- United States

- /

- Biotech

- /

- OTCPK:VCNX

Rock star Growth Puts Vaccinex (NASDAQ:VCNX) In A Position To Use Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Vaccinex, Inc. (NASDAQ:VCNX) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Vaccinex

What Is Vaccinex's Debt?

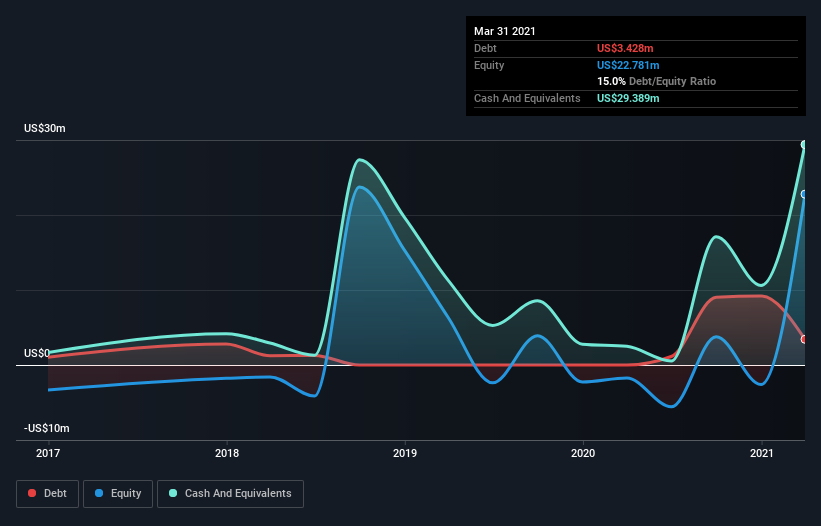

You can click the graphic below for the historical numbers, but it shows that as of March 2021 Vaccinex had US$3.43m of debt, an increase on none, over one year. However, its balance sheet shows it holds US$29.4m in cash, so it actually has US$26.0m net cash.

How Healthy Is Vaccinex's Balance Sheet?

The latest balance sheet data shows that Vaccinex had liabilities of US$6.77m due within a year, and liabilities of US$1.13m falling due after that. Offsetting these obligations, it had cash of US$29.4m as well as receivables valued at US$8.0k due within 12 months. So it actually has US$21.5m more liquid assets than total liabilities.

This luscious liquidity implies that Vaccinex's balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Simply put, the fact that Vaccinex has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Vaccinex's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Vaccinex reported revenue of US$1.5m, which is a gain of 244%, although it did not report any earnings before interest and tax. That's virtually the hole-in-one of revenue growth!

So How Risky Is Vaccinex?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Vaccinex lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through US$28m of cash and made a loss of US$28m. Given it only has net cash of US$26.0m, the company may need to raise more capital if it doesn't reach break-even soon. The good news for shareholders is that Vaccinex has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Vaccinex is showing 5 warning signs in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Vaccinex, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:VCNX

Vaccinex

A clinical-stage biotechnology company, engages in the discovery and development of targeted biotherapeutics to treat cancer, neurodegenerative diseases, and autoimmune disorders.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success