- United States

- /

- Biotech

- /

- NasdaqGM:TVTX

Will Positive Phase 3 FILSPARI Data in FSGS Redefine Travere Therapeutics' (TVTX) Position in Rare Kidney Disease?

Reviewed by Sasha Jovanovic

- Earlier this month, Travere Therapeutics announced new Phase 3 DUPLEX Study data showing that FILSPARI (sparsentan) led to significantly higher rates of proteinuria reduction in patients with focal segmental glomerulosclerosis (FSGS) compared to irbesartan, with reported links to lower risks of kidney failure and a consistent safety profile.

- This late-breaking data, presented at the American Society of Nephrology Kidney Week 2025 and highlighted in a leading medical journal, enhances FILSPARI's profile in a disease area with few approved treatments, potentially strengthening the company's position in rare kidney disorders.

- We'll explore how these positive clinical results for FILSPARI in FSGS could influence Travere's investment narrative and outlook for market expansion.

Find companies with promising cash flow potential yet trading below their fair value.

Travere Therapeutics Investment Narrative Recap

To own Travere Therapeutics, investors need conviction in FILSPARI’s potential to secure regulatory approval for FSGS and drive market expansion in rare kidney diseases, while tolerating reliance on a single asset. The latest DUPLEX Phase 3 results further reinforce confidence ahead of the January 2026 FDA review, but regulatory uncertainty around the approval timeline remains the key short-term risk that could outweigh recent clinical momentum. The news meaningfully strengthens Travere’s lead FSGS catalyst, but approval delays or new regulatory hurdles could quickly shift the story.

Read the full narrative on Travere Therapeutics (it's free!)

Travere Therapeutics' outlook projects $832.7 million in revenue and $221.2 million in earnings by 2028. This implies 35.6% annual revenue growth and a $390.2 million increase in earnings from the current -$169.0 million.

Uncover how Travere Therapeutics' forecasts yield a $41.50 fair value, a 15% upside to its current price.

Exploring Other Perspectives

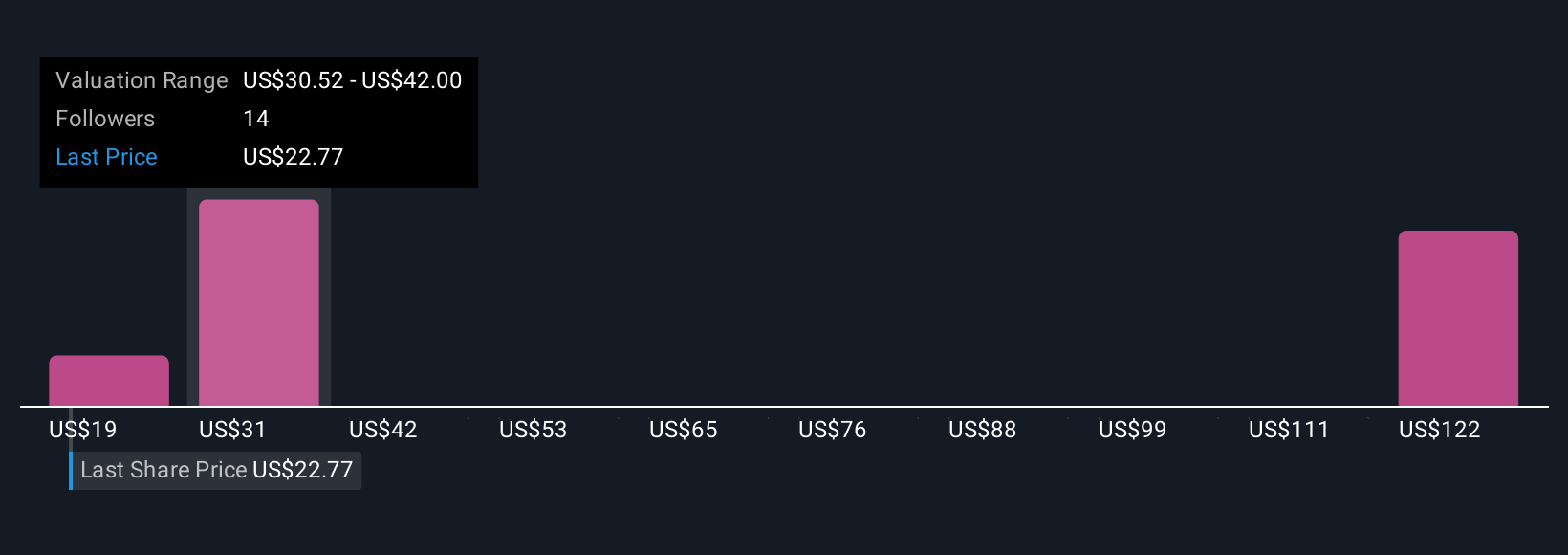

Ten private investors in the Simply Wall St Community value Travere shares from as low as US$19.04 to as high as US$144.51, reflecting wide differences in future growth views. While optimism around FILSPARI's FSGS prospects is gaining traction, the risk of regulatory hurdles or approval delays remains a crucial factor that could reshape the outlook for all stakeholders, explore how this could impact your investment strategy as...

Explore 9 other fair value estimates on Travere Therapeutics - why the stock might be worth over 4x more than the current price!

Build Your Own Travere Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travere Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Travere Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travere Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travere Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TVTX

Travere Therapeutics

A biopharmaceutical company, identifies, develops, and delivers therapies to people living with rare kidney and metabolic diseases in the United States.

Exceptional growth potential and good value.

Market Insights

Community Narratives