- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

A Fresh Look at Bio-Techne (TECH) Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

See our latest analysis for Bio-Techne.

Bio-Techne’s 6% share price drop over the past month has followed a choppy year, with the stock down nearly 19% year-to-date and the 12-month total shareholder return at -12%. Momentum has faded recently amid ongoing debate about valuation and growth prospects.

If recent moves in the biotech space have you looking for new opportunities, consider broadening your search and discover See the full list for free.

With shares lagging and trading nearly 19% below their recent highs, the question now is whether Bio-Techne’s discounted price reflects an undervalued opportunity, or if the market has already accounted for the company’s growth outlook.

Most Popular Narrative: 15.9% Undervalued

Bio-Techne's last close of $58.15 sits significantly below the narrative's fair value estimate of $69.17, creating a gap that fuels speculation over the company's true worth.

The company's shift in portfolio focus, highlighted by the divestiture of Exosome Diagnostics, allows redeployment of capital and resources toward higher-margin core business segments and growth pillars. This supports both immediate operating margin improvement (expected 100 to 200 basis point expansion) and higher future earnings.

Curious what bold projections lie beneath this valuation? The foundation of this price target involves an aggressive turnaround in margins and major revenue catalysts. See which financial levers the narrative claims will fuel such a swift profit transformation.

Result: Fair Value of $69.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing funding constraints and increased competition could quickly undercut the case for margin expansion and revenue acceleration in the months ahead.

Find out about the key risks to this Bio-Techne narrative.

Another View: Multiple-Based Valuation Paints a Cautious Picture

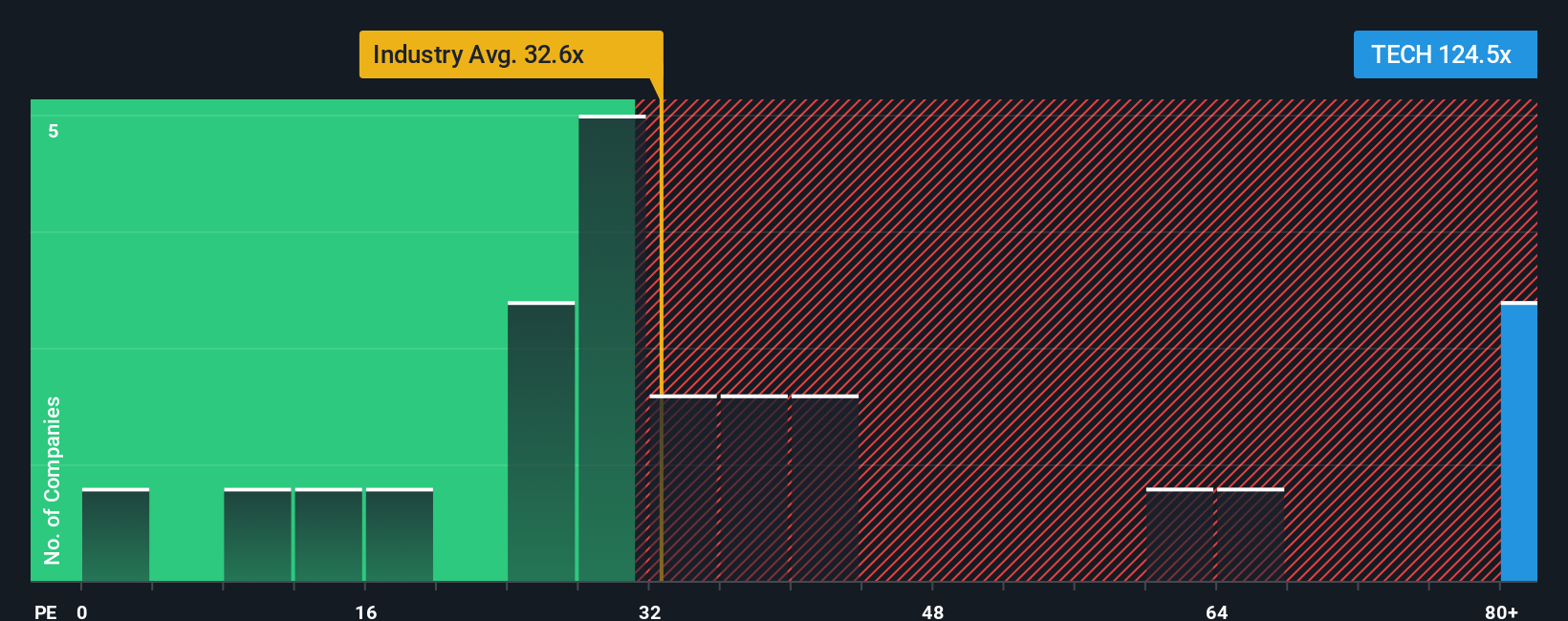

Taking an earnings ratio approach instead, Bio-Techne looks expensive compared to both its industry and peers. Its P/E ratio sits at 116.2x, far higher than the industry average of 36x, peer average of 31.2x, and well above the fair ratio of 25.3x. Such a premium means the market is pricing in a lot of future growth, which leaves little margin for error if those expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bio-Techne Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Bio-Techne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want a real edge, check out investment themes that others are missing. These stock picks could redefine your next winning move.

- Uncover high-yielders and grow your income potential with these 18 dividend stocks with yields > 3%, chosen for their reliable payouts and solid financial health.

- Target tomorrow's technology leaders by backing innovation through these 26 quantum computing stocks, where companies are driving advancements in quantum computing.

- Secure potential bargains before the crowd does by focusing on these 904 undervalued stocks based on cash flows, which look attractive based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Techne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives