- United States

- /

- Biotech

- /

- NasdaqGS:TYRA

Why Tyra Biosciences (TYRA) Is Up 34.3% After Launching Phase 2 Trial in Pediatric Achondroplasia

Reviewed by Sasha Jovanovic

- Tyra Biosciences recently announced the commencement of dosing in its Phase 2 clinical trial for achondroplasia, targeting children aged 3 to 10, with initial safety results expected in late 2026.

- This milestone highlights progress in the company’s clinical pipeline and has brought renewed attention to its therapeutic prospects in rare genetic disorders.

- We’ll explore how the Phase 2 clinical trial initiation for achondroplasia enhances Tyra Biosciences’ evolving investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Tyra Biosciences' Investment Narrative?

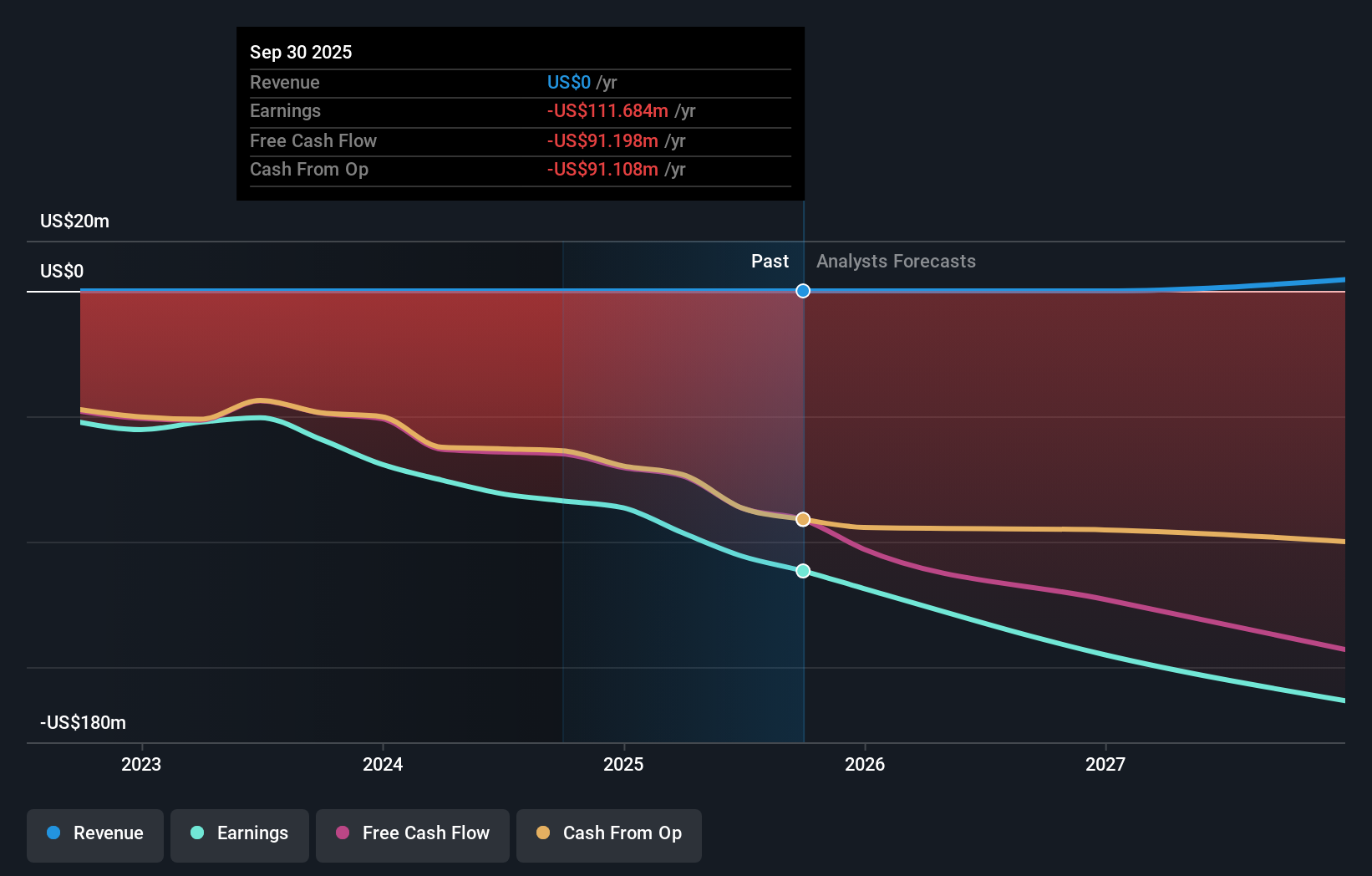

To invest in Tyra Biosciences right now, it takes confidence in the company’s ability to translate clinical milestones, like the latest Phase 2 trial launch for achondroplasia, into long-term value creation, despite no current revenue and growing losses. The recent dosing news does appear to reinforce the core investment case, suggesting regulatory momentum and potential validation of Tyra's lead candidate dabogratinib. Short-term, this may help bolster sentiment and support the share price, as seen in recent strong gains and an analyst price target upgrade. However, this new catalyst doesn’t materially shift the biggest risks, which remain tied to Tyra’s cash burn, lack of profitability, and the long timelines ahead before any commercial revenue is likely. The trend of insider selling and the absence of near-term earnings improvement suggest that any optimism should be balanced with caution.

Yet, despite this clinical momentum, the company’s rising net losses remain a point investors should not overlook.

Exploring Other Perspectives

Explore another fair value estimate on Tyra Biosciences - why the stock might be worth as much as $15.00!

Build Your Own Tyra Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tyra Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Tyra Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tyra Biosciences' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyra Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TYRA

Tyra Biosciences

A clinical-stage biotechnology company, develops precision medicines for fibroblast growth factor receptor (FGFR) biology in the United States.

Flawless balance sheet with low risk.

Market Insights

Community Narratives