- United States

- /

- Pharma

- /

- NasdaqGS:TARS

Tarsus Pharmaceuticals (TARS): Evaluating Valuation as Revenue Surge and Webcast Update Draw Investor Focus

Reviewed by Simply Wall St

Tarsus Pharmaceuticals (TARS) has drawn attention as it prepares to report third quarter results, with expectations pointing to a 139% jump in quarterly revenue. Investors are watching closely because the company is getting ready for its upcoming webcast update.

See our latest analysis for Tarsus Pharmaceuticals.

Tarsus Pharmaceuticals’ upcoming webcast and remarkable projected revenue growth have fueled notable momentum, reflected in a 67% share price return over the last three months. Over the past year, total shareholder return reached nearly 49%, giving long-term investors plenty to cheer about as growth expectations continue to build.

If strong earnings momentum is on your radar, consider expanding your search and discover more promising opportunities with our healthcare stocks screener: See the full list for free.

With shares up sharply and revenue growth projections creating buzz, the crucial question is whether Tarsus Pharmaceuticals offers further room for upside or if the market has already priced in all the expected good news.

Most Popular Narrative: 14.4% Undervalued

With Tarsus Pharmaceuticals closing at $68.81 and the most-followed narrative setting fair value at $80.38, expectations for future growth are setting the tone for the valuation debate ahead of earnings.

Accelerated patient and physician adoption of XDEMVY, driven by a robust direct-to-consumer campaign and increased unaided awareness, points to ongoing demand expansion among an estimated 25 million potential U.S. patients. This suggests material runway for future top-line revenue growth.

Curious how bold projections of surging revenue and margin expansion power this valuation? One key metric, if hit, could shift expectations for years. Dive into the full narrative to see what’s fueling Wall Street’s optimism and which assumptions might be make-or-break for Tarsus’s stock.

Result: Fair Value of $80.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a single product and high spending on sales and marketing could quickly dampen Tarsus’s upbeat outlook if momentum slows.

Find out about the key risks to this Tarsus Pharmaceuticals narrative.

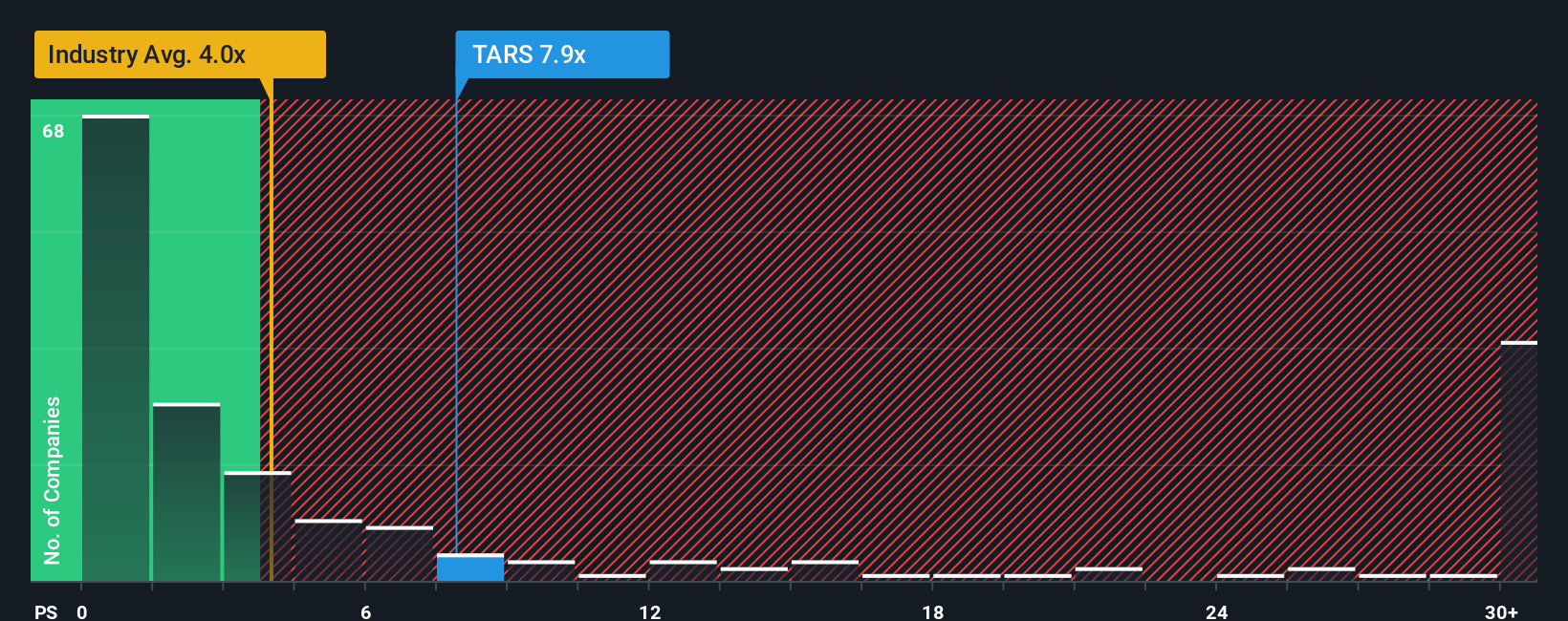

Another View: Valuation Based on Sales Ratios

Looking from a different angle, Tarsus Pharmaceuticals’ price-to-sales ratio stands at 9.8x, more than double the US Pharmaceuticals industry average of 4.2x, though notably lower than the peer average of 19.1x. It is also above the fair ratio the market could eventually move toward, at 8x. This gap suggests investors may be paying up for Tarsus’s high growth potential, but it also raises the risk of a sharp correction if expectations shift. Is the optimism already baked in, or can the company’s momentum justify these elevated levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tarsus Pharmaceuticals Narrative

If you’d rather draw your own conclusions or challenge the prevailing view, you can craft a personalized Tarsus Pharmaceuticals narrative in under three minutes: Do it your way

A great starting point for your Tarsus Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop with just one opportunity? Give yourself an edge by searching for stocks riding powerful trends, untapped value, and strong financial health. Act on these standout ideas and don’t let your next winner pass you by.

- Unlock deep value by analyzing companies with proven cash flow strength through our handpicked list of these 843 undervalued stocks based on cash flows.

- Accelerate your portfolio’s growth by spotting early movers at the intersection of healthcare and artificial intelligence with these 33 healthcare AI stocks.

- Maximize your income potential by choosing from a selection of stocks offering above-average yields thanks to these 20 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tarsus Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TARS

Tarsus Pharmaceuticals

A commercial stage biopharmaceutical company, focuses on the development and commercialization of therapeutic candidates for eye care in the United States.

High growth potential and good value.

Market Insights

Community Narratives