- United States

- /

- Biotech

- /

- NasdaqGS:TYRA

Should Tyra Biosciences’ (TYRA) Executive Hires Shift the Regulatory Outlook for Its Pipeline?

Reviewed by Sasha Jovanovic

- Tyra Biosciences recently appointed Bhavesh Ashar as Chief Operating Officer and Heather Faulds as Chief Regulatory Officer, both joining from major biopharmaceutical companies and bringing extensive commercial and regulatory leadership experience.

- This infusion of talent draws from executives with proven success in product launches and regulatory approvals, reflecting a focused effort to advance Tyra's pipeline initiatives.

- We'll explore how Heather Faulds’s leadership in global regulatory affairs shapes Tyra Biosciences' investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Tyra Biosciences' Investment Narrative?

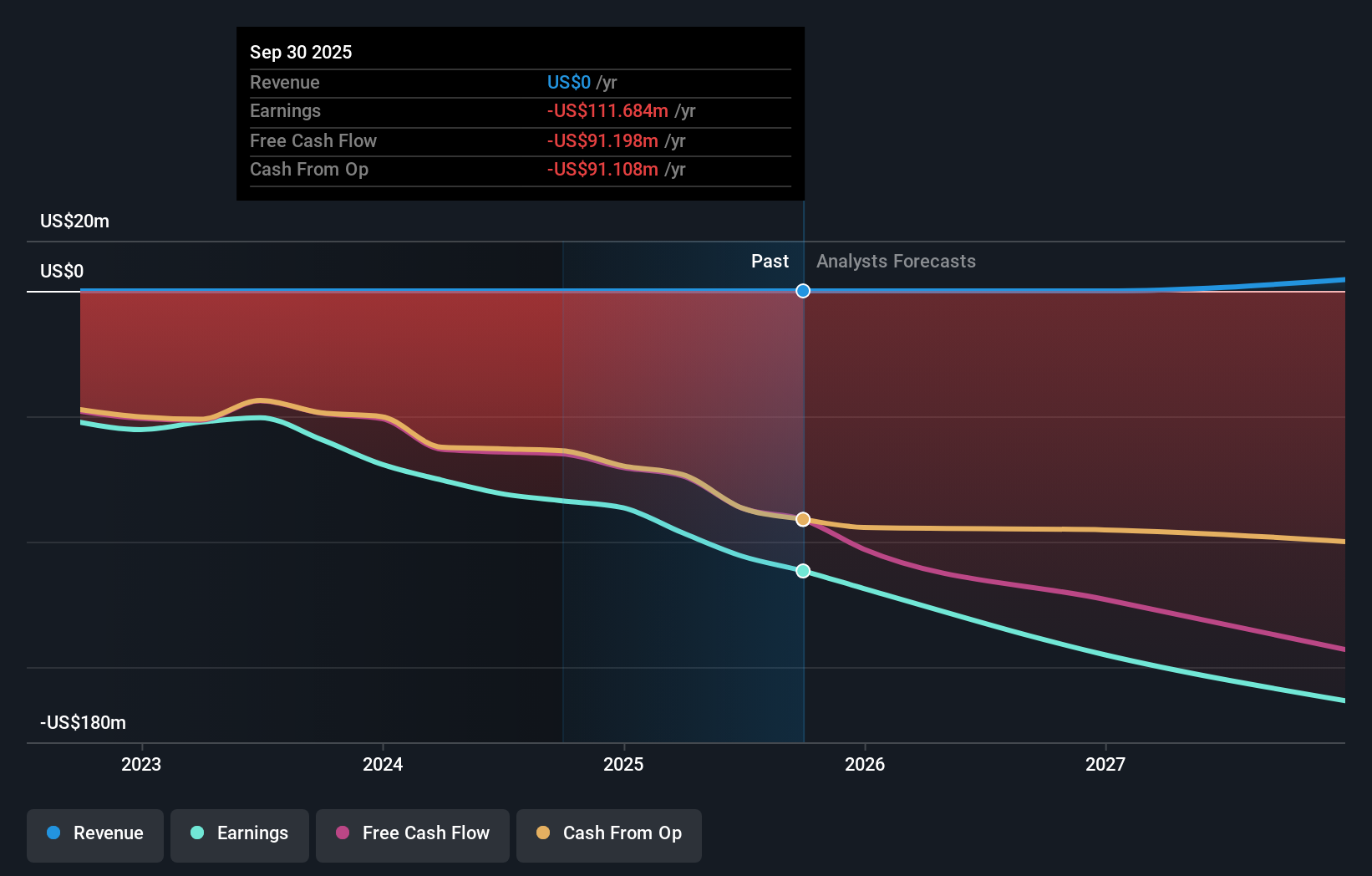

For those following Tyra Biosciences, the recent appointments of Bhavesh Ashar and Heather Faulds signal a clear drive to address some of the company’s key execution risks and next steps in clinical development. With no meaningful revenue and continued financial losses, the near-term catalysts remain closely tied to advancing clinical trials, especially for dabogratinib and TYRA-300. The addition of seasoned talent with proven regulatory and commercialization experience could accelerate Tyra’s efforts to bring these candidates through late-stage development. This is meaningful, as it potentially shifts the focus away from the company’s historical challenges in trial progression and regulatory hurdles. However, Tyra still faces the fundamental risk of ongoing losses and the need for future financing, which can’t be overstated for a pre-revenue biotech. The new leadership may help, but material revenue and profitability remain uncertain.

But investors should think closely about the future funding needs and delays in trial timelines. Insights from our recent valuation report point to the potential overvaluation of Tyra Biosciences shares in the market.Exploring Other Perspectives

Explore another fair value estimate on Tyra Biosciences - why the stock might be worth 28% less than the current price!

Build Your Own Tyra Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tyra Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Tyra Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tyra Biosciences' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyra Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TYRA

Tyra Biosciences

A clinical-stage biotechnology company, develops precision medicines for fibroblast growth factor receptor (FGFR) biology in the United States.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026