- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

Bio-Techne (TECH) Margin Collapse Reinforces Profitability Concerns Despite Forecasted 12.5% Annual Earnings Growth

Reviewed by Simply Wall St

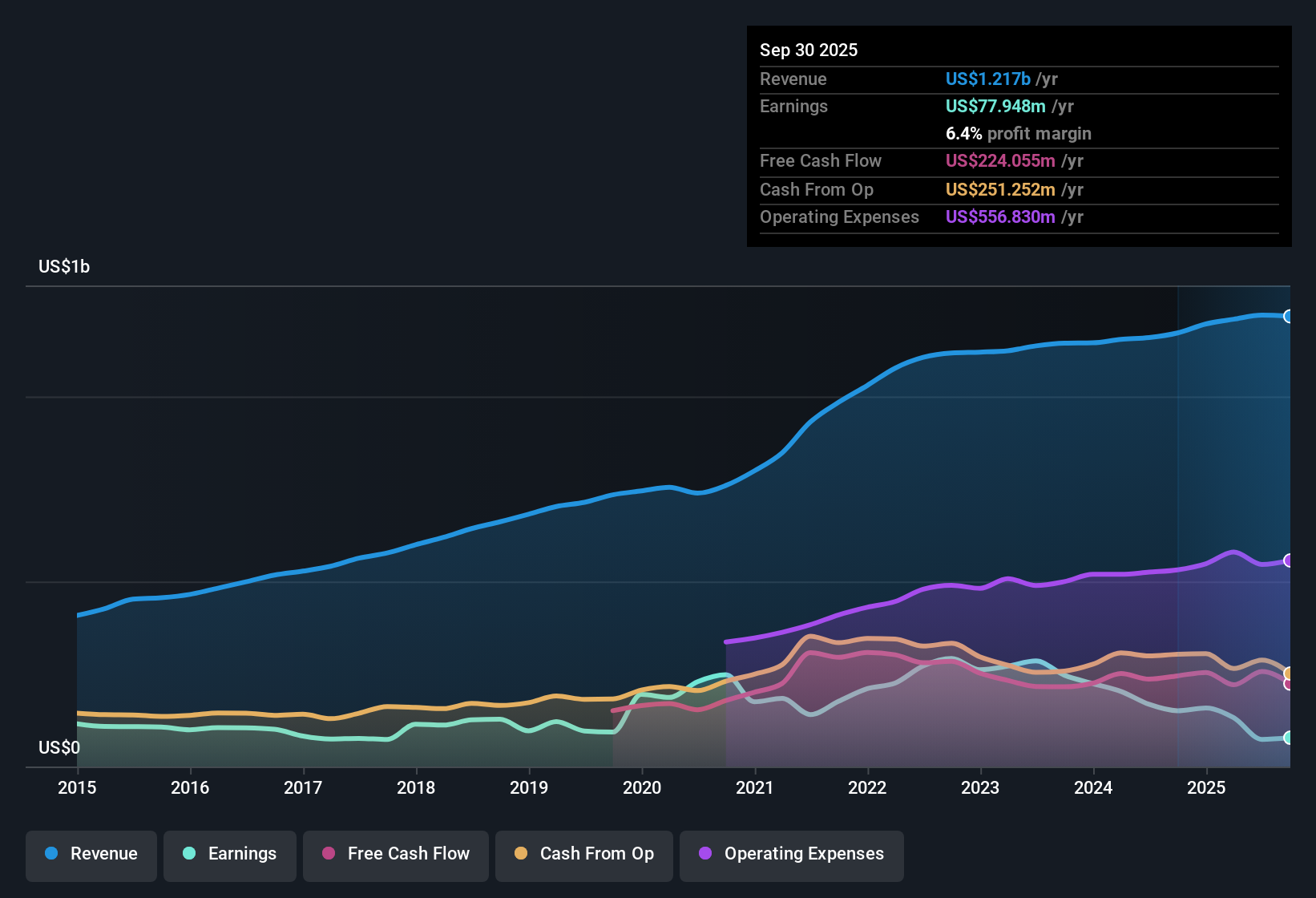

Bio-Techne (TECH) reported net profit margins shrinking to 6% due to a significant one-off loss of $164.1 million. This is down from 14.5% a year ago. Over the past five years, the company’s earnings have declined by 6.8% per year, while revenue is forecast to grow 8.1% annually and earnings are expected to rise 12.49% per year. Investors are weighing these weaker profitability metrics and high valuation multiples against expectations for modest growth and a share price currently trading below an estimated fair value of $77.89, at $59.94.

See our full analysis for Bio-Techne.The next section will explore how these headline numbers compare to the main narratives followed by the market, highlighting areas of consensus and difference.

See what the community is saying about Bio-Techne

Profit Margins Expected to Rebound Sharply

- Analysts project Bio-Techne's profit margins to rise from today's 6.0% to 17.0% in the next three years, a meaningful recovery after last year's one-off $164.1 million loss dragged net margin sharply lower.

- Analysts' consensus view sees innovation and strategic pivots driving this margin improvement, reinforcing the outlook by pointing to:

- Portfolio shifts, such as the Exosome Diagnostics divestiture, freeing up capital for higher-margin growth segments and targeting a 100 to 200 basis point operating margin expansion.

- New product launches in automated proteomic instrumentation and continued international expansion which, together with this margin turnaround, set the stage for a much more profitable business by 2028.

Curious how analysts expect margin momentum to reshape the company? 📊 Read the full Bio-Techne Consensus Narrative.

Valuation Premium Far Above Industry Norms

- Bio-Techne's Price-To-Earnings Ratio of 127.2x is over three times the industry average of 36.3x, and the current multiple would only fall to 47.4x by 2028 according to analyst forecasts, still a material premium over the US Life Sciences industry’s 29.3x.

- Analysts' consensus view points out this stretched valuation:

- Market optimism appears anchored in assumptions of robust long-term margin expansion and earnings acceleration, but this leaves little cushion if future results miss expectations.

- The belief in substantial future growth means that, despite a discounted share price ($59.94) compared to DCF fair value ($77.89), investors are paying well above average for each dollar of today's earnings.

Discounted Share Price Versus Analyst Targets

- At $59.94, Bio-Techne’s share price trades nearly 18% below the consensus analyst price target of $67.42, and at a steeper 23% discount to the DCF fair value of $77.89.

- Analysts' consensus view argues current price levels reflect a compromise:

- Despite flagged short-term risks and year-over-year earnings declines, sustained revenue momentum (forecast at 8.1% CAGR) and an improving margin profile support analyst expectations for long-term outperformance.

- The split between premium multiples and a discounted price may signal that the market is still waiting for margin recovery to fully materialize before closing the valuation gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bio-Techne on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Shape your own perspective and craft your personalized narrative in just a few minutes. Do it your way

A great starting point for your Bio-Techne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Bio-Techne’s profit margins, earnings, and valuation multiples all face pressure. Current performance lags industry standards and depends heavily on future improvements.

If valuation risk concerns you, turn your attention to these 849 undervalued stocks based on cash flows that are trading below their intrinsic worth and offer stronger downside protection right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Techne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives