- United States

- /

- Biotech

- /

- NasdaqGS:TNYA

How Might Tenaya Therapeutics' (TNYA) Industry Visibility Influence Its Strategic Positioning?

Reviewed by Sasha Jovanovic

- On October 6, 2025, Tenaya Therapeutics presented at the Cell & Gene Meeting on the Mesa in Phoenix, Arizona, with CEO Faraz Ali leading the session.

- This high-profile industry platform often serves as a stage for companies to highlight breakthroughs, upcoming milestones, or strategic progress to a focused scientific and investor audience.

- Next, we'll explore how Tenaya Therapeutics' visibility at this flagship event shapes its investment narrative and future industry positioning.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Tenaya Therapeutics' Investment Narrative?

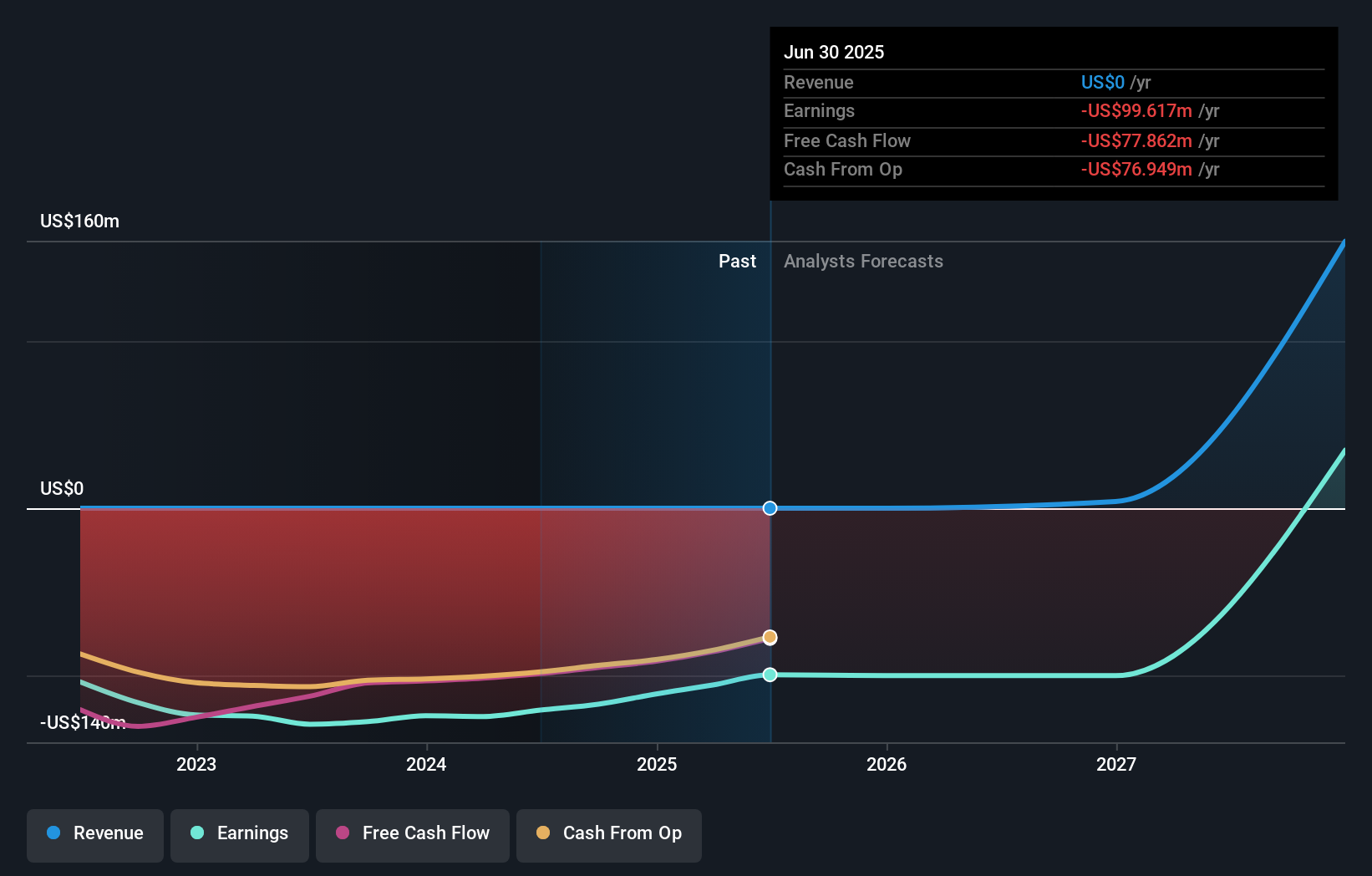

For investors eyeing Tenaya Therapeutics, the big picture still hinges on belief in pioneering gene therapies that address significant unmet needs in cardiovascular disease. The recent Cell & Gene Meeting on the Mesa appearance puts Tenaya in the industry’s spotlight but is more about reinforcing its scientific relevance than altering any immediate catalysts. The most important short-term drivers remain readouts from the TN-201 and TN-401 clinical trials, set for later this year, and the company's path to address its ongoing cash needs. While the Phoenix event may help build visibility and potential partnership interest, it does not change the pressing financial runway risk or the importance of trial data for valuation. The company's volatile share price and ongoing losses still shape the near-term risk profile.

But financial runway pressures haven’t disappeared, even as the pipeline advances. Our valuation report unveils the possibility Tenaya Therapeutics' shares may be trading at a premium.Exploring Other Perspectives

Explore 11 other fair value estimates on Tenaya Therapeutics - why the stock might be worth 43% less than the current price!

Build Your Own Tenaya Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tenaya Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Tenaya Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tenaya Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenaya Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TNYA

Tenaya Therapeutics

A clinical-stage biotechnology company, discovers, develops, and delivers therapies for heart disease in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives