- United States

- /

- Biotech

- /

- NasdaqGM:TNGX

Tango Therapeutics (TNGX) Is Up 8.2% After Positive Vopimetostat Data and $15M Nextech Investment – What's Changed

Reviewed by Sasha Jovanovic

- In late October 2025, Tango Therapeutics announced positive data from an ongoing Phase 1/2 study of Vopimetostat in patients with MTAP-deleted cancers and completed both a follow-on equity offering and a US$15 million private placement led by Nextech Invest Ltd.

- These developments highlight both clinical progress and renewed investor support, as the company strengthens its financial position while advancing a potentially meaningful treatment for targeted cancer populations.

- We'll examine how the positive clinical trial results and new capital raise influence Tango Therapeutics' investment narrative moving forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Tango Therapeutics' Investment Narrative?

To be a Tango Therapeutics shareholder, you’d need conviction in the company’s ability to advance breakthrough cancer treatments and ultimately translate clinical progress into commercial success. The recent announcement of positive Phase 1/2 data for Vopimetostat and concurrent US$210 million equity raise appears to be a turning point, at least in the short term. The trial update strengthens the prospect of future catalysts tied to regulatory progression and broader clinical validation, while fresh capital improves financial resilience to fund ongoing research and development. Notably, the influx of capital could soften immediate funding risks and reassure stakeholders about Tango’s runway. However, with unprofitability persisting and a still-high price-to-sales ratio, execution risk remains elevated. The upcoming earnings report and lock-up period expiration add further complexity and potential volatility for current and prospective investors. But, there’s a catch: dilution risk could become more real, especially as new shares hit the market.

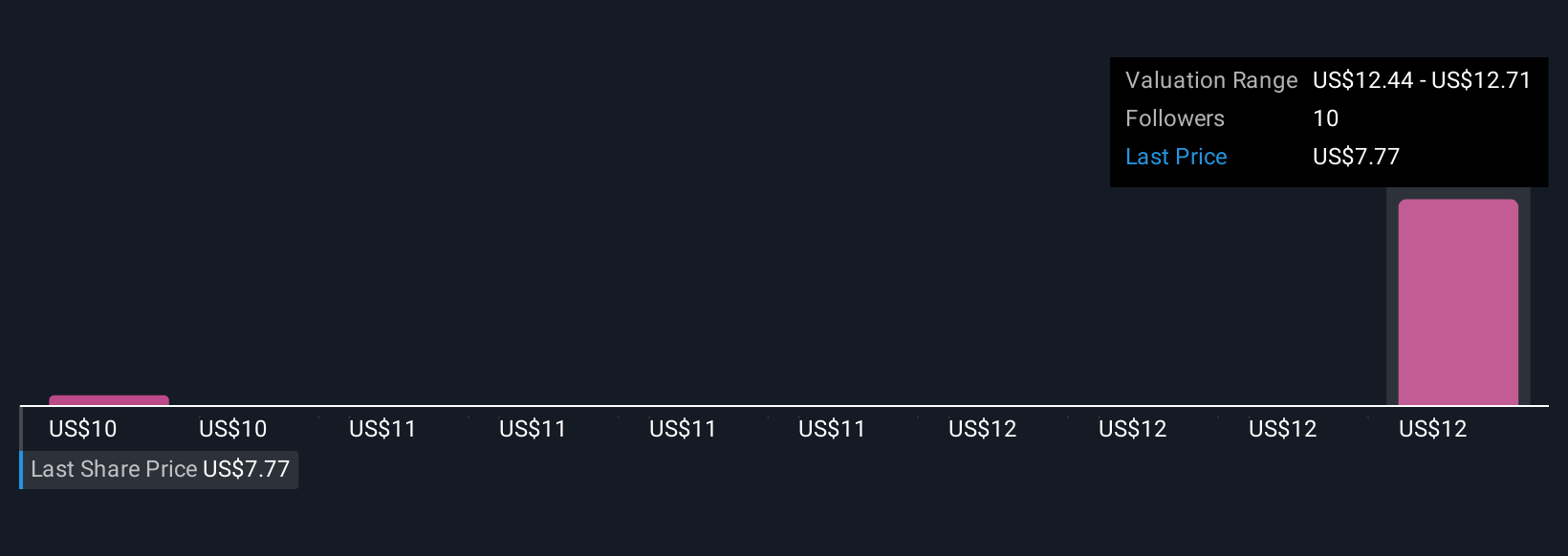

Insights from our recent valuation report point to the potential overvaluation of Tango Therapeutics shares in the market.Exploring Other Perspectives

Explore 2 other fair value estimates on Tango Therapeutics - why the stock might be worth just $10.00!

Build Your Own Tango Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tango Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tango Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tango Therapeutics' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tango Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TNGX

Tango Therapeutics

A precision oncology company, focuses on the discovery and development of drugs in defined patient populations with unmet medical need.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives