- United States

- /

- Biotech

- /

- NasdaqGM:VCEL

Vericel (VCEL): Evaluating Valuation After MACI Revenue Surge and New Growth Initiatives

Reviewed by Simply Wall St

Vericel (VCEL) attracted fresh attention after reporting a sharp jump in third-quarter earnings and MACI product revenue. This highlights the company’s ability to capitalize on new clinical indications such as MACI Arthro.

See our latest analysis for Vericel.

Vericel’s strong third-quarter drove a sharp recovery in momentum, with a 22% share price return over the past month as investors responded to record MACI revenue, new clinical progress, and international expansion plans. While the stock is still down year-to-date and the 12-month total shareholder return remains negative, its three-year total return of nearly 64% reflects the company’s longer-term growth story and a renewed sense of optimism around its expanding franchise.

If Vericel’s rebound has piqued your interest, consider exploring other healthcare innovators making waves this year. See the full list for free.

But after such a strong rebound and impressive quarterly growth, is Vericel’s current share price underestimating its future trajectory? Or has the recent rally already factored in all the company’s upside, leaving investors to question whether there is still a buying opportunity or if the market is fully pricing in Vericel’s next phase of growth?

Most Popular Narrative: 27.7% Undervalued

With Vericel’s last close at $38.94 and the most followed narrative setting fair value at $53.88, market expectations suggest major potential upside as optimism builds around future growth drivers. Below, discover what’s underpinning this view.

Rapid expansion of the trained surgeon base for MACI Arthro and launch into new procedure types (for example, trochlea defects and a new arthro-only surgeon segment) is driving broadening market penetration and accelerating biopsy and implant growth. This activity could fuel sustained top-line revenue growth as adoption deepens and as larger segments of a multi-billion dollar addressable market are tapped.

Curious how Vericel’s forecast connects breakout business growth with a strikingly bold future valuation? The secret sauce behind this price target involves aggressive expansion, bullish revenue trajectories, and a profit surge rarely seen in this sector. Dig into the full narrative to unravel the specific financial leaps analysts are betting on.

Result: Fair Value of $53.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Vericel’s reliance on a narrow product lineup and ongoing pressure from rising operational costs could still limit sustainable growth if these factors are not well managed.

Find out about the key risks to this Vericel narrative.

Another View: Multiples Send a More Cautious Signal

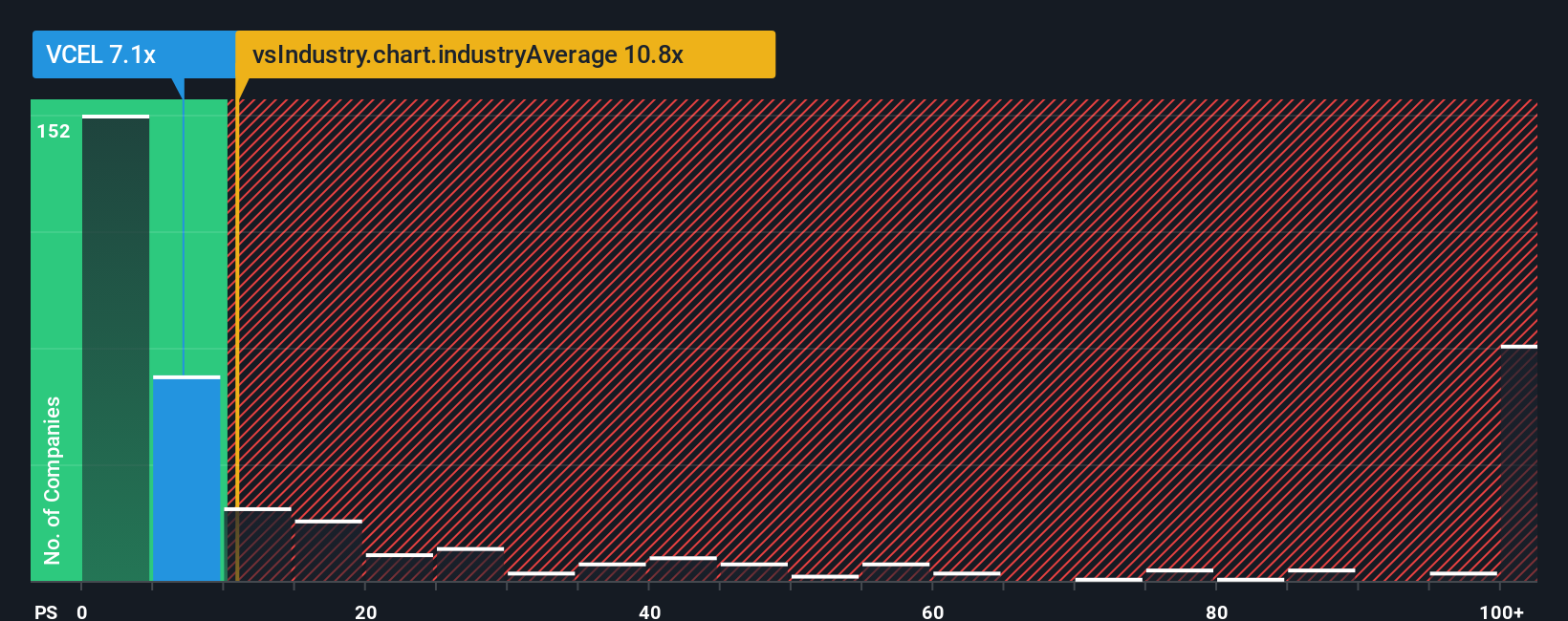

While analyst forecasts imply a big upside for Vericel, our comparison using the company's price-to-sales ratio draws a more nuanced picture. At 7.6 times sales, Vericel looks like good value compared to its peers' average of 19 and is also below the US biotech industry average of 10.8. However, it is priced well above its fair ratio of 5.7, suggesting there could be less room for error if growth slows. Is the optimism in the current price justified, or might the market adjust expectations down the road?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vericel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vericel Narrative

If these viewpoints do not reflect your own, or if you enjoy investigating the numbers firsthand, you can easily shape your own perspective in just a few minutes by using Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vericel.

Looking for More Smart Investment Opportunities?

Don't settle for what's already trending. Make your next move count by leveraging the latest stock ideas powered by Simply Wall Street's research tools. Open up new possibilities and position yourself ahead of the crowd with strategies others might be missing out on.

- Uncover early-stage companies with major upside by checking out these 3588 penny stocks with strong financials that stand out for their growth potential and strong financials.

- Boost your portfolio's future-readiness by tapping into breakthroughs from these 25 AI penny stocks at the forefront of artificial intelligence innovation.

- Maximize your returns with value picks. Target opportunities among these 874 undervalued stocks based on cash flows identified through leading-edge cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCEL

Vericel

A commercial-stage biopharmaceutical company, engages in the research, development, manufacture, and distribution of cellular therapies and specialty biologic products for sports medicine and severe burn care markets in North America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives