- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

A Closer Look at Tilray Brands (NasdaqGS:TLRY) Valuation After Return to Profitability and Debt Reduction

Reviewed by Simply Wall St

Tilray Brands (NasdaqGS:TLRY) just reported its first quarterly net income in over a year, signaling a meaningful turnaround. In addition, the company trimmed its net debt and maintained a positive outlook for adjusted EBITDA.

See our latest analysis for Tilray Brands.

While Tilray’s upbeat quarter and moves like the new Redhook 81 beer launch have grabbed headlines, momentum in the share price has been anything but smooth. The stock more than doubled in the last 90 days with a 135.6% share price return. However, it is still down 18.3% on a one-year total shareholder return basis, hinting that while recent excitement is real, long-term investors are waiting to see if this turnaround sticks. Overall, short-term momentum is building, but it has been a rough ride for those holding on over the last few years.

If Tilray’s swings got your attention, maybe it’s time to broaden your search and discover fast growing stocks with high insider ownership.

But with the stock still trading well below analyst targets despite the recent surge, the question remains: is there real value left on the table or is the market already factoring in every bit of future growth?

Most Popular Narrative: 24.9% Undervalued

Compared to Tilray Brands’ last close of $1.34, the most widely followed narrative pegs the fair value considerably higher. This suggests that the company’s recent advances and regulatory tailwinds could drive stronger upside than the share price reflects today.

Tilray's international cannabis business is achieving rapid organic growth, with European cannabis revenue up 112% year-over-year (excluding Australia) and significant share gains in Germany. This is due to regulatory tailwinds, broader medical adoption, and expanding legalization, supporting a long runway for top-line revenue acceleration as global cannabis markets open.

Want to know which bold financial shifts could rewrite Tilray's future? This narrative hinges on hard-hitting growth catalysts and ambitious earnings projections. Ever wondered what must happen for the numbers to justify today’s valuation? See what’s really fueling the higher fair value forecast and then decide if Tilray’s rebound is just beginning.

Result: Fair Value of $1.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty around U.S. cannabis legalization and persistent price pressures in Canada could quickly challenge the positive outlook surrounding Tilray’s rebound story.

Find out about the key risks to this Tilray Brands narrative.

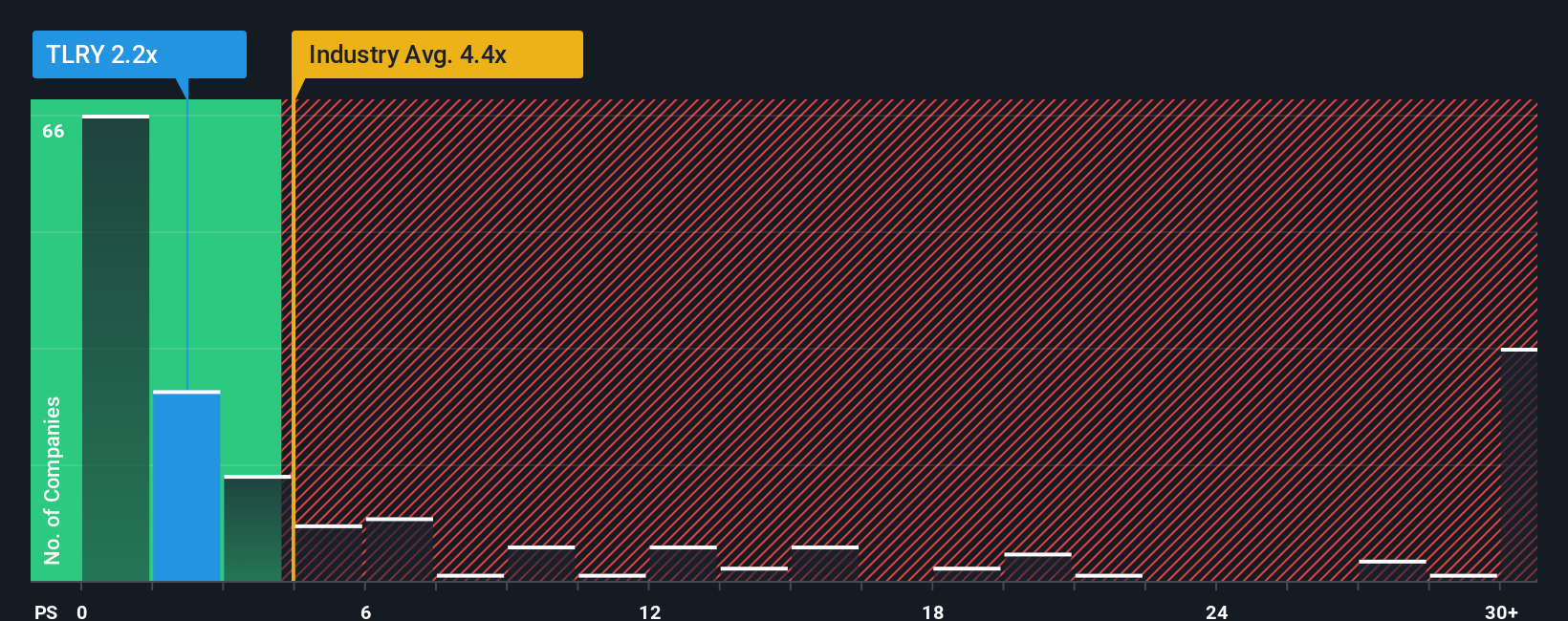

Another View: Looking at Price-to-Sales

While the analyst narrative sees upside, our price-to-sales ratio tells a mixed story. Tilray trades at 1.8x sales, lower than the US Pharmaceuticals average of 4.3x, but a bit expensive compared to peers at 1.3x. Interestingly, the fair ratio is 2.3x, leaving room for sentiment to move in either direction. Could the market be too conservative, or are analysts too bullish?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tilray Brands Narrative

If you want to test your own ideas or dig deeper into the numbers, you can build your perspective on Tilray’s future in just a few minutes, and Do it your way.

A great starting point for your Tilray Brands research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your potential? Uncover unique stocks and fresh sectors using powerful filters. Make your next smarter move and avoid missing tomorrow's top performers!

- Unleash hidden value by scanning these 834 undervalued stocks based on cash flows, which combine strong cash flow fundamentals and attractive valuations for future growth.

- Capture the future of healthcare innovation with these 33 healthcare AI stocks, and access companies reshaping medical diagnostics, treatments, and patient care.

- Fuel your portfolio with passive income and stability by targeting these 22 dividend stocks with yields > 3%, featuring consistent yields above 3% and resilient financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives