- United States

- /

- Biotech

- /

- NasdaqCM:TGTX

The Bull Case For TG Therapeutics (TGTX) Could Change Following Raised 2025 Outlook and Surging BRIUMVI Sales

Reviewed by Sasha Jovanovic

- TG Therapeutics reported strong third quarter results in the past week, posting revenue of US$161.71 million and net income of US$390.9 million, and raising its full-year 2025 global revenue guidance to approximately US$600 million.

- This performance was propelled by robust sales of BRIUMVI for relapsing multiple sclerosis and supported by the company's decision to authorize an additional US$100 million share repurchase program.

- We'll now examine how TG Therapeutics' increased revenue guidance and BRIUMVI sales impact the company's long-term investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

TG Therapeutics Investment Narrative Recap

To be a shareholder in TG Therapeutics, you need confidence in the continued growth of BRIUMVI as the company’s main revenue engine, and in TG’s ability to maintain or increase market share in a highly competitive MS treatment space. The recent strong revenue and earnings, along with the raised 2025 revenue outlook, reinforce optimism for near-term commercial execution; however, the biggest short-term catalyst remains progress with subcutaneous BRIUMVI, while significant competitive and pricing risks persist, these results do not fundamentally alter that equation.

One of the most relevant announcements is the completion of enrollment in the Phase 3 ENHANCE trial for intravenous BRIUMVI, which seeks to optimize dosing schedules and patient experience. This trial’s outcome could directly impact BRIUMVI’s positioning and the company’s ability to keep pace with evolving payer and provider expectations, especially as the market shifts toward self-administered therapies.

On the other hand, investors should also be aware of the risk that payers may increasingly push for lower-cost, self-administered alternatives, potentially affecting BRIUMVI’s margins and growth profile if...

Read the full narrative on TG Therapeutics (it's free!)

TG Therapeutics' narrative projects $1.2 billion in revenue and $469.0 million in earnings by 2028. This requires 39.5% yearly revenue growth and a $408.5 million earnings increase from $60.5 million currently.

Uncover how TG Therapeutics' forecasts yield a $43.57 fair value, a 29% upside to its current price.

Exploring Other Perspectives

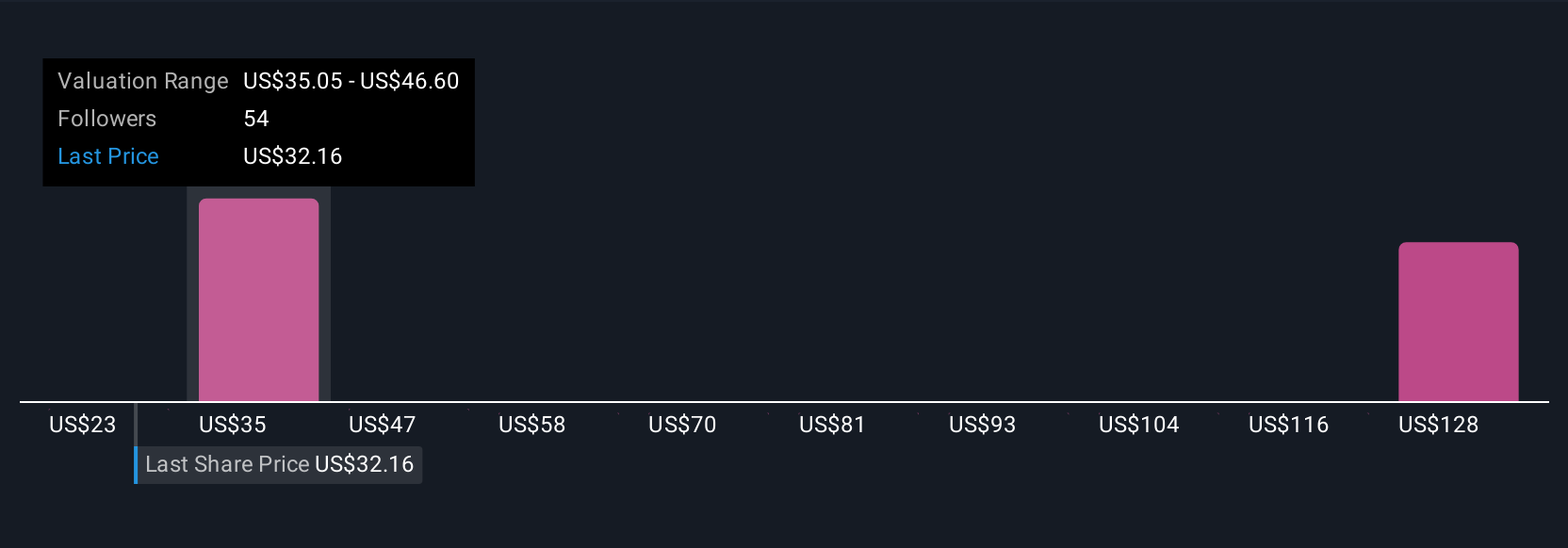

Simply Wall St Community members provided 6 fair value estimates for TG Therapeutics, ranging widely from US$12.34 to US$140.19 per share. With strong BRIUMVI sales fueling raised guidance, consider how this main product’s reliance could shape future performance and seek out other viewpoints.

Explore 6 other fair value estimates on TG Therapeutics - why the stock might be worth over 4x more than the current price!

Build Your Own TG Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TG Therapeutics research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TG Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TG Therapeutics' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TG Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TGTX

TG Therapeutics

A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives