- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

Taysha Gene Therapies (TSHA): Revenue Forecast to Grow 70.5% Annually, Balancing Risks and Valuation

Reviewed by Simply Wall St

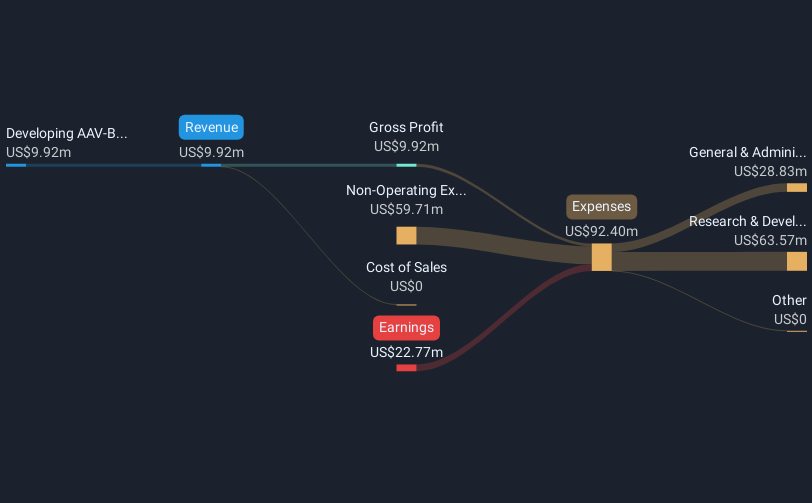

Taysha Gene Therapies (TSHA) remains unprofitable, but its revenue is forecast to grow rapidly by 70.5% per year, far outpacing the broader US market's expected 10.5% annual growth. Over the past five years, the company has managed to cut its losses at a 7.5% annual rate, even as it is projected to stay in the red for at least the next three years. With shares recently trading at $4.27, below an estimated fair value of $20.71, investors are weighing the promise of significant top-line growth against continued losses and a valuation that is well above market and industry averages.

See our full analysis for Taysha Gene Therapies.We are now putting these headline numbers side by side with the prevailing narratives among investors, highlighting where the data aligns and where it may raise new questions.

See what the community is saying about Taysha Gene Therapies

Losses Narrow Despite Ongoing R&D Spend

- Taysha reduced its net losses at a pace of 7.5% per year over the last five years, even as it invests significantly in research and development to drive future growth.

- According to the analysts' consensus view, ongoing trials for TSHA-102 and constructive engagement with regulators are positive catalysts that could potentially support future profitability.

- Promising safety and efficacy data in the pivotal REVEAL trials supports this optimism by making regulatory approval more likely.

- There is still a considerable gap to cross, as analysts do not anticipate the company becoming profitable within the next three years.

- To see how the full narrative anchors around these clinical milestones, revenue forecasts, and unprofitability, read the detailed consensus perspective: 📊 Read the full Taysha Gene Therapies Consensus Narrative.

Share Dilution Outpaces Industry

- Share count is expected to rise by 7.0% per year for the next three years, outpacing most biotech peers and raising dilution risk for existing investors.

- Analysts' consensus view notes that this heightened dilution, combined with ongoing net losses and costly clinical trials, challenges Taysha's pathway to robust earnings growth.

- Dependence on expensive, long-term trial phases and rising expenses for GMP batch manufacturing pushes management to raise capital regularly, leading to more shares being issued.

- The need for additional cash to sustain R&D progress puts returns per share under pressure unless revenue growth accelerates substantially.

Trading Below DCF Fair Value, But Premium to Peers

- At $4.27, Taysha trades well below its DCF fair value estimate of $20.71, but at a price-to-book ratio of 5.3x, it commands a significant premium to both the US biotech industry average (2.5x) and its peer group average (4.4x).

- Analysts' consensus view sees this valuation gap as a double-edged sword.

- On one hand, the steep discount to DCF fair value highlights potential upside if revenue growth materializes and clinical milestones are achieved.

- On the other hand, the premium multiples increase risk if regulatory or commercialization setbacks delay the journey to profitability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Taysha Gene Therapies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the financials point you in another direction? Take a couple of minutes to shape and share your own narrative. Do it your way

A great starting point for your Taysha Gene Therapies research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Taysha’s ongoing losses, heavy reliance on fundraising, and rising share dilution expose investors to persistent financial risk and uncertain value creation.

If a healthier balance sheet is a priority for you, check out solid balance sheet and fundamentals stocks screener (1980 results) to find companies with stronger financial health and less dilution pressure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives