- United States

- /

- Biotech

- /

- NasdaqGM:TVTX

Exploring 3 High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has remained flat over the last week but is up 32% over the past year with earnings forecast to grow by 15% annually. In this environment, identifying high growth tech stocks often involves looking for companies with innovative products and strong potential for revenue expansion.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.11% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.45% | ★★★★★★ |

| Blueprint Medicines | 26.51% | 67.43% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 252 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

PowerFleet (NasdaqGM:AIOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PowerFleet, Inc. is a company that offers Internet-of-Things solutions across the United States, Israel, and internationally with a market capitalization of $660.36 million.

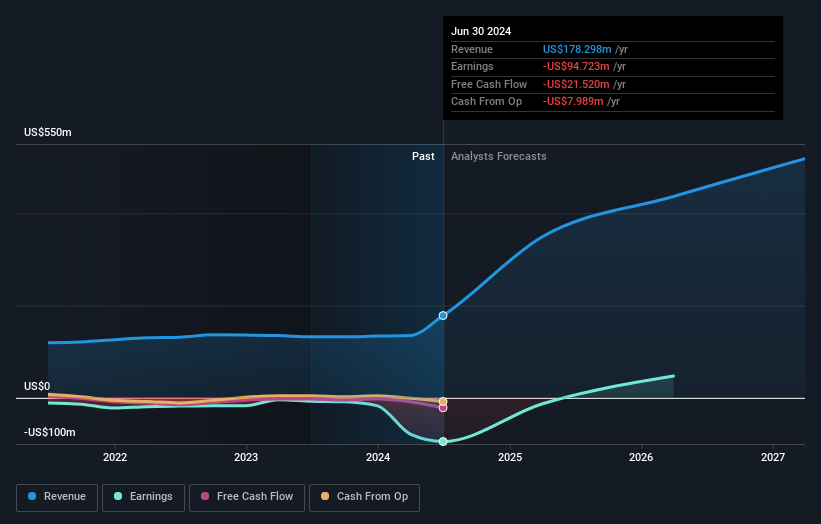

Operations: PowerFleet, Inc. generates revenue primarily from its Wireless IoT Asset Management segment, amounting to $178.30 million. The company focuses on providing advanced Internet-of-Things solutions across various regions, enhancing operational efficiency for its clients.

PowerFleet, amidst a challenging fiscal landscape marked by a net loss of $22.31 million in Q1 2024, continues to drive substantial revenue growth, evidenced by a 35.5% annual increase forecasted to outpace the broader US market's 8.7%. The company's strategic acquisition of Fleet Complete not only cements its position as a leader in the global AIoT SaaS sector but also promises enhanced market reach and product capabilities. This move aligns with PowerFleet's R&D commitment, where recent expenditures are strategically poised to fuel innovations that meet evolving industry demands and customer needs. Despite near-term profitability challenges, with earnings expected to surge by 154.6% annually, PowerFleet is actively shaping its future through significant investments in technology and market expansion strategies.

- Click to explore a detailed breakdown of our findings in PowerFleet's health report.

Gain insights into PowerFleet's past trends and performance with our Past report.

Travere Therapeutics (NasdaqGM:TVTX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Travere Therapeutics, Inc. is a biopharmaceutical company focused on identifying, developing, and delivering therapies for rare kidney and metabolic diseases, with a market cap of approximately $1.16 billion.

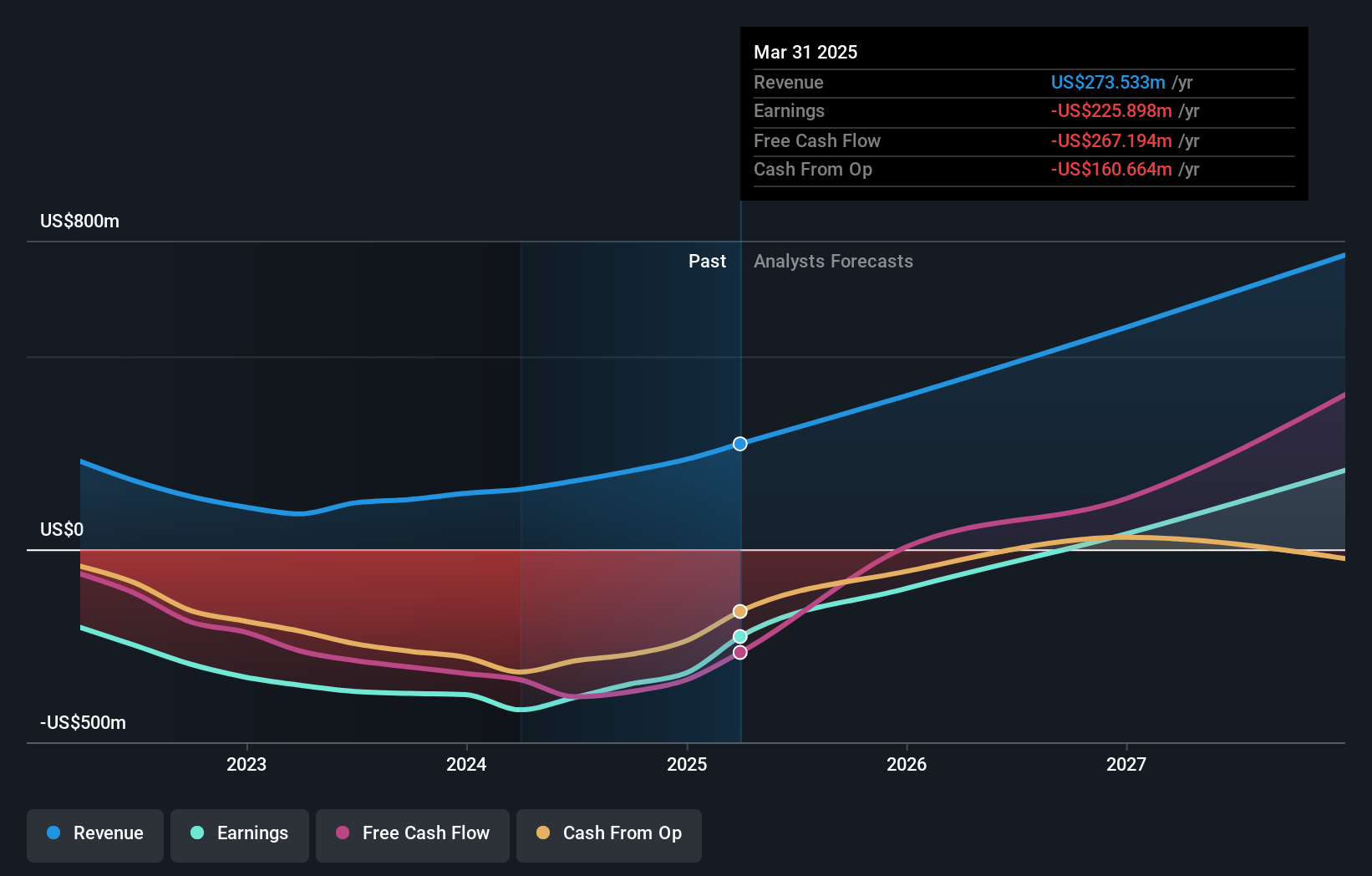

Operations: Travere Therapeutics generates revenue primarily from the development and commercialization of innovative therapies, amounting to $177.64 million. The company's focus on rare kidney and metabolic diseases drives its business operations.

Travere Therapeutics, despite its unprofitability, is on a trajectory to outpace the Biotech industry's growth, with revenue expected to surge by 26.5% annually. This growth is bolstered by significant R&D investments aimed at pioneering treatments in rare diseases, as evidenced by their recent FDA approval of FILSPARI for IgAN and ongoing Phase 3 trials for pegtibatinase. The firm's strategic focus on developing novel therapies could potentially reshape treatment paradigms in niche medical fields, positioning it well for future profitability amidst a forecasted annual earnings increase of 69.3%.

- Navigate through the intricacies of Travere Therapeutics with our comprehensive health report here.

Explore historical data to track Travere Therapeutics' performance over time in our Past section.

DoubleVerify Holdings (NYSE:DV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DoubleVerify Holdings, Inc. operates a software platform focused on digital media measurement and data analytics across the United States and internationally, with a market capitalization of $2.93 billion.

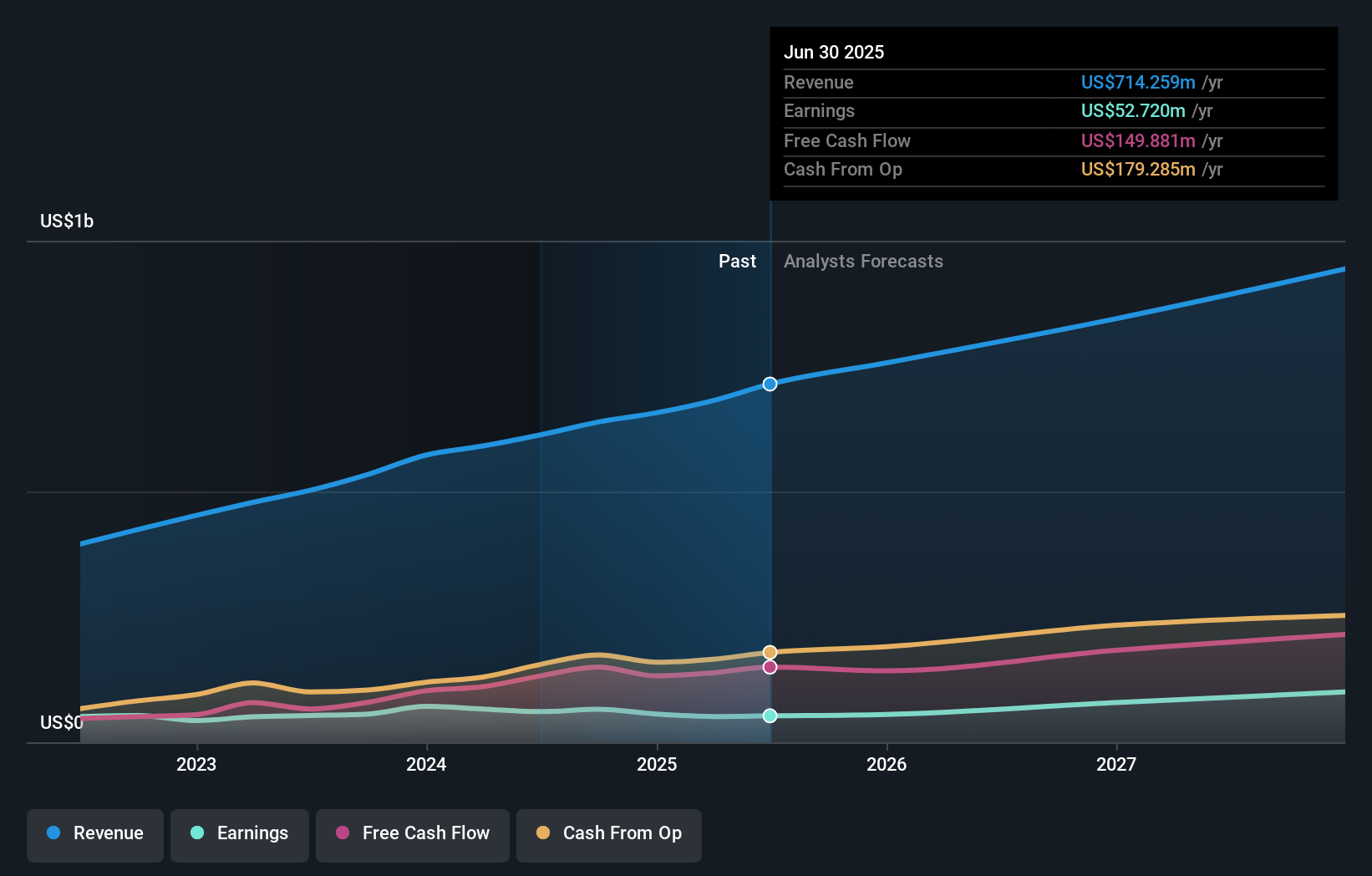

Operations: The company generates revenue primarily through its data processing services, amounting to $612.88 million.

DoubleVerify Holdings, amid a bustling tech landscape, is steering its growth trajectory with strategic mergers and acquisitions, eyeing enhancements in product innovation and geographic expansion. Recently announcing a robust year-over-year revenue increase forecast of 14.4% to between $667 million and $675 million, the company also highlighted its proactive capital allocation through share repurchases totaling $50 million. Complementing these financial maneuvers are DoubleVerify's technological strides in digital advertising efficacy, as evidenced by their recent partnership with Hakuhodo DY Media Partners to optimize ad delivery using AI-driven solutions. This blend of financial health and innovative partnerships underscores DoubleVerify's adaptability in the evolving digital space while maintaining a competitive edge through substantial R&D investments that fuel continuous improvement and market relevance.

- Dive into the specifics of DoubleVerify Holdings here with our thorough health report.

Evaluate DoubleVerify Holdings' historical performance by accessing our past performance report.

Make It Happen

- Embark on your investment journey to our 252 US High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travere Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TVTX

Travere Therapeutics

A biopharmaceutical company, identifies, develops, and delivers therapies to people living with rare kidney and metabolic diseases.

Exceptional growth potential and good value.