- United States

- /

- Biotech

- /

- NasdaqGM:TVTX

Does Travere Therapeutics' (TVTX) Streamlined REMS Hint at Lasting Pipeline Momentum?

Reviewed by Simply Wall St

- In early September 2025, Travere Therapeutics announced that the FDA approved updated REMS labeling for FILSPARI, reducing liver function monitoring frequency and removing the embryo-fetal toxicity monitoring requirement, while also sharing positive long-term clinical data from ongoing pegtibatinase studies in classical homocystinuria at an international conference in Japan.

- These developments may support improved FILSPARI adoption in IgA nephropathy and highlight steady progress in Travere’s pipeline targeting rare metabolic diseases.

- We’ll explore how streamlined REMS requirements for FILSPARI could shift Travere’s growth outlook and influence its evolving investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Travere Therapeutics Investment Narrative Recap

To be a shareholder in Travere Therapeutics, you need conviction in the company’s ability to execute on late-stage rare disease drug launches, especially the anticipated approval and market penetration of FILSPARI in FSGS, where there are currently no approved therapies. The recent FDA REMS update for FILSPARI, reducing liver function and embryo-fetal toxicity monitoring, improves the commercial profile but does not materially shift the biggest near-term catalyst: securing FDA approval for FSGS, or the main risk, FILSPARI’s heavy revenue concentration amid incoming competition.

Among recent announcements, the FDA's acceptance of the supplemental New Drug Application for FILSPARI in FSGS (with a target action date set for January 2026) stands out, as it directly ties to expanding Travere’s addressable market and remains the key valuation driver for the stock. Changes to safety requirements may help support physician adoption, but patient access and successful label expansion remain the primary determinants of growth.

However, investors should also be aware that increased competition in the IgA nephropathy and FSGS drug markets could...

Read the full narrative on Travere Therapeutics (it's free!)

Travere Therapeutics' narrative projects $832.7 million revenue and $221.2 million earnings by 2028. This requires 35.6% yearly revenue growth and a $390.2 million earnings increase from -$169.0 million today.

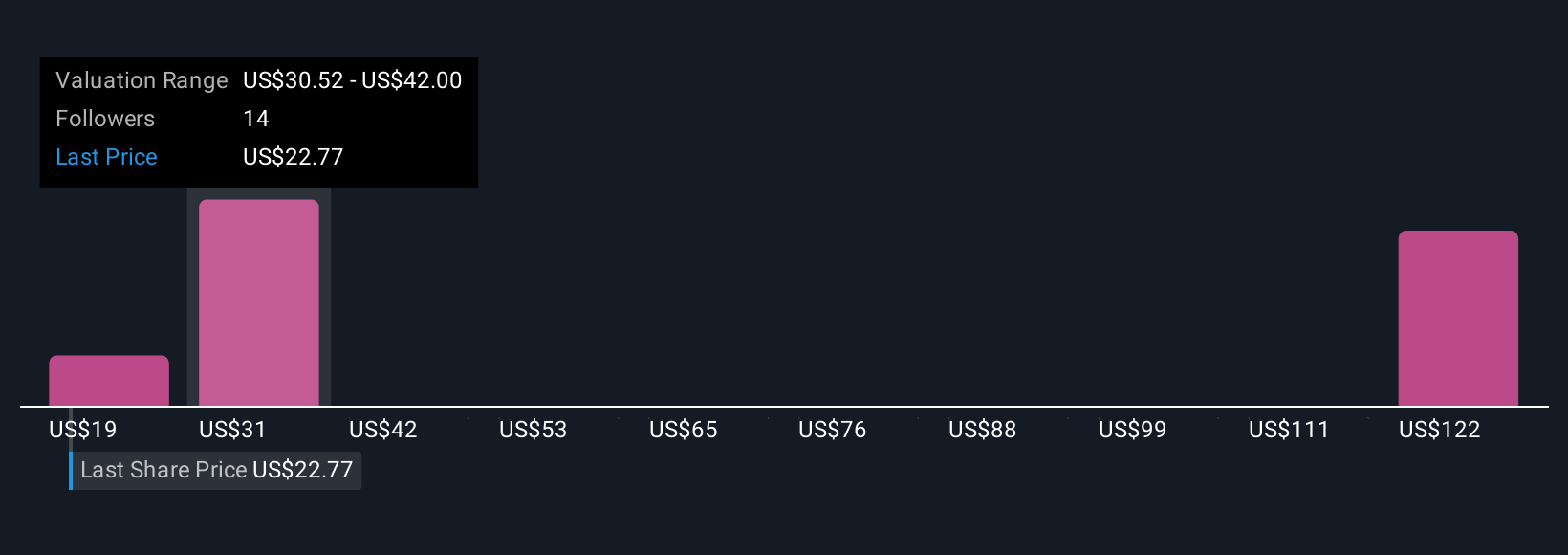

Uncover how Travere Therapeutics' forecasts yield a $35.71 fair value, a 65% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Travere range from US$19.04 to US$172.84 across six contributors. With the FSGS approval process and evolving regulatory profile as core drivers, your view could differ widely from consensus.

Explore 6 other fair value estimates on Travere Therapeutics - why the stock might be worth over 7x more than the current price!

Build Your Own Travere Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travere Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Travere Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travere Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travere Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TVTX

Travere Therapeutics

A biopharmaceutical company, identifies, develops, and delivers therapies to people living with rare kidney and metabolic diseases in the United States.

Exceptional growth potential and good value.

Market Insights

Community Narratives