- United States

- /

- Biotech

- /

- NasdaqGM:URGN

UroGen Pharma (URGN): Assessing Valuation After Strong UTOPIA Trial Results and FDA NDA Pathway

Reviewed by Simply Wall St

UroGen Pharma (URGN) recently announced preliminary data from its Phase 3 UTOPIA trial, which showed a 78% complete response rate for UGN-103 in treating certain bladder cancer patients. The FDA has now agreed that these results can support a New Drug Application submission.

See our latest analysis for UroGen Pharma.

Following the impressive UTOPIA trial results and recent FDA agreement on a potential New Drug Application, momentum has surged for UroGen Pharma. The share price has increased 21.9% in the last day and 120% year-to-date, reflecting growing optimism about the company’s future prospects. Despite near-term losses, three-year total shareholder return sits at 164.2%. This highlights both the volatility and longer-term upside investors have seen as the biotech pipeline advances and new milestones are reached.

If UroGen’s clinical breakthroughs sparked your interest, this could be the perfect time to discover more healthcare innovators through our curated See the full list for free.

The stock has surged on breakthrough trial results. With shares now trading near half of their analyst price target, is there still room to run, or has the market already baked in all the future growth?

Most Popular Narrative: 30.3% Undervalued

With the current share price well below the narrative fair value of $33.75, the latest consensus sets ambitious expectations for UroGen Pharma’s future. This backdrop intensifies the debate about how far the company’s rapid growth prospects can stretch valuations.

The shift toward minimally invasive, office-based therapies (away from repeated surgeries) and demonstrated long-term durability data for ZUSDURI directly align with industry-wide transitions in care standards, supporting broader market penetration and the company's ability to command premium pricing, thus improving future net margins and profitability.

What is driving this bold fair value? The narrative hinges on bullish revenue forecasts and a future profit margin jump that could reshape biotech expectations. The calculations behind the target involve more than just drug approvals. Ready to see which financial projections are tipping the scales?

Result: Fair Value of $33.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses and slower than expected adoption of ZUSDURI could quickly challenge the optimistic outlook underpinning current growth projections.

Find out about the key risks to this UroGen Pharma narrative.

Another View: What Do the Ratios Say?

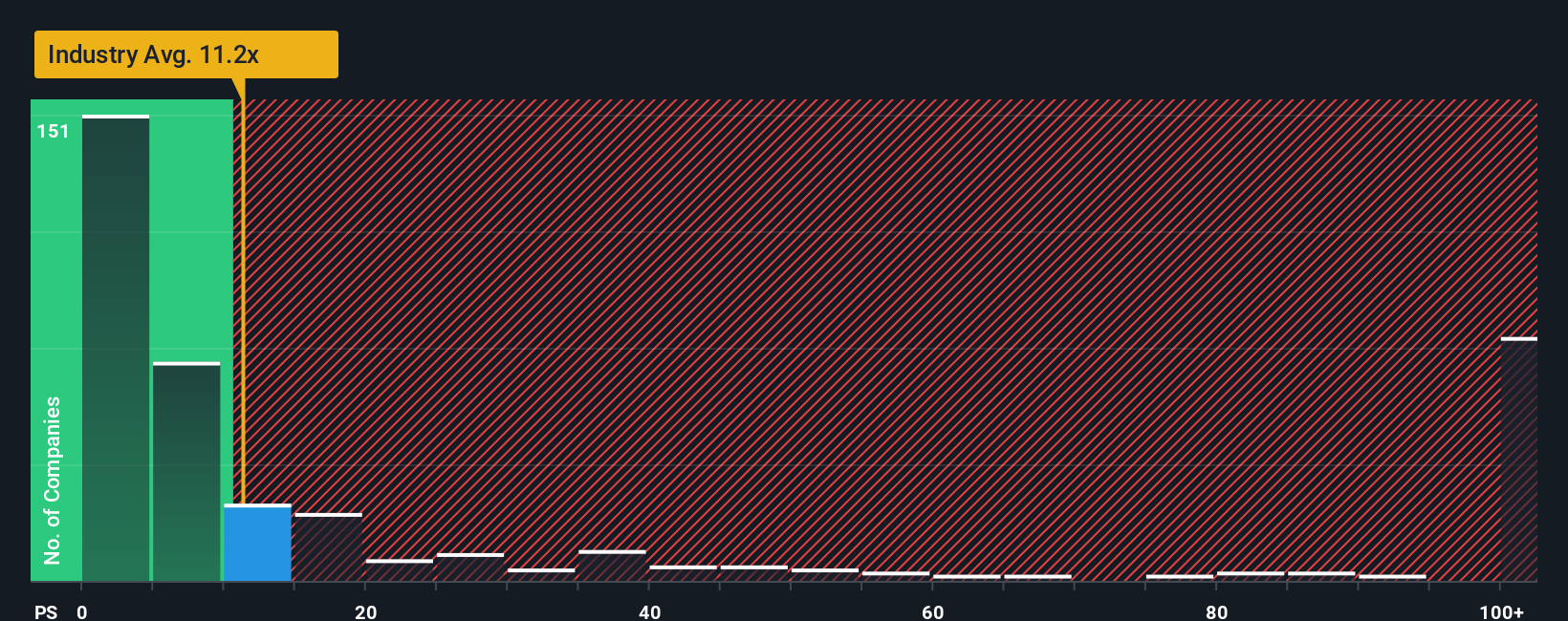

Looking through a different lens, UroGen Pharma’s price-to-sales ratio stands at 11.3x, which is notably higher than both the peer average of 9.1x and the US Biotechs industry average of 11.2x. While the current ratio may signal optimism, it also introduces heightened valuation risk if growth does not keep pace. The market’s fair ratio for UroGen could be closer to 15.2x. Are investors potentially underestimating or overestimating the real upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UroGen Pharma Narrative

If you see the numbers differently or want to dig into the details on your own terms, you can craft a personalized UroGen Pharma view in just a few minutes. Do it your way

A great starting point for your UroGen Pharma research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Portfolio Moves?

Expand your investment options with handpicked ideas you might regret missing later. Give yourself the unfair advantage by seeing what’s fueling market buzz next.

- Capture early growth and strong fundamentals with these 3594 penny stocks with strong financials, which seasoned investors don’t want you to overlook.

- Supercharge your income stream by tapping into these 17 dividend stocks with yields > 3%, offering attractive yields for your portfolio.

- Lead the technology race as you target breakthroughs with these 25 AI penny stocks, driving advancements in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:URGN

UroGen Pharma

Engages in the development and commercialization of solutions for urothelial and specialty cancers.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives