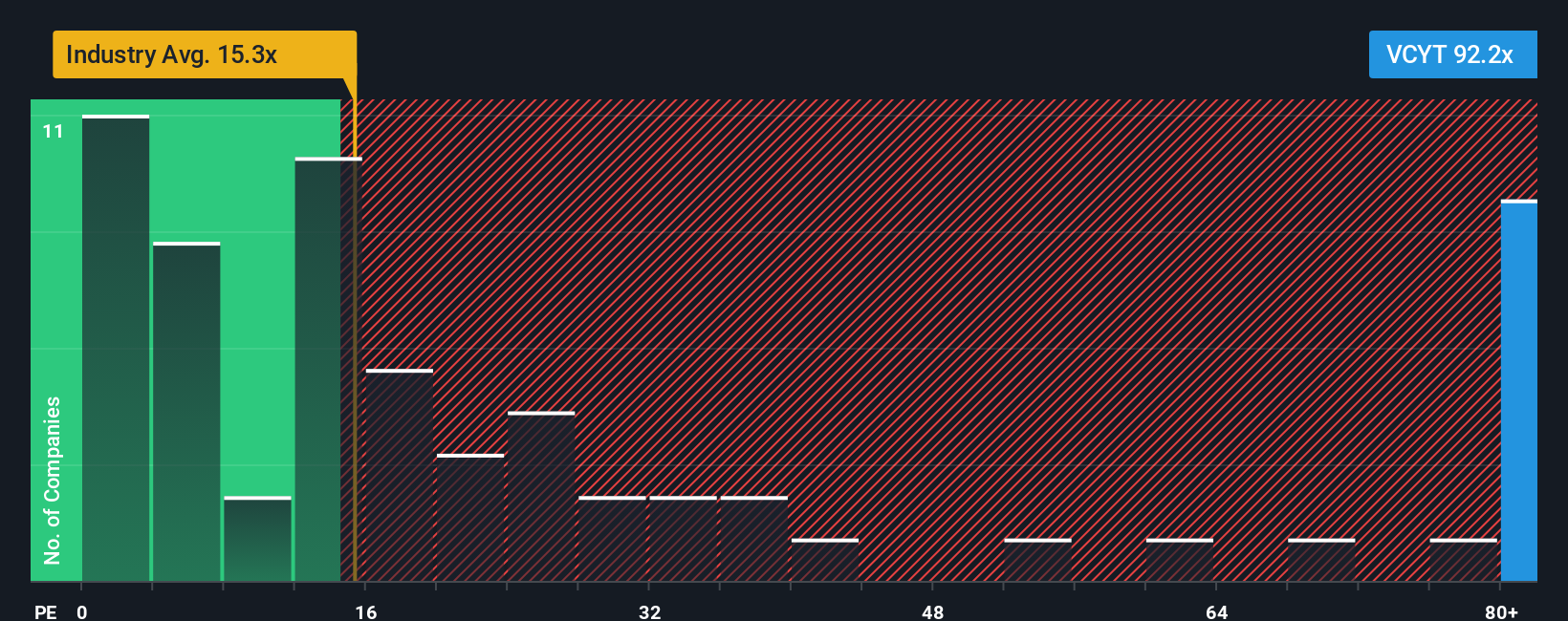

While the earlier valuation set fair value just below the current share price, a look at market multiples tells a more sobering story. Veracyte is trading at a price-to-earnings ratio of 110.4x, much higher than both the biotech industry average of 17x and its peer group at 66.2x. Even compared to a fair ratio of 27.8x, the gap is stark, implying the stock carries significant valuation risk if these lofty expectations are not met. Do these stretched multiples signal growing optimism, or raise red flags about downside?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Veracyte for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 871 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Veracyte Narrative

If you see things differently or want to dive into the numbers yourself, you can shape your own Veracyte story in just a few minutes. Do it your way

A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the best opportunities pass you by. Uncover exciting stocks matched to your interests with these tailored screeners from Simply Wall Street:

- Spot fast-growing companies at the forefront of AI by checking out these 24 AI penny stocks, which are shaking up entire industries with intelligent automation.

- Unlock potential deals when you search through these 871 undervalued stocks based on cash flows, where high-quality, attractively priced stocks may be flying under the radar.

- Catch tomorrow’s market leaders early as you browse these 3572 penny stocks with strong financials, tapping into emerging trends before the mainstream catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives