- United States

- /

- Life Sciences

- /

- NasdaqGS:TEM

Is Tempus AI’s Share Price Justified After 146% Surge and New Healthcare Partnerships?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Tempus AI is a hidden gem or riding a hype wave, you are in the right place to get a clear view of what the stock is actually worth.

- The stock has made a dramatic climb this year, jumping 146.7% year-to-date but has recently paused, dropping 2.4% in just the past week.

- A flurry of headlines about Tempus AI's advancements in health data and strategic partnerships has fueled investor excitement and raised questions about how sustainable this growth could be. For example, announcements of major collaborations with leading healthcare systems have caught Wall Street’s attention.

- Tempus AI currently scores a 2 out of 6 on our value checks, meaning there are both risks and potential opportunities worth considering. We will examine several ways to assess the company’s valuation. Be sure to read on for a method that could offer even deeper insight.

Tempus AI scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tempus AI Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth by projecting its future cash flows and then discounting those expected amounts back to today’s value. For Tempus AI, this approach highlights both its potential for future growth and the uncertainty faced in early-stage, high-growth companies.

Tempus AI’s current Free Cash Flow stands at negative $90.1 Million, reflecting the company's ongoing investment in its platform and business expansion. Analysts forecast robust growth, projecting Free Cash Flow of $21.1 Million in 2026, rapidly increasing to $766.6 Million by 2029. Beyond that, projections are extended, and by 2035, the expected Free Cash Flow rises to over $3.4 Billion, all reported in USD.

According to the DCF calculation, Tempus AI’s estimated intrinsic value per share is $263.40. Given the current share price, this suggests the stock is trading at a 67.9% discount, making it appear significantly undervalued by this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tempus AI is undervalued by 67.9%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Tempus AI Price vs Sales

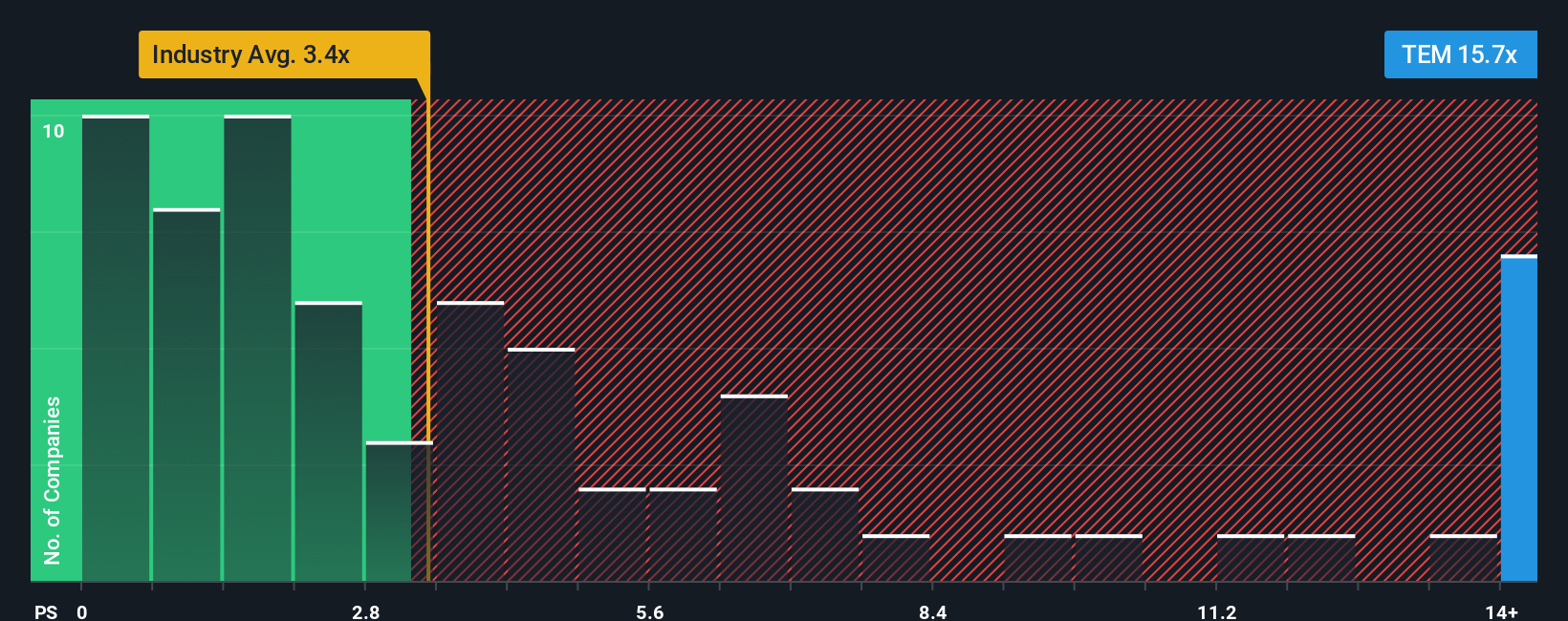

For companies like Tempus AI, where profitability is not yet established, the Price-to-Sales (P/S) ratio is often the preferred valuation metric. This is because a company's revenue is typically more stable and less susceptible to accounting adjustments or short-term fluctuations. As a result, it provides a more reliable baseline for comparing valuation across fast-growing or early-stage firms.

Growth expectations and risk play a crucial role in what is considered a “normal” or “fair” P/S ratio. High growth and low risk generally support higher multiples, while slower growth or greater risks tend to warrant a lower multiple. Investors look to industry benchmarks to see how companies stack up, but these should be viewed in the context of each company’s individual outlook.

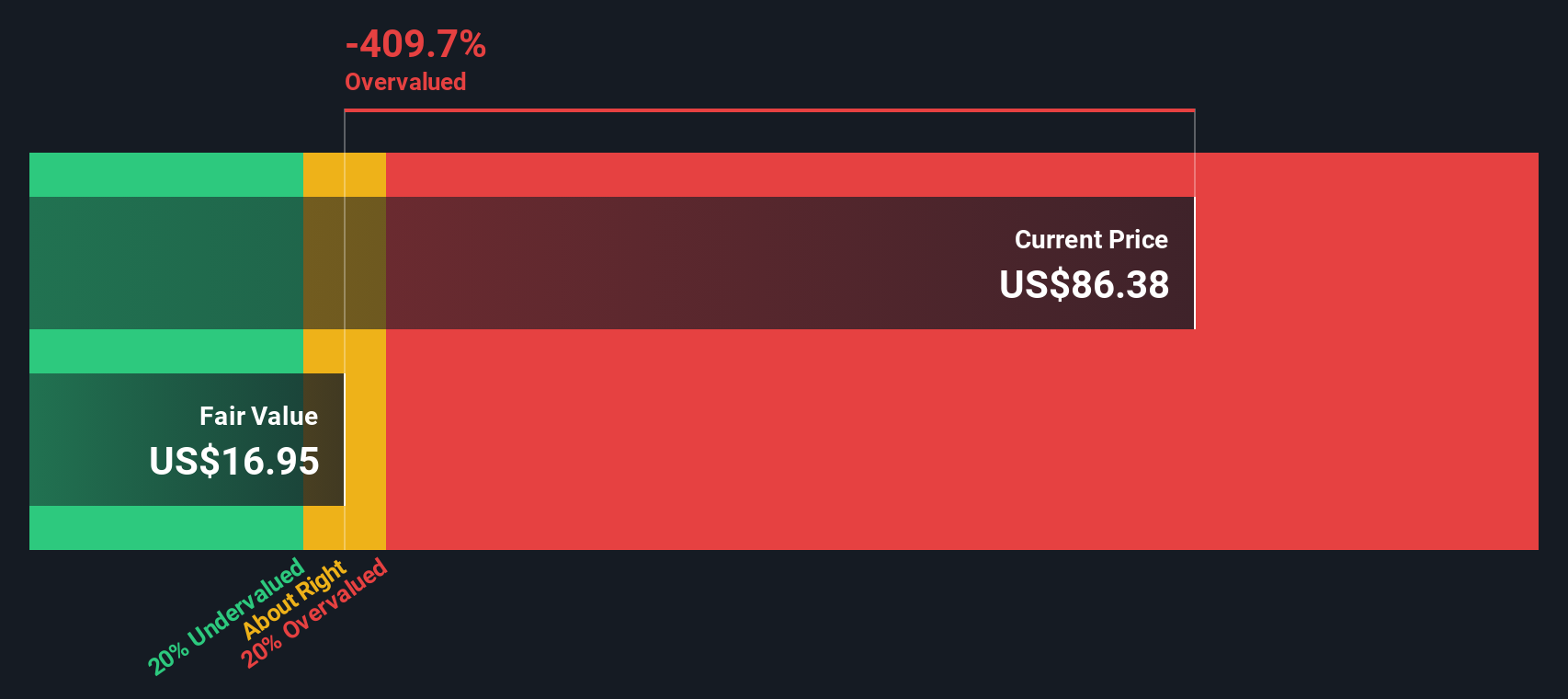

Currently, Tempus AI trades at a P/S ratio of 15.42x. This is significantly higher than the industry average of 3.35x and the peer average of 4.91x, reflecting both its ambitious growth prospects and the market’s high expectations. Simply Wall St’s proprietary "Fair Ratio" for Tempus AI is 10.09x, which accounts for factors like the company’s revenue growth, industry characteristics, profit margins, market capitalization, and risk profile. The Fair Ratio is more tailored than a simple industry or peer comparison because it is designed to consider what makes Tempus distinct, offering investors a more nuanced sense of value.

With Tempus AI’s current P/S ratio standing notably above its Fair Ratio, the stock appears overvalued based on this multiple.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tempus AI Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal perspective on a company, a story that weaves together your expectations about things like Tempus AI’s market opportunity, future growth, potential risks, and profitability. This story is more than just numbers, because it allows you to combine your views or research into a unique set of financial forecasts, which then produces your own fair value for the company.

By linking Tempus AI’s story with data, Narratives help you make more informed decisions, showing whether the current price justifies your assumptions or if it is time to reconsider your stance. Narratives are easy to use and instantly accessible on Simply Wall St’s Community page, where millions of investors can create and compare their own ideas. Best of all, Narratives update automatically whenever new news or earnings data is released, keeping your view relevant and accurate.

For example, some investors might see Tempus AI as having the potential for remarkable revenue growth and assign a price target of $90, while others remain cautious and set their fair value closer to $60. Narratives help you map your confidence and your skepticism directly onto the numbers, giving you a smarter, more dynamic way to decide if and when to buy or sell.

Do you think there's more to the story for Tempus AI? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tempus AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEM

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives