- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

Evaluating Bio-Techne’s Value After 18.7% Rally and Major Portfolio Expansion News

Reviewed by Bailey Pemberton

- Wondering if Bio-Techne is a hidden bargain or an overlooked risk? You're not alone. Here is a breakdown of what matters most for anyone thinking about its real value.

- After a sharp 18.7% surge over the last month, Bio-Techne's stock has still fallen 13.2% year-to-date and sits 18.0% lower than a year ago, highlighting both volatility and shifting investor sentiment.

- Bio-Techne recently made headlines with several notable developments that have turned investor heads, from expanding its product portfolio to forging new partnerships. These moves provide key context behind the recent stock price rebound and signal management's confidence in driving future growth.

- Right now, Bio-Techne has a valuation score of 2 out of 6 for undervaluation. This article explores how traditional models weigh up this stock, and at the end, introduces a method that may reveal more than meets the eye.

Bio-Techne scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bio-Techne Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those amounts back to their present value. This approach helps investors understand what the business is worth today, based on expectations of how much cash it can generate over the coming years.

For Bio-Techne, current annual Free Cash Flow stands at $241.7 million. Analysts forecast steady growth, with projections reaching $439.25 million by 2027. Looking further ahead, extended estimates place annual Free Cash Flow in 2035 at about $791.7 million, according to Simply Wall St's extrapolations. All figures are in US dollars and, since these amounts are under 1 billion, described in millions.

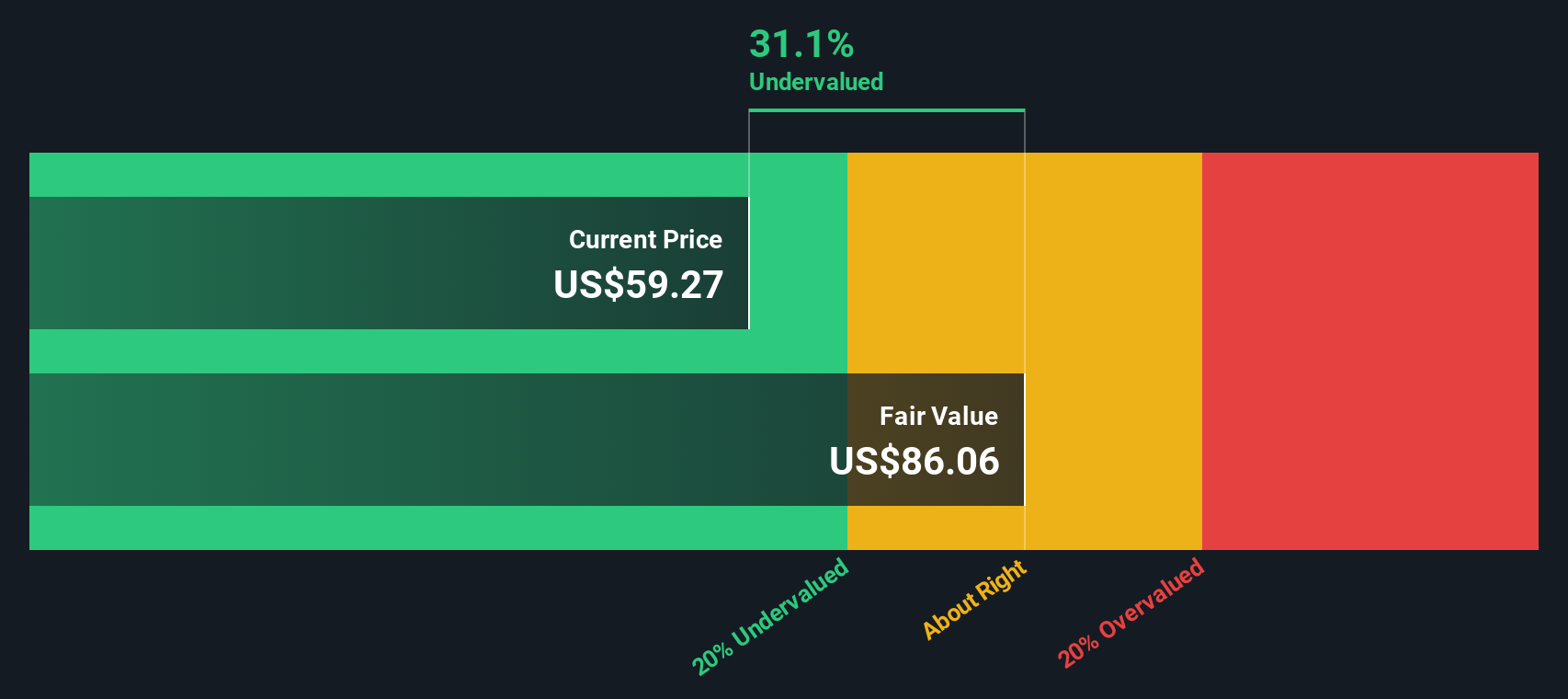

Using these projections, the DCF model calculates a fair value for Bio-Techne shares of $85.78. Compared to the current market price, this model suggests a discount of 27.7%, indicating that Bio-Techne stock is significantly undervalued based on expected future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bio-Techne is undervalued by 27.7%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Bio-Techne Price vs Earnings

The Price-to-Earnings (PE) ratio is a common valuation tool for profitable companies like Bio-Techne, as it directly relates the company's market value to its earnings. Investors favor the PE ratio because it provides a simple way to compare how much they are paying for each dollar of current profit.

What makes a "fair" PE ratio can vary. Companies with higher growth prospects or lower risk generally justify a higher PE, while slower-growing or riskier firms command lower multiples. Considering this, it's crucial to compare not only with current earnings, but also with the broader market context.

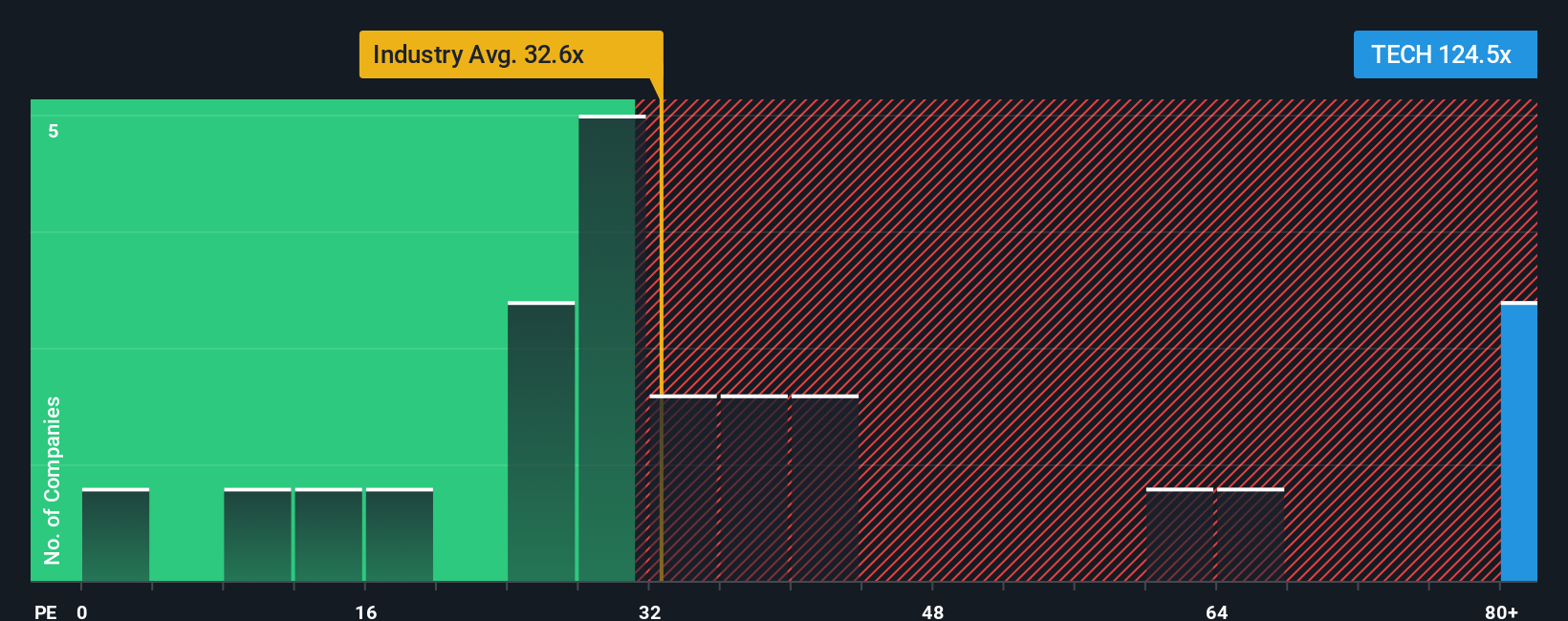

Bio-Techne currently trades at a PE of 131.6x. This is substantially higher than both its industry average of 33.0x and the average among peers at 21.8x. These numbers suggest the market is pricing in high expectations for future earnings growth or unique strengths.

This is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio, calculated at 23.9x for Bio-Techne, refines this assessment by building in key company characteristics such as growth, profit margins, risks, industry, and its size. This makes it a far more tailored benchmark than a simple peer or sector average. In Bio-Techne's case, the actual PE of 131.6x is significantly above the Fair Ratio, indicating the stock is priced well above what fundamentals alone would suggest is reasonable.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1380 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bio-Techne Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, streamlined way for you to connect your unique perspective on a company directly to its financial outlook, letting you tell the story behind the numbers and see how your views play out in a real financial forecast and a resulting fair value.

With Narratives, you decide what matters most, like future revenue or margin assumptions, and the tool translates your perspective into a clear fair value estimate along with a story that makes your thinking transparent even to other investors. Available on Simply Wall St's Community page and used by millions, Narratives make it easy for anyone, not just professional analysts, to understand how changes in business conditions or news can affect a company's fair value as every Narrative updates dynamically whenever new data arrives.

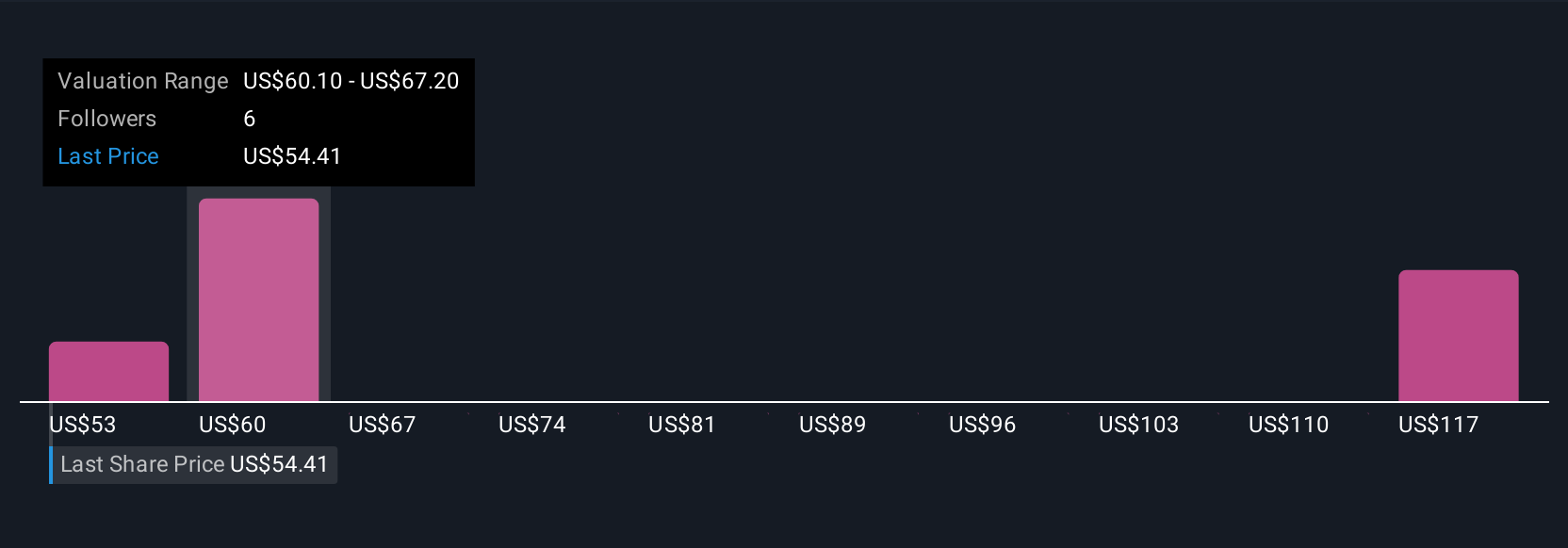

This approach empowers you to make more confident buy or sell decisions by comparing your own fair value directly to the market price, rather than relying solely on generic ratios or consensus targets. For example, some Bio-Techne investors believe its focus on precision medicine and strong international expansion justifies a price as high as $75.0, while others see risk from funding and competition and estimate a fair value as low as $53.0. Your Narrative helps you decide which story and valuation make the most sense for you.

Do you think there's more to the story for Bio-Techne? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Techne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives