- United States

- /

- Biotech

- /

- NasdaqCM:TGTX

A Look at TG Therapeutics (TGTX) Valuation Following Positive Six-Year BRIUMVI Trial Results

Reviewed by Kshitija Bhandaru

TG Therapeutics (TGTX) shared updated six-year data from its ULTIMATE I & II Phase 3 trials of BRIUMVI for relapsing multiple sclerosis at the 2025 ECTRIMS meeting, highlighting consistency between clinical and real-world outcomes.

See our latest analysis for TG Therapeutics.

On the heels of this promising data, TG Therapeutics has seen its momentum build, with positive sentiment around BRIUMVI reflected in the company’s recent product announcements. The one-year total shareholder return stands at 65%, well above peers, and the market appears to be factoring in both improved fundamentals and future growth potential as the latest share price trends steadily upward.

If these developments have you thinking about potential in the biotech arena, now is a perfect time to discover other innovators on our See the full list for free..

With the share price already up strongly and revenue growth gaining pace, the key question for investors now is whether TG Therapeutics remains undervalued or if expectations for future growth are already fully reflected in the current price.

Most Popular Narrative: 9.5% Undervalued

With TG Therapeutics closing at $36.66 and the most popular narrative setting fair value at $40.50, expectations are high as current momentum and catalysts hint at further upside.

The planned launch of subcutaneous (subcu) BRIUMVI is a significant upcoming catalyst, as it could unlock access to 35 to 40% of the anti-CD20 MS market segment currently dominated by self-administered therapies, greatly increasing BRIUMVI's addressable market and supporting long-term revenue growth.

Curious which bold growth assumptions are baked into this call? Hint: this outlook rests on sharp gains in patient access, margin expansion, and some surprisingly aggressive future profit forecasts. See what makes this possible and how the financials play out. Are you ready to uncover the full narrative?

Result: Fair Value of $40.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the company's heavy reliance on BRIUMVI and growing payer pressure for lower-cost treatments could quickly shift momentum if market dynamics change.

Find out about the key risks to this TG Therapeutics narrative.

Another View: Looking at Market Ratios

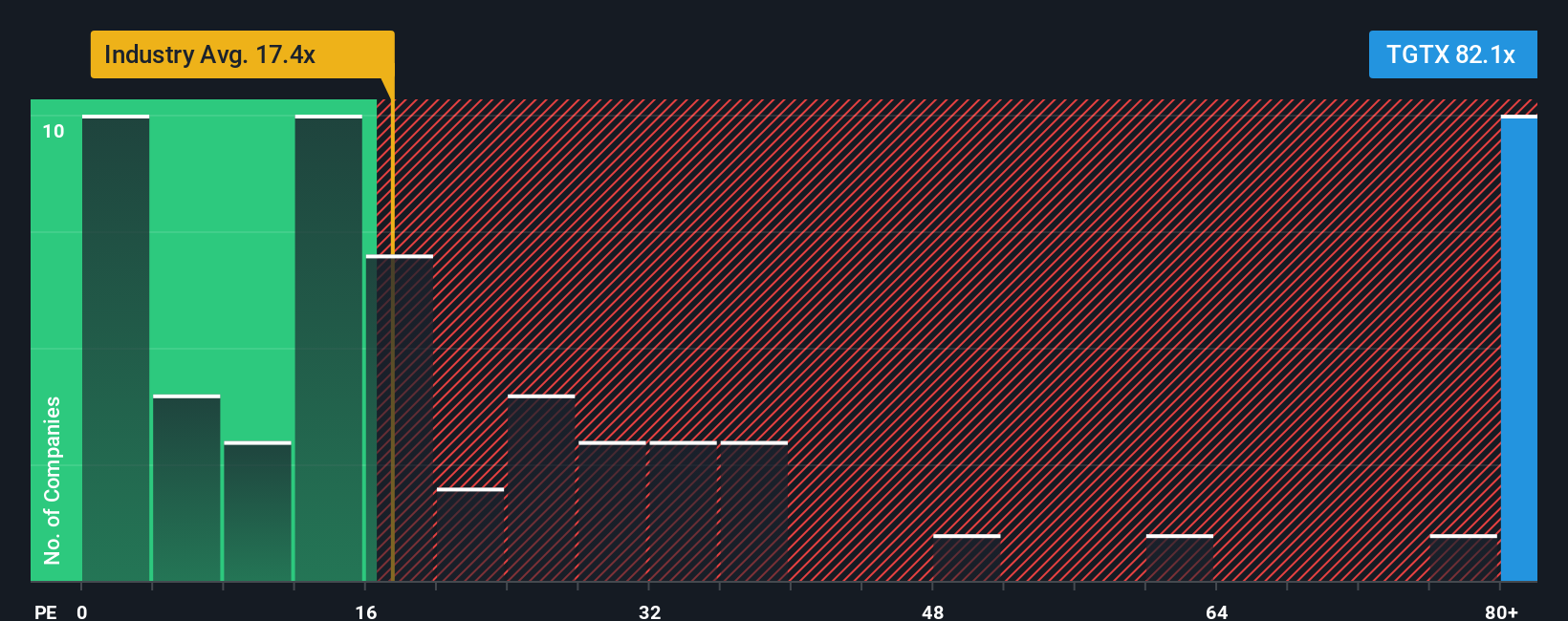

While the fair value estimate relies on long-term earnings assumptions, a quick glance at the company's price-to-earnings ratio shows a very different picture. TG Therapeutics currently trades at 88.5 times earnings, which is much higher than the industry average of 16.6x and its own fair ratio of 30.5x. This suggests investors are paying a hefty premium for future growth, introducing a real valuation risk if expectations are not met. Does this premium reflect justified optimism or set the stage for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TG Therapeutics Narrative

Whether you see things differently or want to back up your own perspective with data, you can easily craft a fresh narrative in just a few minutes using our platform, and even Do it your way.

A great starting point for your TG Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Seize your chance to spot tomorrow’s winners before they hit the headlines. With the right tools, you can target the high-potential stocks others overlook.

- Capture growth potential from the ground floor by acting early on these 3563 penny stocks with strong financials, where overlooked stocks show robust financials and exciting momentum.

- Explore next-wave innovation with these 24 AI penny stocks, highlighting companies at the forefront of artificial intelligence’s rapid expansion.

- Increase potential income streams and stability by choosing these 19 dividend stocks with yields > 3%, featuring businesses that offer regular yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TG Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TGTX

TG Therapeutics

A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives