- United States

- /

- Biotech

- /

- NasdaqGS:TWST

A Look at Twist Bioscience’s (TWST) Valuation Following Improved Earnings and Operational Progress

Reviewed by Simply Wall St

Twist Bioscience (TWST) just released its fourth quarter and full year earnings, highlighting higher sales and a much narrower net loss compared to last year. Investors are watching as the company's operational improvements come into focus.

See our latest analysis for Twist Bioscience.

Twist Bioscience’s latest operational progress has caught investors’ attention, but the share price return tells a more cautious story. With a 16% slide over the past month and a 42% year-to-date decline, momentum has clearly faded despite recent earnings improvements. Over the past year, total shareholder return also sits deep in negative territory, underscoring the challenges the company is working to turn around.

If this shift in sentiment makes you curious about other growth opportunities in biotech and life sciences, explore the latest innovators on our healthcare stocks screener: See the full list for free.

With Twist shares now trading at a sizable discount to analyst targets after a challenging year, investors are left weighing whether the recent drop offers an attractive entry point or if future growth is already accounted for.

Most Popular Narrative: 26.7% Undervalued

Twist Bioscience’s most popular valuation narrative sees fair value well above the last close, suggesting the market could be missing major upside if consensus projections play out. With shares trading significantly below the headline figure, anticipation centers on the company’s ability to deliver against bullish forecasts.

Expansion of Twist's customer base, especially among smaller academic clients and long-tail customers, combined with the successful rollout of new synthetic biology (SynBio) product lines, is likely to drive sustained top-line growth and broaden the company's addressable market, positively impacting future revenue. High demand from large pharma, biotechnology, and clinical diagnostic customers for personalized medicine, genomics, and next-generation sequencing (NGS) services continues to accelerate, supported by long-term increases in global life sciences R&D investment, which should fuel ongoing revenue growth and earnings stability.

Want to know what powers this bullish fair value? The secret is in standout growth projections, margin leaps, and profit forecasts that outpace current trends. The calculations hinge on aggressive revenue, profit, and multiple expansion targets. Do you want to see why the narrative stands by a much higher price?

Result: Fair Value of $35.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses and heavy reliance on a handful of major customers could quickly change the story if market conditions unexpectedly deteriorate.

Find out about the key risks to this Twist Bioscience narrative.

Another View: What Do Relative Valuations Say?

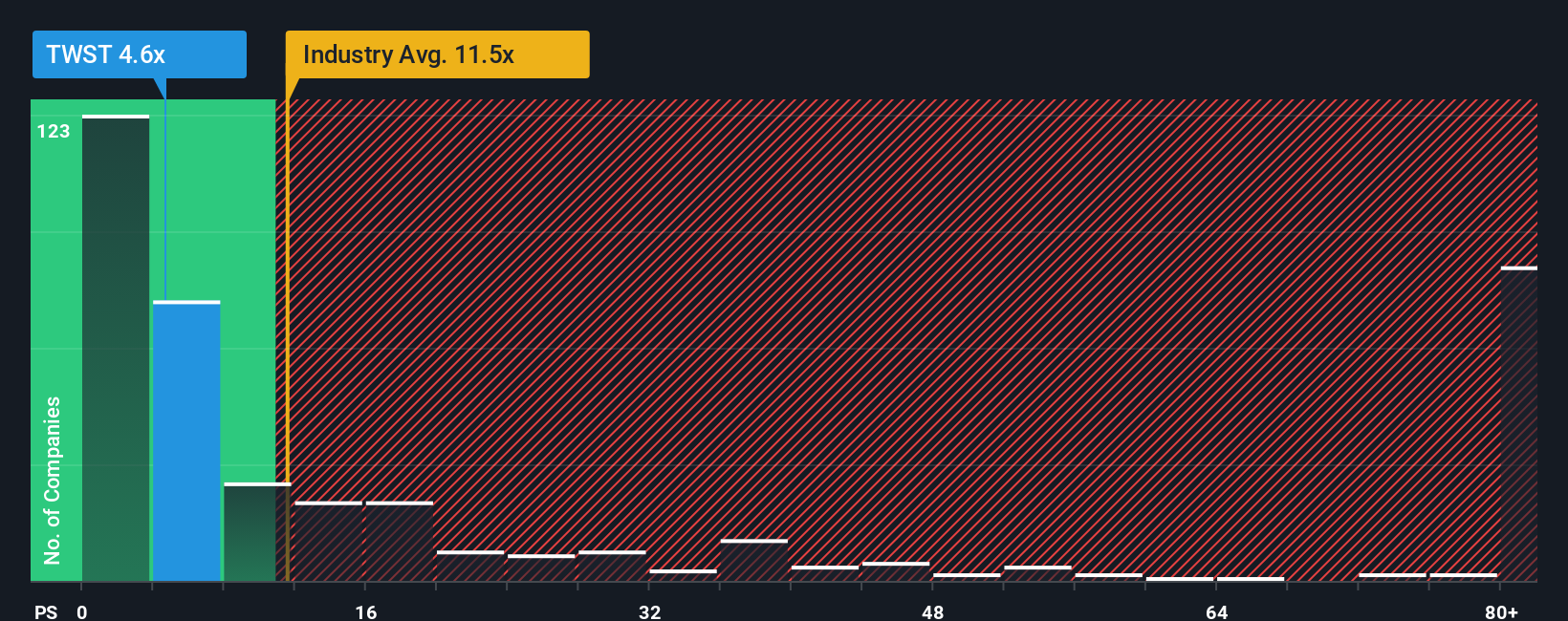

Looking from a different angle, Twist Bioscience trades at a price-to-sales ratio of 4.2x, notably lower than both the US Biotechs industry average of 11.5x and the peer group at 9x. However, it is still above the fair ratio of 3.8x, suggesting shares could be pricier than they seem relative to their own fundamentals. Does this gap offer a margin of safety or is it a warning for more cautious investors to wait?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Twist Bioscience Narrative

Keep in mind, if you see the numbers differently or want to dig deeper, you can build your own narrative in just a few minutes: Do it your way

A great starting point for your Twist Bioscience research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their watchlist growing by seeking fresh opportunities beyond the headlines. Don’t let game-changing stocks slip through the cracks. Your next winner could be just a click away!

- Boost your income potential and see which companies offer strong payouts by scanning these 16 dividend stocks with yields > 3% with yields exceeding 3%.

- Tap into emerging artificial intelligence breakthroughs by analyzing these 25 AI penny stocks driving innovation in this fast-advancing sector.

- Seize bargains first by tracking undervalued opportunities through these 919 undervalued stocks based on cash flows based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twist Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TWST

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives