- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

How Recent Insider Share Sales and Rett Syndrome Progress at Taysha (TSHA) Are Reframing Its Investment Narrative

Reviewed by Sasha Jovanovic

- Nagendran Sukumar, President and Head of R&D at Taysha Gene Therapies, recently sold 370,172 shares of common stock for approximately US$1.69 million, while the company continues advancing its gene therapy for Rett Syndrome, which has shown encouraging results in clinical trials.

- The timing of the executive share sale, alongside the progress in clinical development, highlights both confidence in the pipeline and the complexity of interpreting insider transactions.

- We’ll explore how the finalization of REVEAL clinical trial plans could shift Taysha’s investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Taysha Gene Therapies Investment Narrative Recap

To be a shareholder in Taysha Gene Therapies, an investor would need conviction in the promise of gene therapy for rare neurodevelopmental diseases, especially the company’s progress with TSHA-102 for Rett syndrome. The recent executive share sale does not materially alter the key catalyst, the advancement and potential regulatory milestones of the REVEAL trial, nor does it significantly impact the ongoing risk of high R&D expenses and the need for eventual regulatory approval. One pertinent recent announcement is the FDA Breakthrough Therapy designation for TSHA-102 and alignment on pivotal trial protocols for a future Biologics License Application. This achievement supports the main near-term catalyst of progressing the clinical program, but the challenge of commercializing a successful therapy remains at the forefront of investor considerations. By contrast, investors should also be aware that the company’s persistent net losses and the financial pressure of long clinical trials have yet to be resolved...

Read the full narrative on Taysha Gene Therapies (it's free!)

Taysha Gene Therapies' narrative projects $88.9 million in revenue and $14.1 million in earnings by 2028. This requires 120.1% yearly revenue growth and a $103.4 million increase in earnings from the current -$89.3 million.

Uncover how Taysha Gene Therapies' forecasts yield a $10.54 fair value, a 138% upside to its current price.

Exploring Other Perspectives

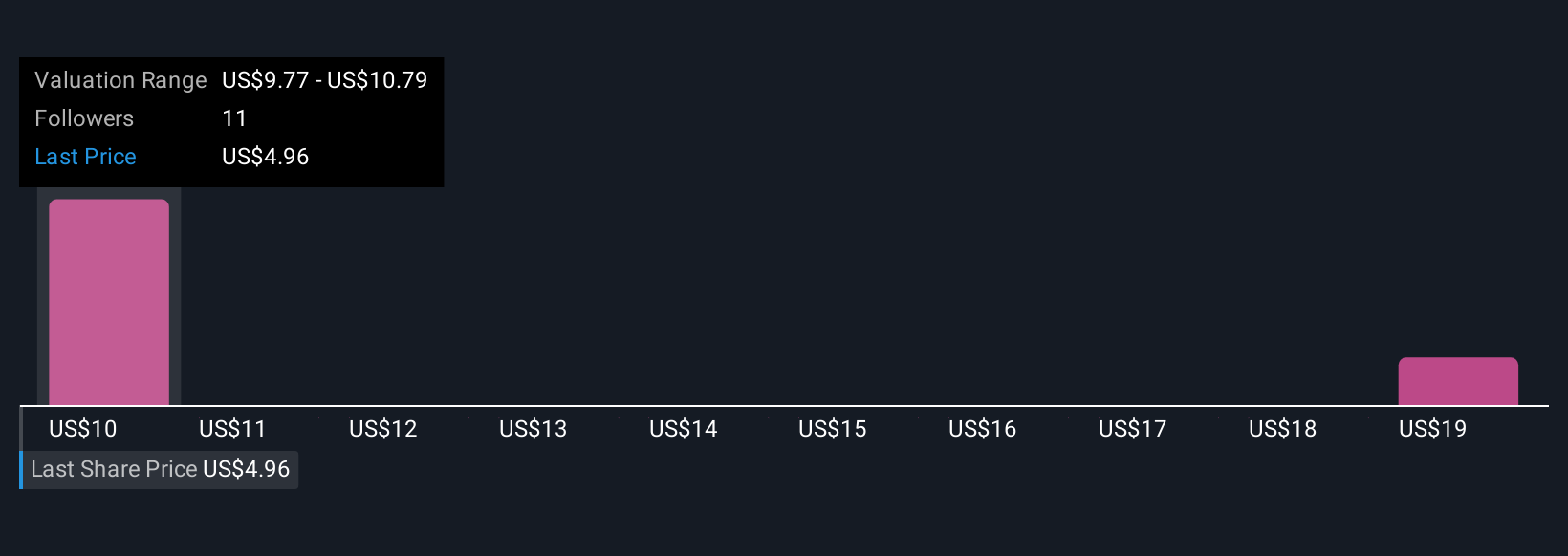

Simply Wall St Community analysts offered two fair value estimates for Taysha Gene Therapies, ranging from US$10.54 to US$19.07 per share. Yet with ongoing unprofitability and reliance on successful late-stage trials, the broader implications for long-term value remain highly dependent on clinical results and regulatory progress.

Explore 2 other fair value estimates on Taysha Gene Therapies - why the stock might be worth over 4x more than the current price!

Build Your Own Taysha Gene Therapies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Taysha Gene Therapies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Taysha Gene Therapies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Taysha Gene Therapies' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026