- United States

- /

- Life Sciences

- /

- NasdaqGS:TEM

Tempus AI (TEM): Mounting Losses Challenge Bullish Growth Narrative Despite Strong Earnings Forecasts

Reviewed by Simply Wall St

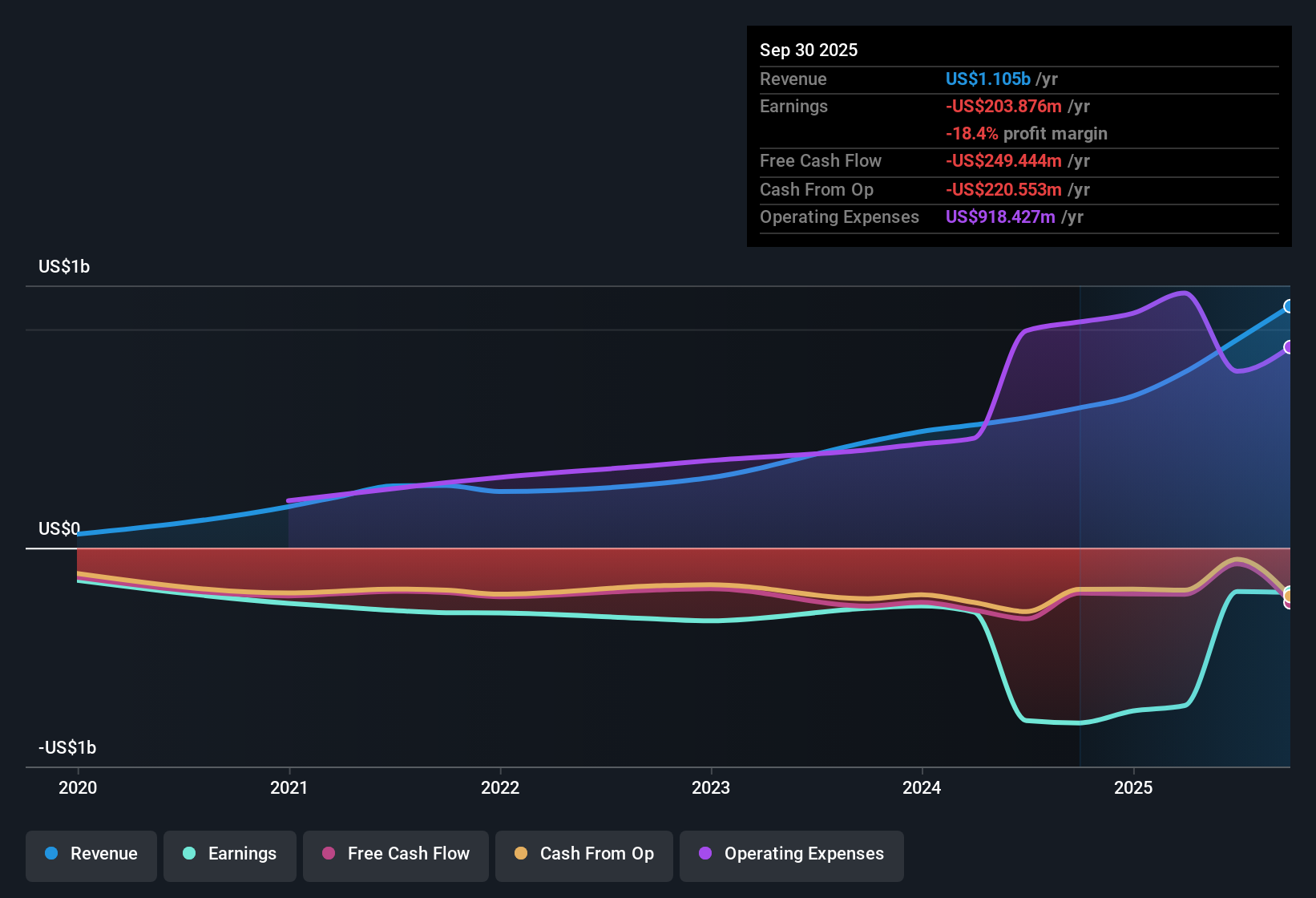

Tempus AI (TEM) posted continued losses, with net losses increasing at a rate of 19.6% annually over the past five years and profit margins remaining unimproved during that period. Despite these persistent losses, the company is projected to see earnings grow 62.68% per year and cross into profitability within the next three years. Revenue growth is estimated at 19.1% per year, which is well ahead of the broader US market forecast of 10.4%.

See our full analysis for Tempus AI.The next section takes a closer look at how these headline figures stack up against the key narratives circulating in the market, highlighting where expectations line up and where surprises may emerge.

See what the community is saying about Tempus AI

Margin Pressure as Losses Compound

- Tempus AI’s net losses have grown at a steep 19.6% annual rate over the last five years, while reported profit margins have shown no improvement during that period.

- Analysts’ consensus narrative highlights growing testing volume and data partnerships as future margin levers. However, ongoing investment needs and reimbursement hurdles present unresolved risks for a pathway to scalable profitability.

- On one hand, the expanding clinical-genomic portfolio and disciplined cost management could gradually drive operating leverage and margin upside.

- At the same time, delays in reimbursement for new AI-driven diagnostics and the need for ongoing R&D investment could weigh on margins for far longer than analysts forecast.

Trading at a Price-to-Sales Premium

- With a Price-To-Sales ratio of 15.4x, Tempus AI’s shares are valued much higher than both industry (3.8x) and peer (5x) averages, even though the stock is currently trading at $82.26.

- According to the analysts’ consensus view, this valuation gap reinforces the case for long-term growth if revenue acceleration and profitability expectations are met. Risks remain if Tempus AI fails to transition from loss-making status.

- Despite the steep premium, the company’s differentiated technology and rising AI adoption are seen as justifying a higher multiple compared to industry standards.

- The consensus also acknowledges that if durable profitability proves more elusive, the current premium could be hard to defend, especially against a backdrop of intensifying competition and “wait-and-see” attitudes regarding new reimbursement models.

DCF Fair Value Signals Upside Potential

- The latest DCF fair value estimate sits at $239.12, nearly three times higher than Tempus AI’s closing price of $82.26 and well above the analyst consensus price target of $87.92.

- The analysts’ consensus narrative suggests this large disconnect could be justified if Tempus AI achieves aggressive revenue and margin targets by 2028. The fair value is based on ambitious forecasts that require both sustained growth and rapid operating discipline.

- Bulls will point to recurring biopharma partnerships and large data advantages as drivers of upside surprise.

- Critics underline that consensus requires belief in major profit margin expansion from -21.0% today to 14.2%. Analysts admit this shift is still unproven.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Tempus AI on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique take on the figures? In just a few minutes, you can craft your perspective and shape the story: Do it your way.

A great starting point for your Tempus AI research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Tempus AI’s persistent losses, uncertain profit trajectory, and steep valuation premium highlight execution risks if profit margins fail to improve as expected.

If you want to focus on consistent performers with stronger track records, use stable growth stocks screener (2076 results) to shift your search to companies showing reliable growth and greater predictability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tempus AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEM

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives