- United States

- /

- Pharma

- /

- NasdaqGS:TARS

Tarsus Pharmaceuticals (TARS): Valuation Insights After Strong Q3 Revenue Growth and Upbeat Guidance

Reviewed by Simply Wall St

Tarsus Pharmaceuticals (TARS) just released its third quarter results, reporting a sharp increase in year-over-year revenue and a meaningful narrowing of net loss. The company also shared upbeat revenue guidance for the coming quarter, which signals ongoing momentum.

See our latest analysis for Tarsus Pharmaceuticals.

Tarsus Pharmaceuticals’ latest wave of upbeat financial news has lit a fire under the share price, with a 6.65% gain in one day and a 41.73% share price return over the past three months. Recent positive revenue guidance and event appearances have helped fuel growing market confidence, and the company’s 1-year total shareholder return of 48.31% is a reminder that longer-term investors have been well rewarded during this surge in momentum.

If this burst of progress has you interested in what else the healthcare sector is serving up, take the next step and discover See the full list for free.

But with shares delivering an impressive rally already, is Tarsus Pharmaceuticals still trading at a discount? Or has the market already priced in all the future growth, leaving limited upside for new investors?

Most Popular Narrative: 9.4% Undervalued

With Tarsus Pharmaceuticals’ last close at $72.79 and the most widely followed narrative placing fair value at $80.38, the market may not be fully reflecting the company’s earnings momentum and long-term revenue potential just yet.

Accelerated patient and physician adoption of XDEMVY, driven by a robust direct-to-consumer campaign and increased unaided awareness, points to ongoing demand expansion among an estimated 25 million potential U.S. patients. This suggests material runway for future top-line revenue growth.

Curious what’s fueling this valuation? One core assumption behind the narrative is a leap in profit margins, along with aggressive revenue expansion projections. Want to know if these bullish expectations truly stack up? Peek inside to find out what’s supercharging this fair value estimate.

Result: Fair Value of $80.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including Tarsus’s reliance on XDEMVY’s rapid adoption and the challenge of sustaining revenue growth if market momentum slows.

Find out about the key risks to this Tarsus Pharmaceuticals narrative.

Another View: Multiples Analysis Tells a Different Story

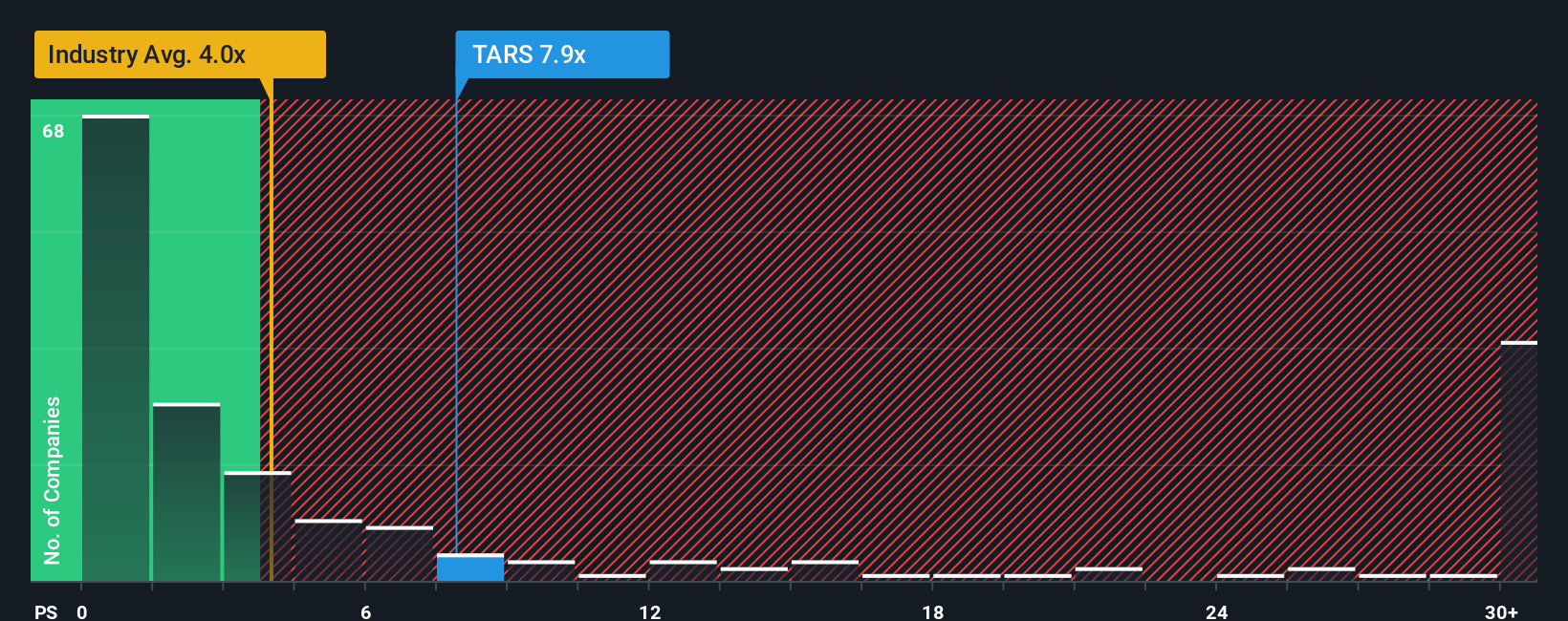

While some valuation models see Tarsus Pharmaceuticals as heavily undervalued, a look at its price-to-sales ratio suggests caution. With a ratio of 8.4x, the company trades well above the US Pharmaceuticals industry average of 4x and the fair ratio of 7.9x. This gap could present a valuation risk if the market cools. Does this higher multiple reflect confidence in future growth, or are expectations getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tarsus Pharmaceuticals Narrative

If you see things differently or would rather dig into the details yourself, you can shape your own narrative from scratch in just a few minutes. Do it your way

A great starting point for your Tarsus Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means staying ahead of the curve. Expand your perspective with new opportunities you might not have considered to make sure you’re not leaving smart gains on the table.

- Uncover opportunities in digital assets by checking out these 82 cryptocurrency and blockchain stocks making waves in secure payments and blockchain tech.

- Tap into future healthcare trends and see which companies are pioneering innovation within these 32 healthcare AI stocks.

- Maximize potential returns by evaluating these 865 undervalued stocks based on cash flows that analysts say offer more upside based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tarsus Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TARS

Tarsus Pharmaceuticals

A commercial stage biopharmaceutical company, focuses on the development and commercialization of therapeutic candidates for eye care in the United States.

High growth potential and good value.

Market Insights

Community Narratives