- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Veracyte Shares Surge 20% as Analyst Upgrades Spark Fresh Valuation Debate

Reviewed by Bailey Pemberton

- Wondering if Veracyte is offering real value right now? You're not alone, and with so much movement in health tech stocks, this could be a good moment to take a closer look.

- Veracyte shares have rallied recently, jumping 15.6% in the last week and up 19.8% for the past month, easily outpacing the broader market.

- The buzz isn't just about the price. A series of positive research collaborations and analyst upgrades are turning heads, giving fresh context to the recent upswing. These developments suggest that both partners and insiders may be seeing untapped potential ahead.

- On our quick valuation check, Veracyte scores just 2 out of 6 for being undervalued, so there is clearly more to the story. In the next section, we break down what traditional valuation metrics say and hint at a more insightful approach to understanding Veracyte's real worth later on.

Veracyte scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Veracyte Discounted Cash Flow (DCF) Analysis

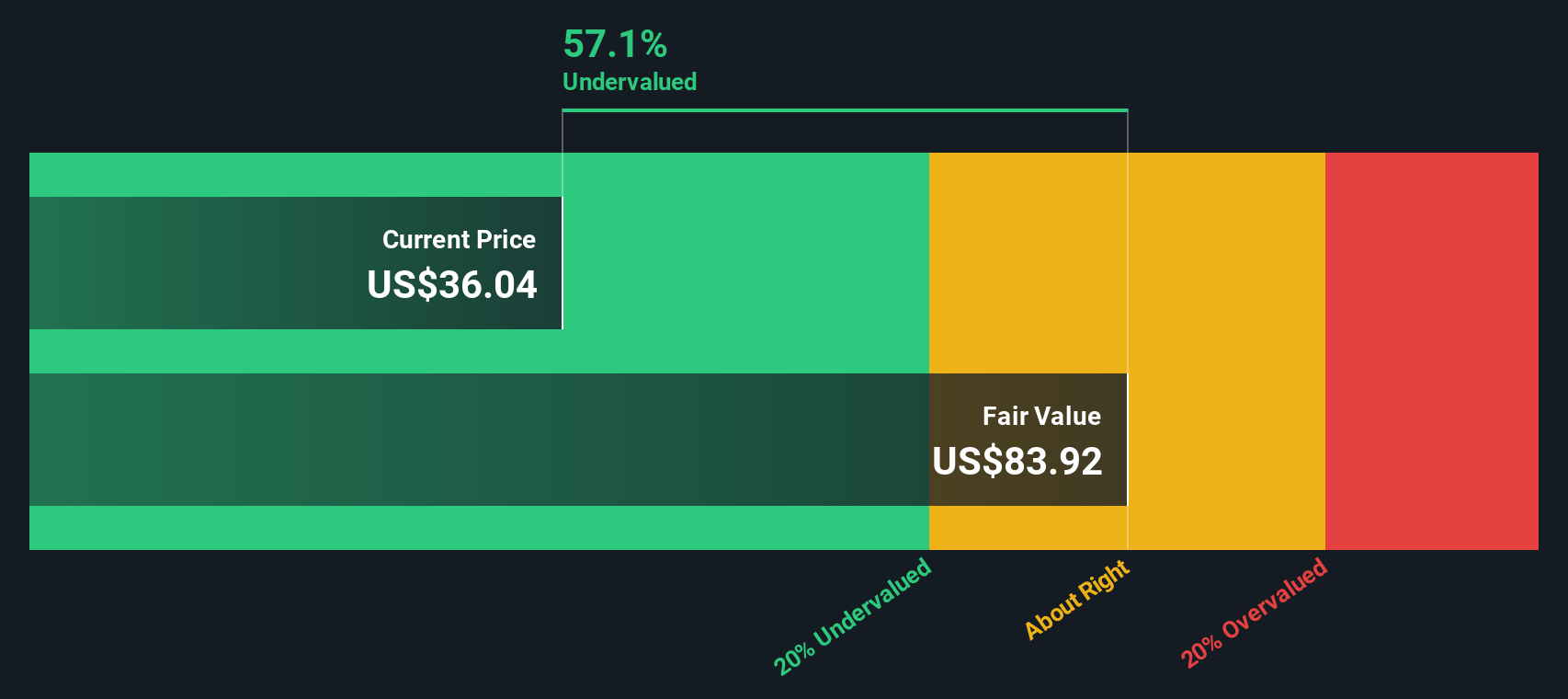

A Discounted Cash Flow (DCF) model works by taking Veracyte's expected future free cash flows and projecting them forward. The model then discounts those values back to today's dollars to estimate what the company is truly worth now. This method is widely used to gauge a business’s intrinsic value using its ability to generate cash.

Veracyte's latest reported Free Cash Flow stands at $96.88 million. Analysts estimate this will increase every year, reaching $171.3 million by 2029. After those analyst projections end, further years are extrapolated using typical industry growth rates to estimate continued momentum. In total, Simply Wall St's 2 Stage Free Cash Flow to Equity model projects Veracyte's intrinsic fair value at $60.87 per share.

Based on this DCF calculation, Veracyte's stock currently trades at a 31.5% discount to its estimated intrinsic value. In simple terms, the shares are considered undervalued by a solid margin according to this cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Veracyte is undervalued by 31.5%. Track this in your watchlist or portfolio, or discover 875 more undervalued stocks based on cash flows.

Approach 2: Veracyte Price vs Earnings

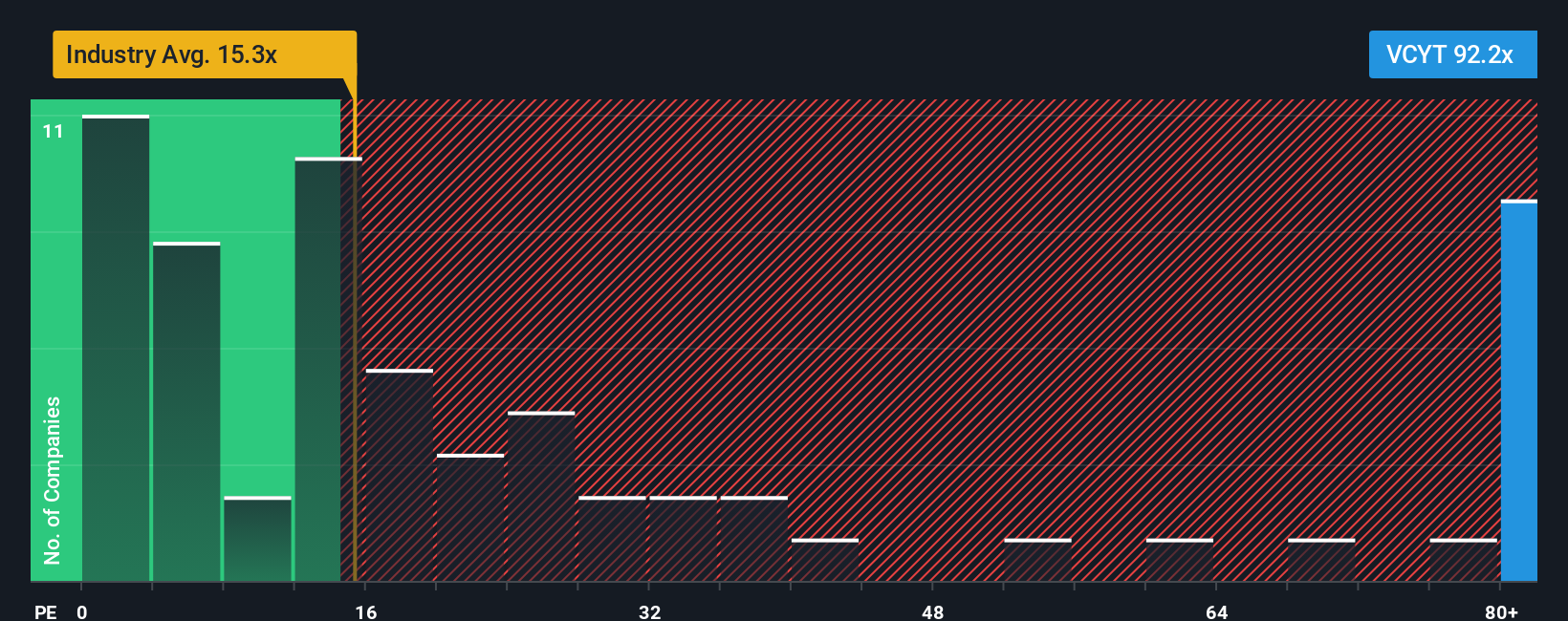

The Price-to-Earnings (PE) ratio is a popular valuation multiple for profitable companies as it directly ties a stock’s price to its ability to generate earnings. It serves as a go-to gauge for how the market values future growth, profitability, and perceived risks. A higher PE can signal optimism about growth, but too high a premium could point to elevated expectations or underappreciated risks, so it is essential to compare these ratios in context.

Currently, Veracyte trades at a PE ratio of 108.7x. For reference, the average PE for the biotech industry sits at 17.0x, while the average among Veracyte's listed peers is 33.1x. At a glance, Veracyte’s multiple is well above both benchmarks, suggesting investors are paying a premium for anticipated earnings growth or perhaps pricing in lower risk.

Simply Wall St’s proprietary “Fair Ratio” comes in at 27.8x for Veracyte. This figure goes beyond basic comparables by factoring in variables like Veracyte’s projected earnings growth, industry dynamics, margins, size, and specific risk profile. Using the Fair Ratio is more insightful than comparing to blunt industry or peer averages because it adjusts for what actually makes Veracyte different or special in the market.

Given Veracyte’s current PE of 108.7x compared to the Fair Ratio of 27.8x, the shares appear to be significantly overvalued by this measure alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

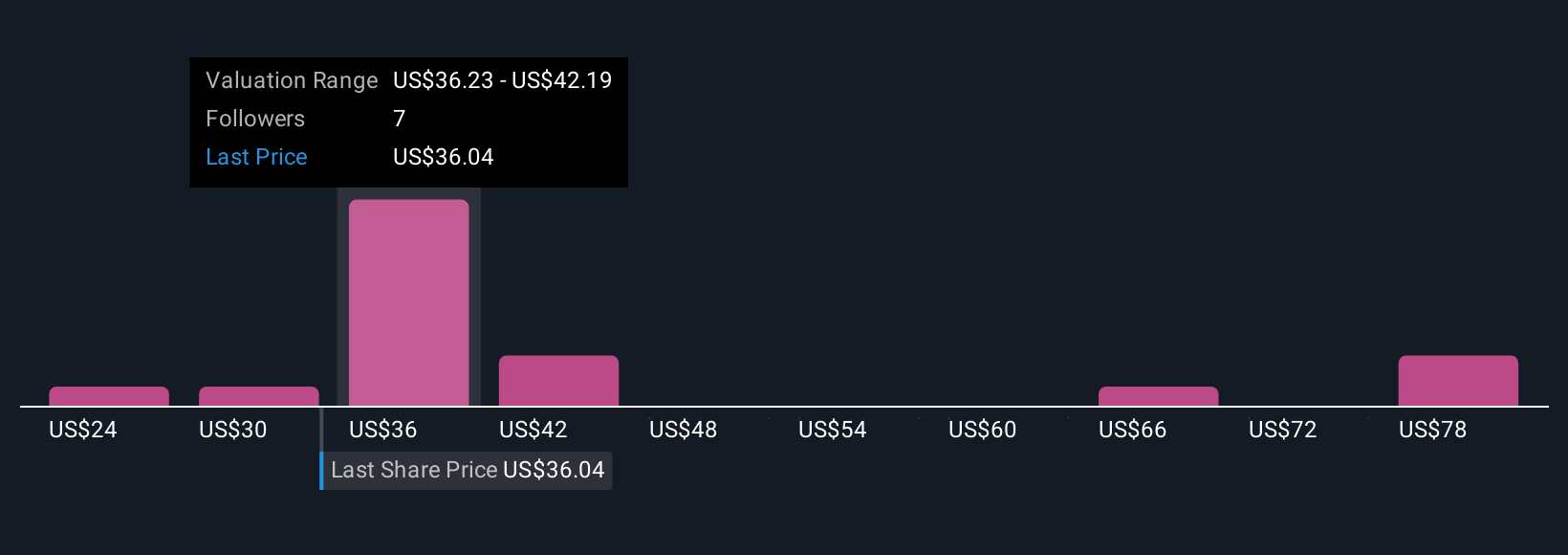

Upgrade Your Decision Making: Choose your Veracyte Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own investment story about a company. It's the way you connect your personal perspective, research, and assumptions about Veracyte’s future growth, earnings, and margins to form a unique view of what the company is worth. Narratives are more than just numbers; they link Veracyte’s journey, industry context, and financial forecasts, and use these to generate a fair value so you can clearly see whether the current price is attractive.

Simply Wall St’s Community page makes it easy for anyone to build, share, and update their own Narrative, with millions of investors already using this dynamic tool. Narratives empower you to decide when to buy or sell Veracyte by comparing your calculated Fair Value with the actual share price, and they automatically update when new news or earnings reports come out.

For example, some investors might see Veracyte’s continued portfolio expansion and rising adoption as reasons to believe in a $45 fair value. In contrast, more cautious investors focus on reimbursement and competition, giving a fair value closer to $28. Narratives let you choose the story you want to follow and respond as new facts emerge.

Do you think there's more to the story for Veracyte? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives